Earnings

Earnings

-

Other moves it is undertaking include business divestitures and increased dividends while defending against a takeover attempt.

July 23 -

Other regionals set more aside for loan losses than the Cleveland bank did in the second quarter, and its ratio of reserves to total loans is slightly lower, too. But Key executives say the portfolio is balanced and holding up well despite the pandemic’s economic toll.

July 22 -

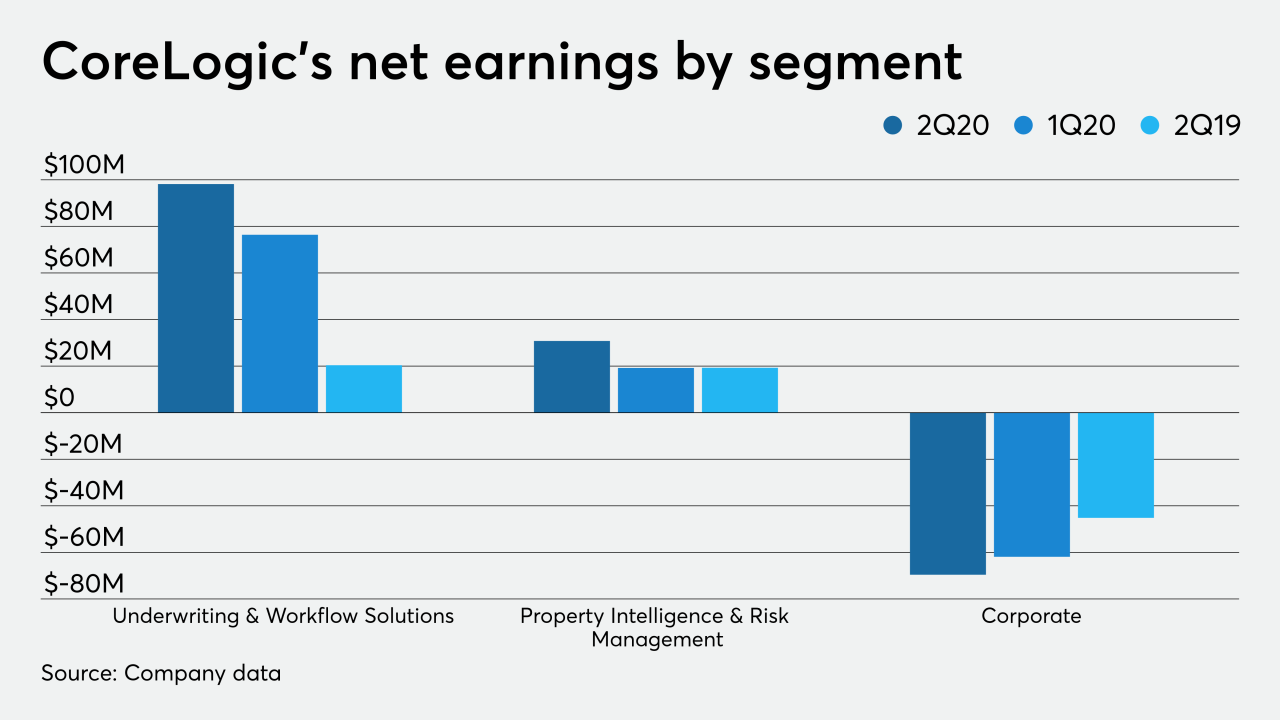

The company lost $8.9 million in the second quarter, but its origination and servicing businesses were profitable.

July 22 -

Fannie Mae could be worthless to public shareholders, according to its newest analyst.

July 22 -

Ocwen Financial's preliminary second-quarter results put it back in the black, and it is positioning its growing distressed-servicing expertise and pandemic-induced exposures as a net positive.

July 17 -

Rocket Cos. profits were over 35 times greater than what it disclosed for the first quarter.

July 17 -

The Pittsburgh bank says fewer borrowers are asking for help and that many borrowers who received assistance are making payments again. But with the coronavirus pandemic still raging in much of the country, CEO William Demchak and other bankers are tempering their optimism.

July 15 -

The Minneapolis company said 75% transactions have been handled online since the pandemic hit.

July 15 -

Home purchases in markets outside of cities accounted for some of the San Francisco bank's loan growth. Executives believe this will be a long-term trend because a generous supply of inventory in less populated areas will appeal to buyers.

