-

While mobile applications have become increasingly present in the originations segment of the mortgage industry, they're now making their mark in the servicing space.

April 5 -

Lenda, launched in 2014, currently makes mortgages start to finish in two weeks. But it's aiming to make it a process that can be finished on a borrower's lunch break.

March 28 -

Servicers are still trying to figure out how they can best take advantage of the growing use of electronic notes and other digital mortgage tools by lenders and the secondary market.

March 27 -

Governments are studying ways blockchain can safeguard property records and simplify how they get tracked.

March 26 Hodgson Russ

Hodgson Russ -

While the industry continues adopting digital mortgage methods, homebuyers expect to be able to apply for a mortgage and complete the application online, but still want human interaction, according to Ellie Mae.

March 20 -

Fannie Mae is about to roll out a new underwriting system that will address some concerns about layered risk that cropped up after it raised its maximum debt-to-income ratio.

March 16 -

Financial data and analytics company FinLocker has gained the approval of a second patent supporting its digital vault functionality.

March 12 -

Mortgage settlement software provider Qualia is getting a new $33 million round of funding that it will use to expand into additional U.S. markets.

March 7 -

The bank will spend an additional $1.4 billion on technology in 2018 to gain share and boost efficiency, executives said Tuesday. But they were peppered with questions about whether the big investment will yield a big financial return down the road.

February 27 -

Banco Santander joined existing investors JPMorgan and USAA as well as others in raising $25 million in secondary-round financing for Roostify, which seeks to build a paperless mortgage process.

February 15 -

Billionaire Dan Gilbert's Quicken Loans Inc. outgrew almost every U.S. mortgage provider by unfurling technology like its online Rocket Mortgage platform faster than big banks.

December 28 -

From deregulation to digital innovation, here's a look at the top storylines that defined the mortgage industry in 2017.

December 26 -

As digital mortgage technology helps consumers take a more hands-on approach to the mortgage process, lenders are stepping up their adoption of automation and machine learning through artificial intelligence capabilities.

December 26 -

Fannie Mae and Freddie Mac have new technology-driven initiatives planned for 2018 that are expected to help lenders improve the borrowing experience for home buyers and make full use of the government-sponsored enterprises' credit box.

December 26 -

A breach at Alteryx that exposed sensitive information from more than 100 million U.S. households could add to fraud risks in housing finance

December 22 -

Consumer credit bureau and data aggregator Experian will gain a foothold in the U.K. mortgage market by acquiring a minority stake in mortgage brokerage London & Country Mortgages Limited.

