Earnings

Earnings

-

The loan origination system provider, which launched an IPO on July 28, reported that its second quarter revenue and income grew 38% year-over-year.

September 8 -

Improved capitalization and smaller balance sheets should help several weather the likely consolidation that is coming, Moody's said.

September 3 -

Even as lenders increased purchase share, higher expenses and margin compression related to pricing competition led to smaller quarterly net gains.

August 24 -

Revenue at the fintech company grew from prior periods without even taking into account any contributions from the Title365 acquisition at the end of the quarter.

August 20 -

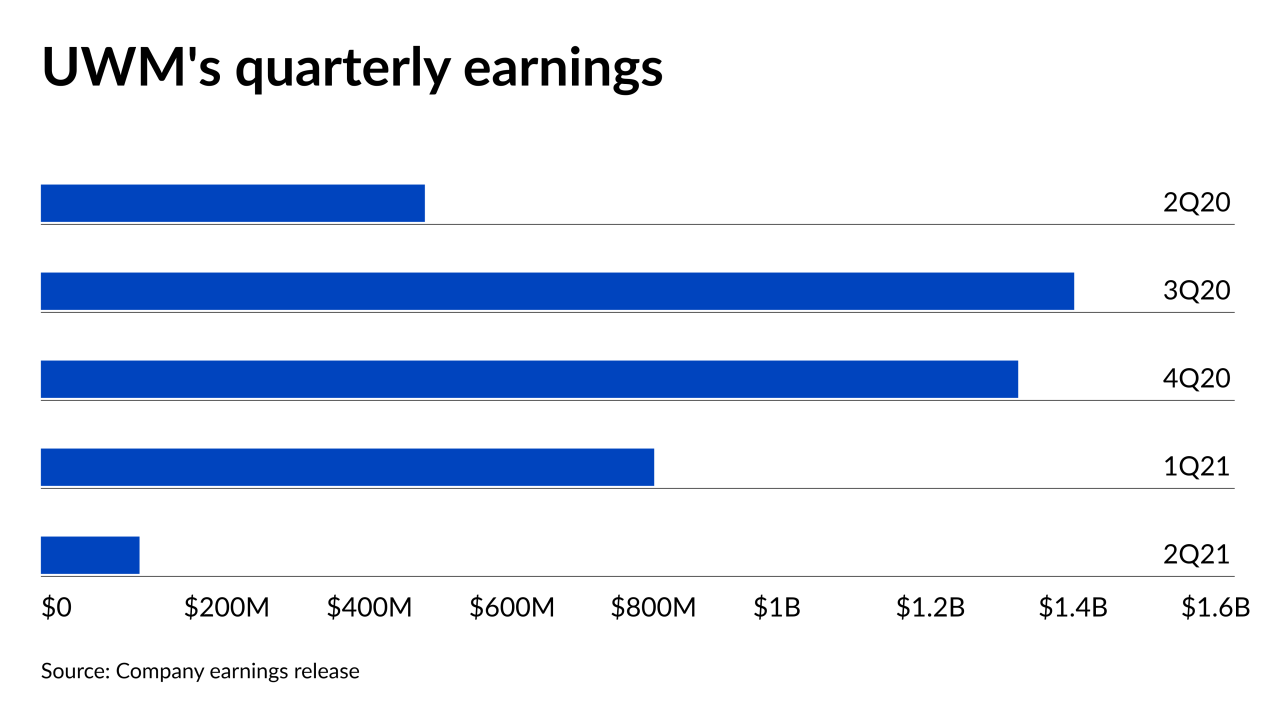

The wholesale lender has a cost structure aimed at beating the competition in a rising rate environment, Chairman and CEO Mat Ishbia said on the second quarter earnings call.

August 17 -

Depressed margins and a $219 million hit to its servicing rights fair value translated to a lower bottom line at the wholesaler.

August 16 -

While the company's mortgage originations saw a 46% annual drop in gain on sale margin, it anticipates that annual volumes will exceed 2020 levels.

August 13 -

Shrinking gain-on-sale margins also ate into earnings, with growth expected to slow for the rest of 2021.

August 12 -

The company attributed its second quarter loss to competitive pricing pressures and GSE-imposed charges.

August 10 -

The company’s $204 million in net income was down from unusual highs seen recently but still historically strong thanks to the balance between its loan channels and servicing operation, representatives said.

August 6 -

Delinquency concerns continue to wane as the end of forbearances is not expected to lead to a massive wave of foreclosure activity.

August 6 -

The company's expanded portfolio through its acquisition spree drove revenue, representatives said.

August 5 -

The company has been making investments in correspondent originations and servicing and “reverse” loans used by borrowers age 62 and up to withdraw home equity.

August 5 -

Many banks reported sharp declines in income from home loans during the second quarter. The large gains they enjoyed last year thanks to a surge in refinancing activity are unlikely to return, according to bankers and analysts.

August 4 -

The gain on sale in the retail channel dropped by more than half annually, as the wholesale and joint venture channel endured an even tighter squeeze due to competitive pressures

August 3 -

While the hot market’s actual and forecast home price gains were key drivers of Fannie’s results, they also present a challenge to the affordable housing mission that it’s working to address.

August 3 -

The bank saw a modest increase in net income from the first quarter, as lawsuit settlements tied to the company’s discontinued home lending business and fees regarding an anti-money laundering and securities class action suit continue to limit growth.

August 2 -

The REIT also reveals plans to expand in the single-family rental market with a new brand and target of $5 billion in acquisitions over five years.

July 29 -

The company’s results included some transitory revenue sources, including early buyouts of loans in forbearance from securitized pools, but executives plan to maintain growth over time through economies of scale.

July 29 -

New customer growth and increased adoption of a digital workflow by mortgage lenders resulted in better than expected results for the Intercontinental Exchange unit.

July 29