-

At Digital Mortgage 2018, Bill Emerson, the vice chairman of Quicken Loans and its parent company Rock Holdings, outlined a vision of dramatic digital disintermediation.

September 18 -

Blend, a provider of mortgage point of sale systems, is offering a new product that uses machine learning to streamline loan closings and analyze loan data quality.

September 18 -

Ellie Mae EVP Joe Tyrrell talks customer acquisition strategy. Crafting a personalized consumer experience, he says, starts with data.

September 18 -

Shifting to digital processes requires rethinking staffing levels and responsibilities. Mid-America Mortgage CEO Jeffrey Bode outlines how his company has adjusted.

September 17 -

LoanDepot's CEO Anthony Hsieh delivered a bracing message to mortgage lenders on Monday — strong new competitors are coming into this market, so they need to expand their offerings.

September 17 -

Loan officers whose habits are attuned to the refi market need to improve their relationship game to make it in this business, NBKC Bank's Dan Stevens told attendees at Digital Mortgage 2018.

September 17 -

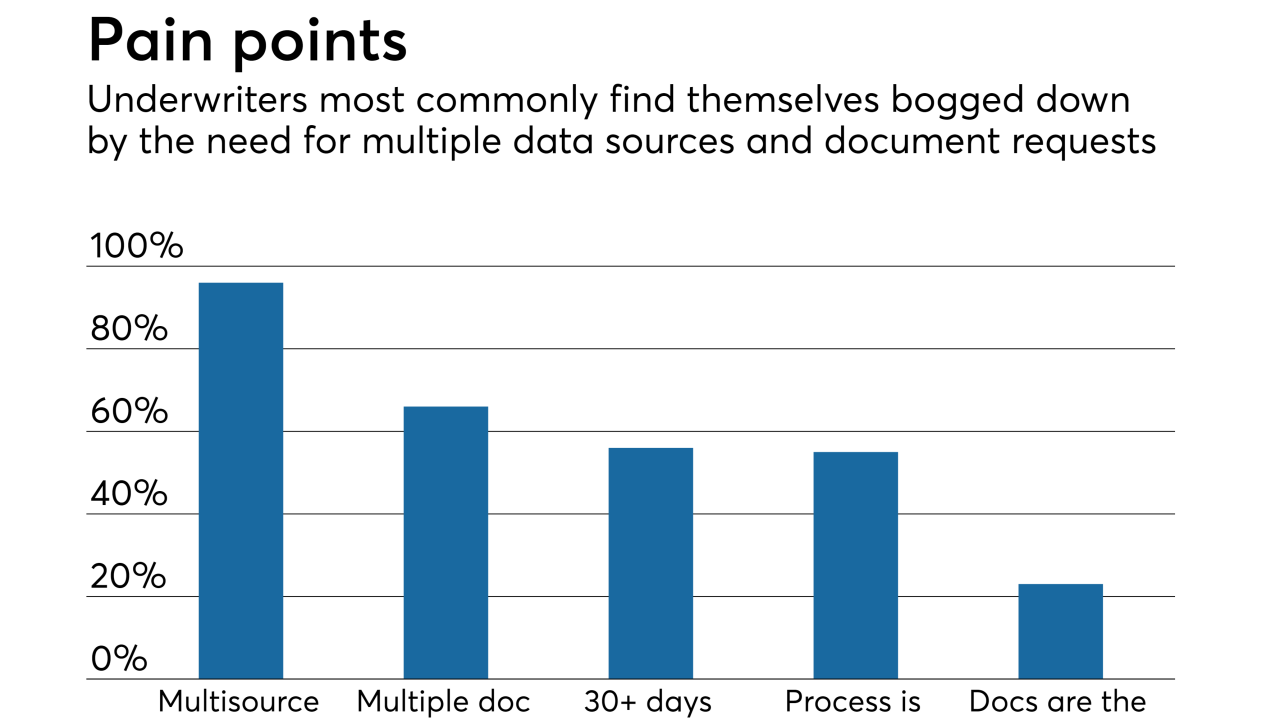

Accessing a mortgage applicants' data from a direct source goes a long ways toward shortening the origination process, according to 96% of mortgage underwriters responding to a recent CoreLogic survey.

September 17 -

Customers are increasingly demanding that their mortgage providers provide more than loans; they want help finding a realtor and handling all the pieces of the mortgage process, said Anthony Hsieh, CEO of loanDepot, during the opening keynote at Digital Mortgage.

September 17 -

Early adopters took digital mortgages from concept to reality. What will it take for everyone else to catch up?

September 10 -

From origination to servicing and everything in between, here's a sneak peek at the companies and products presenting demos at the 2018 Digital Mortgage Conference.

September 10 -

Due diligence firm American Mortgage Consultants has launched a new subsidiary in response to growing lender and servicer interest in digital transactions.

September 10 -

Lennar Corp. closed its first fully electronic digital mortgage with a remote notary, just a few months after the homebuilder made an equity investment in digital mortgage vendor Notarize.

September 4 -

Future reductions in loan application defect risk are likely because of mortgage lenders' fintech investments, even as the purchase origination share grows, said First American Financial.

August 31 -

The vast majority of consumers start the mortgage process with internet research, but when it comes time to initiate contact with a lender, borrowers are nearly as likely to pick up the phone as they are to connect online.

August 29 -

Wire fraud committed through business email compromise schemes has emerged as a serious threat to mortgage and real estate transactions. Defending against these scams requires a comprehensive strategy that includes technology, training and nonstop vigilance.

August 27 -

Fraudsters can track a home sale from the moment it goes on the market until the deal closes, make these transactions a ripe target for business email compromise scams that seek to intercept wire transfers and steal from legitimate participants in a deal.

August 27 -

Moody's Investors Service downgraded JPMorgan Chase's prime jumbo mortgage originator assessment to its second-highest rating, citing the bank's growing reliance on correspondents with delegated underwriting authority and shortcomings in its technology infrastructure.

August 24 -

Post-crisis measures made it harder for rogue borrowers and employees to commit fraud. Now, a new threat has emerged from scammers posing as title agents, real estate professionals and more.

August 24 -

Credit Karma is diving into the mortgage industry with a plan to acquire digital mortgage startup Approved, a provider of consumer-facing online point of sale technology.

August 17 -

Banks aren’t the only ones that need to keep pace with digital innovation — government agencies must also work to stay relevant.

August 7 Ginnie Mae

Ginnie Mae