December 11 -

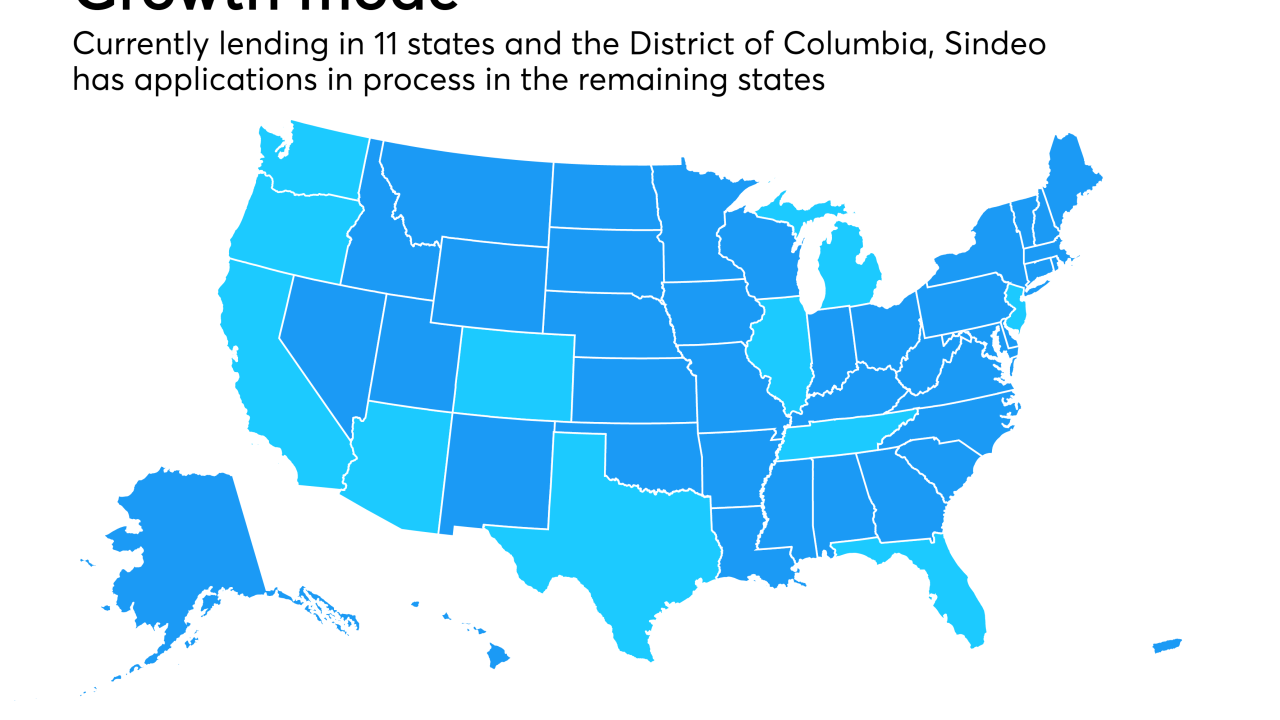

When a $40 million round of venture funding fell through at the last minute, digital mortgage broker Sindeo all but shut down this summer. Now recapitalized and rejuvenated, founder and CEO Nick Stamos explains why Sindeo is ready to grow again.

November 21 -

Closing mortgages more quickly could introduce efficiencies but it also could introduce fraud risks if done without strong identity verification procedures in place, LexisNexis Risk Solutions finds.

November 17 -

Mid America Mortgage's deal to acquire the assets of two Oklahoma City-based lenders will double the Addison, Texas, company's loan volume.

November 15 -

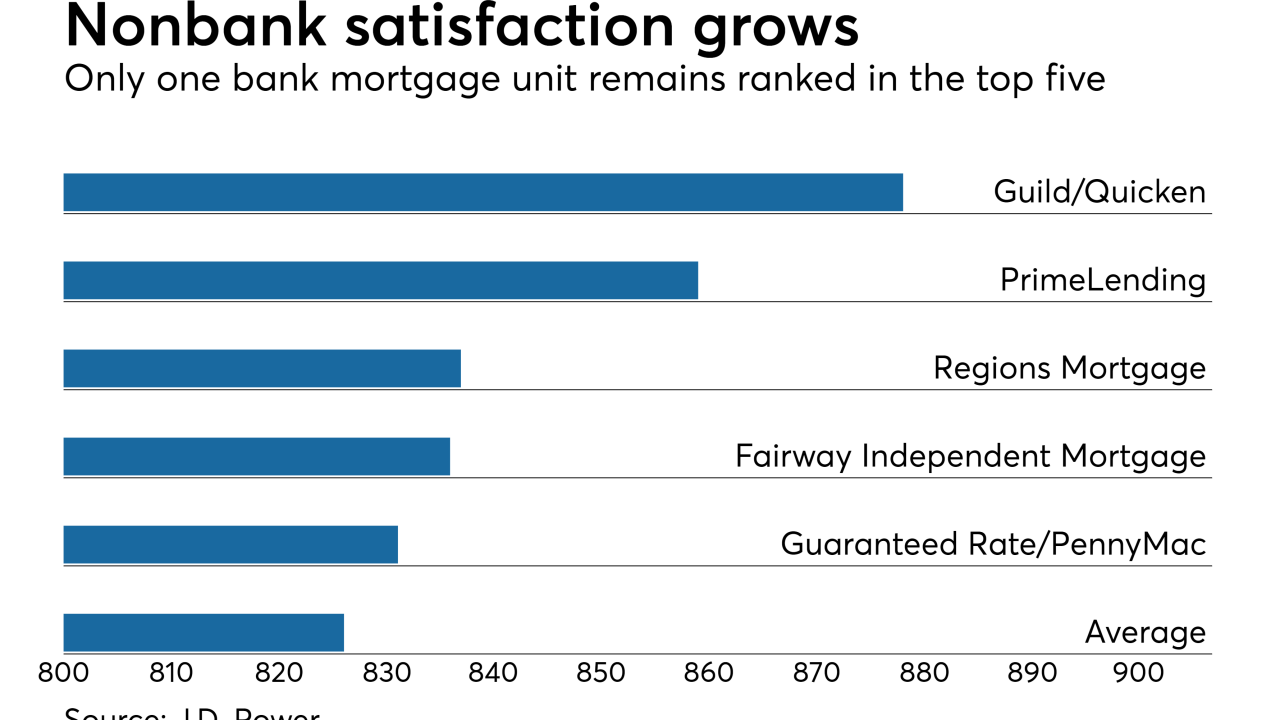

Despite digital mortgage advances, borrowers think it still takes too long to get a loan, J.D. Power finds in its annual customer satisfaction ranking of originators.

November 9