July 14 -

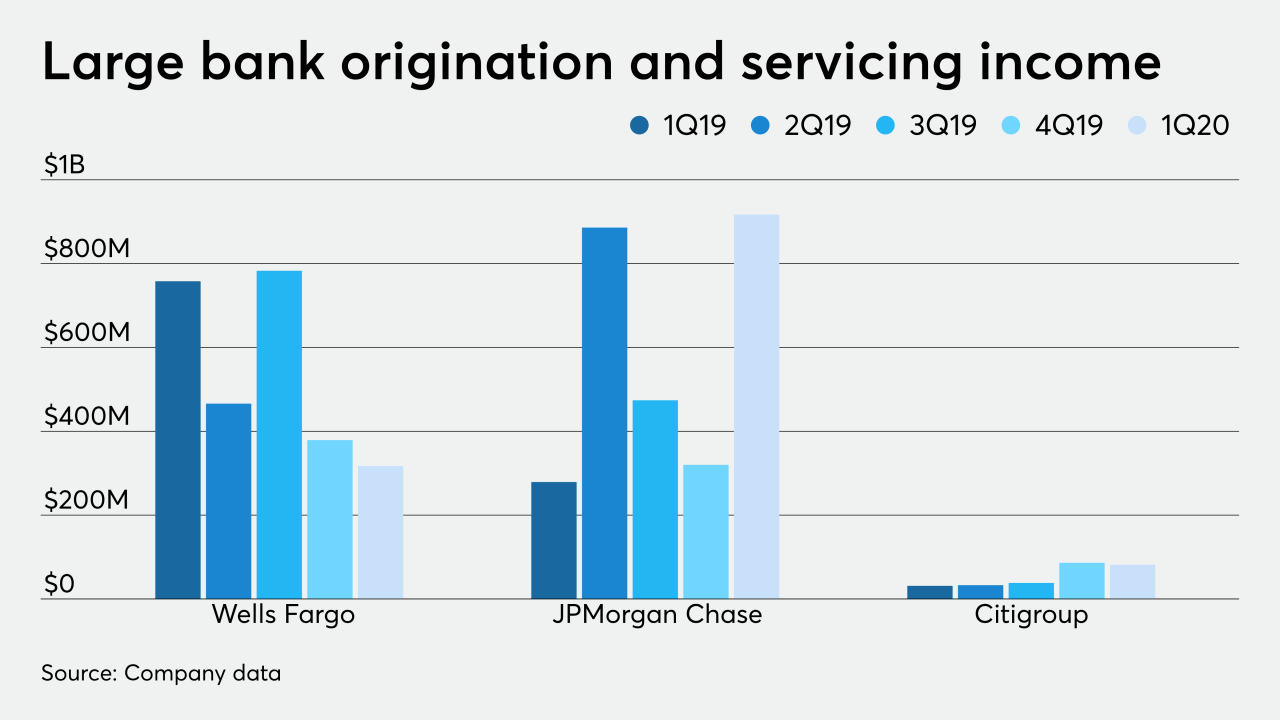

The banks logged strong year-over-year growth in gain-on-sale margins for mortgage loans.

July 14 -

B. Riley FBR raised its ratings for both Fannie Mae and Freddie Mac to sell from neutral on the possibility the net worth sweep is declared illegal.

July 13 -

The lending giant's filing reveals what the company's internal structure will look like going forward.

July 8 -

Booming refinancing is expected to more than offset the tighter underwriting in second-quarter mortgage results.

July 8 -

Reps called the offer "opportunistic" and said it did not address regulatory concerns regarding overlaps with Bill Foley's other businesses, Fidelity and Black Knight.

July 7 -

Andy Peach is leaving after less than a year in the top spot.

June 30 -

The company formally reported a nearly $65 million loss in the first quarter as the coronavirus affected its operations in March.

June 26 -

The outbreak has completely upended whatever expectations the industry had heading into 2020. Here's key areas that have been shaped by the pandemic, some potentially forever.

June 24 -

Unemployment is high. Credit is tight. And scientists are warning that a dangerous second wave of the coronavirus is coming. But somehow, U.S. mortgage companies are having one of their best years in history.

June 16 -

The REIT will add $500 million in capital through a senior secured loan, and it received a $1.65 billion term facility.

June 16 -

The company could be seeking a cash infusion to handle market difficulties ahead, but representatives are keeping mum on the matter.

June 12