-

Mortgage fintech LoanSnap launched VA Smart Loans, which will provide personalized options to current and former service members applying for a Veterans Affairs-guaranteed mortgage.

November 15 -

Online personal lending pioneer Prosper is developing a home equity line of credit product that it will offer in partnership with banks. The embrace of traditional depositories marks a departure from fintech lenders that typically seek to disrupt and displace legacy institutions.

November 14 -

-

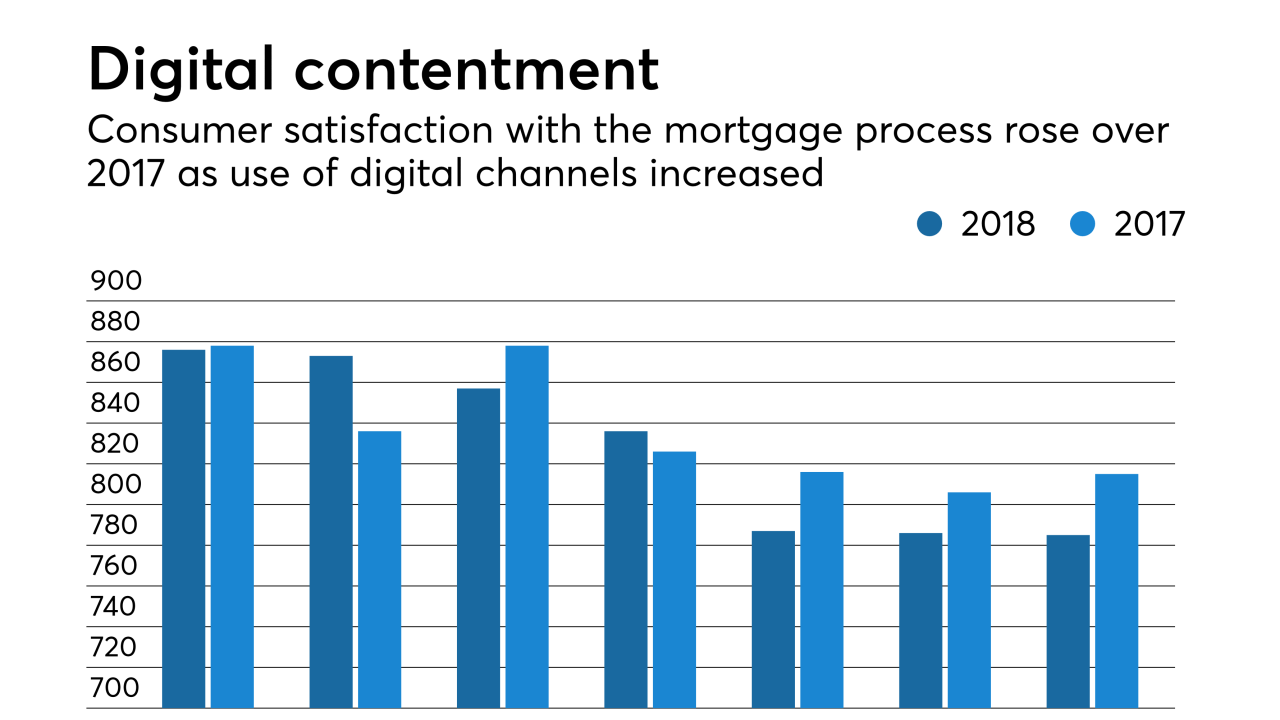

The growth of digital mortgage origination channels has improved customer satisfaction with the process, but consumers still want personal interaction at some point, according to J.D. Power.

