Earnings

Earnings

-

The company expects loan growth in the “mid-teens” this year, despite concerns that a housing supply crunch could stymie new mortgage originations. “As soon as COVID fades into the background we'll pick up volume,” CEO and Chairman Jim Herbert said.

April 14 -

The REIT is planning its own stock sale to pay for the all-cash purchase from Lone Star Funds.

April 14 -

However, companies were largely unable to use that cash infusion to make investments that lower their costs, since they had to pay out more in compensation.

April 13 -

With independent title companies scoring the largest market share gain last year, the sector saw a 22% increase in premiums overall, the American Land Title Association said.

April 9 -

Banks can mitigate damage from slowing origination activity by putting excess cash to work, Keefe, Bruyette & Woods said.

April 6 -

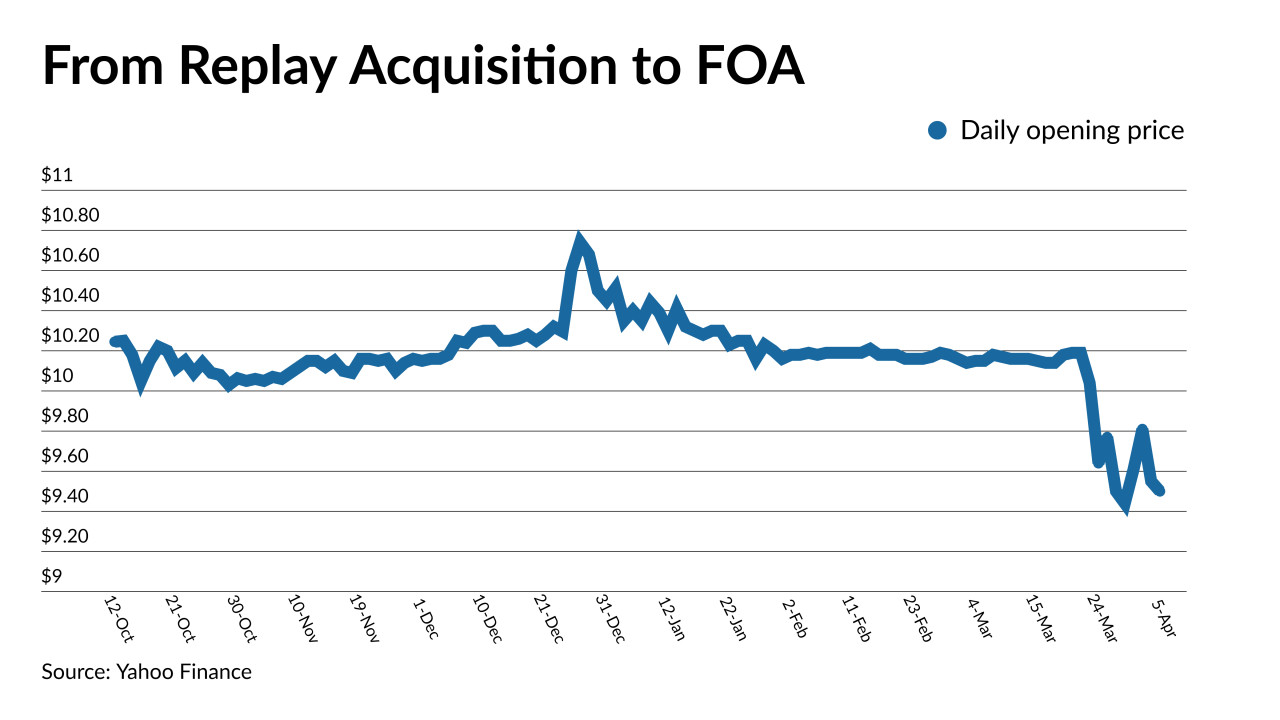

The forward and reverse mortgage lender completed its merger with blank check company Replay Acquisition Corp. on April 1.

April 5 -

The San Diego-based company produced $10.6 billion in the fourth quarter, and has done $6.1 billion in the first two months of 2021.

March 23 -

The company posted an $88 million loss for 2020 after shutting down for nearly the entire second quarter.

March 12 -

After a booming 2020, more mortgage lenders than ever before expect diminishing margins in the coming months as climbing interest rates set up heightened competition.

March 11 -

Mortgage brokers are telling the company that they "are looking for another large source," according to President and CEO Willie Newman.

March 11 -

But profitability may have peaked. Rocket reported a 4.41% profit margin on newly originated loans last quarter but told investors on Thursday to expect margins on new loans this quarter to be around 3.6% to 3.9%.

February 26 -

As its mortgage origination volume delivered another quarter of strong earnings, Mr. Cooper’s banking on its "enormous backlog" of REO orders to generate further profitability once the foreclosure moratorium is lifted.

February 23 -

The newly public digital mortgage giant is relying on a diverse set of loan channels to take on competitors in an increasingly crowded field, CEO Anthony Hsieh said in an earnings call this week.

February 18 -

Also: New Residential, Fannie Mae and Freddie Mac release Q4 earnings reports

February 12 -

While its net income declined annually for the second consecutive year, CEO Hugh Frater touted Fannie Mae’s resiliency in a record year for providing mortgage liquidity.

February 12 -

The company purchased $1.1 trillion of single-family mortgages and $83 billion of multifamily loans during 2020.

February 11 -

The growing popularity of the company’s websites and apps has earned the company record profits during the fourth quarter, with adjusted earnings before interest, taxes, depreciation and amortization of $170 million, according to a statement on Wednesday.

February 11 -

The agreement would generate $250 million in proceeds, which the nonbank mortgage company plans to use to pay down and refinance existing debt, while also investing in its servicing and origination businesses.

February 10 -

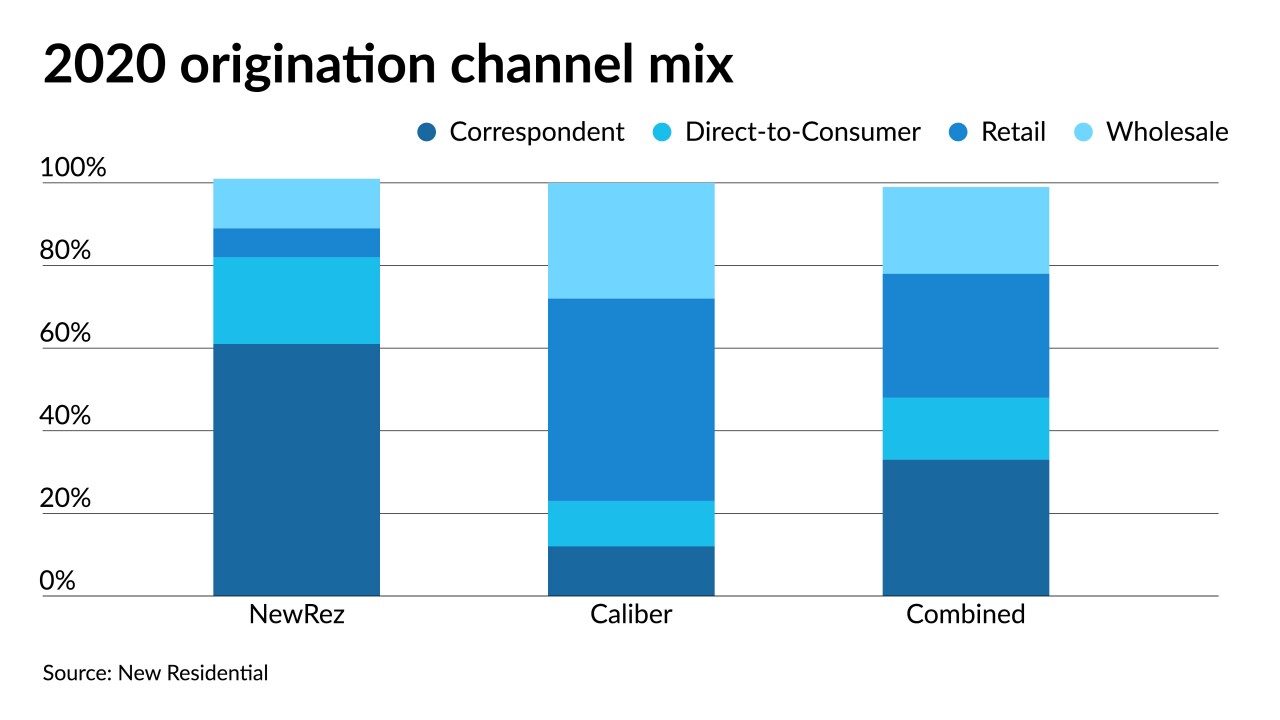

But the company sees reasons to be optimistic about the second half of the year, CEO and Chairman Michael Nierenberg said during its fourth quarter earnings call

February 9 -

Even as the company posted record numbers, it could have originated more loans if it had not stopped buying FHA and jumbo mortgages from brokers.

February 4