November 8 -

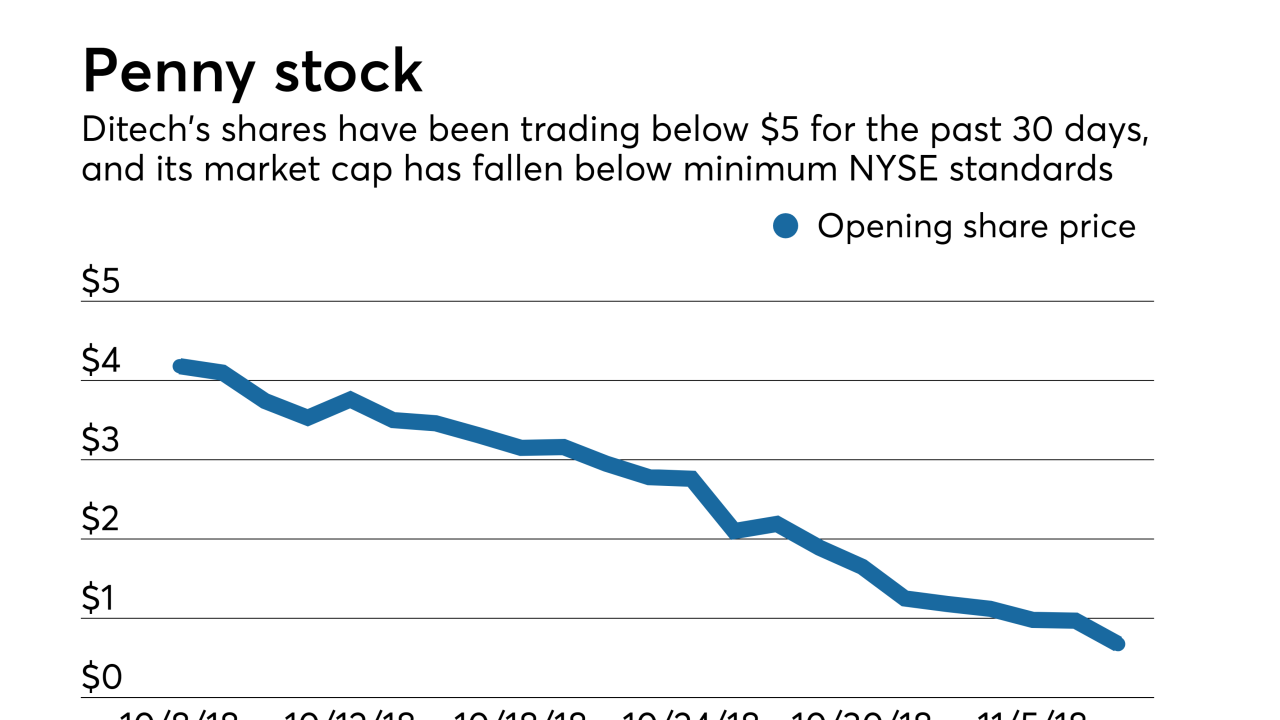

Ditech Holding Corp.'s stock is being delisted from the New York Stock Exchange, and the company is recommitting itself to finding an acquirer or other option that could improve investor value.

November 7 -

Texas is expected to be the tipping point in online closing adoption, and title companies predict that e-closings will soon be standard operating procedure.

November 6 NotaryCam

NotaryCam -

-

-

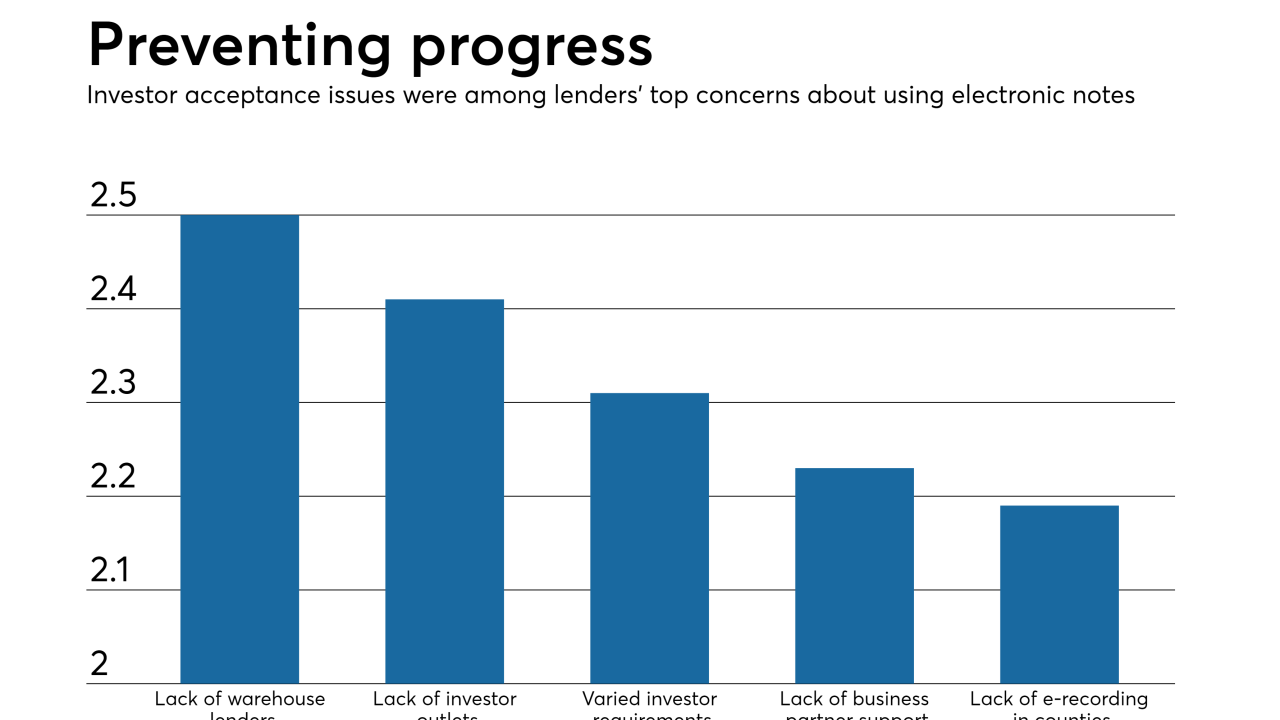

QRL Financial Services, the mortgage outsourcing division of First Federal Bank of Florida, is the latest investor to seek out better secondary market execution by purchasing electronic notes from correspondents.

October 29 -

Larger mortgage companies are paying less than other creditors when fraud occurs, but the expense is still detracting enough from their revenue to cause concern.

October 23 -

A new credit score that includes consumers' cash flow alongside their credit score is winning praise for its potential to help expand access to credit, but some worry it gives the credit bureaus even more data that could be compromised.

October 23 -

Top technology initiatives in digital mortgage you need to see

October 22 -

-

Exploration and adoption of new technologies is essential for achieving strategic goals and satisfying the needs and expectations of mortgage borrowers.

October 16 Freddie Mac

Freddie Mac -

First American Mortgage Solutions is stepping up its digital mortgage game by offering electronic closing capabilities.

October 16 -

A notable drop in home equity lending at Bank of America during the third quarter contributed to an overall decline in new single-family loans produced by the company.

October 16 -

Wells Fargo Home Lending is tapping eOriginal to launch an electronic note program, marking a step forward for the mortgage industry's push toward a more digital process.

October 15 -

From discussing the future of mortgage tech to debating the shifting sands of political policies, here's a preview of the big issues, topics and ideas when the industry gathers in the nation's capital for the Mortgage Bankers Association's Annual Convention & Expo.

October 12 -

-

Total Expert will use its new $20 million venture capital investment — led by Emergence Capital — to build out its Marketing Operating System, designed for the future of financial services.

October 11