Earnings

Earnings

-

Three of the four had fewer new notices of delinquency for the quarter, but that should change going forward.

May 8 -

Bisignano, who engineered a technology-driven recovery at First Data before it was acquired by Fiserv last year, will take Fiserv's top job as the company forges its coronavirus strategy.

May 7 -

But it is still looking to conserve capital to cover future delinquencies and will likely halt dividends to the parent company.

May 6 -

But Black Knight and Arch Capital's mortgage insurance business aren't as affected, at least so far.

May 5 -

Jay Bray speaks about the company's experience in working with distressed borrowers going back to the Great Recession.

May 1 -

Fannie Mae's profitability suffered but it managed to stabilize the mortgage market in the first quarter even with the coronavirus disrupting, among other things, certain credit-risk transfer vehicles it has used.

May 1 -

Net income grew by nearly 1,990% year-over-year as its core mortgage services businesses gained scale.

May 1 -

While Freddie Mac stabilized liquidity in mortgage markets, coronavirus-related credit losses drove the GSE's income down in the first quarter of 2020.

April 30 -

The first-quarter loss ended a two-quarter profitability streak the company hoped to maintain.

April 30 -

The broker/wholesale business was by far the smallest origination segment for the company.

April 29 -

Refinancing drove a 75% year-over-year increase in mortgage banking revenue during the first quarter at Flagstar Bancorp as it shored up its operations to avoid other negative repercussions from the coronavirus.

April 28 -

Low mortgage rates increased new orders, but fallout from the pandemic hurt investment income.

April 23 -

Declines in mortgage servicing rights valuations at JPMorgan Chase and Wells Fargo point to the resurgence of a dilemma that came up during the last downturn.

April 15 -

New Residential Investment, a real estate investment trust focused on housing, is selling a portfolio of debt with a face value of $6 billion.

March 31 -

The impending wave of loan delinquencies because of the coronavirus hurt private mortgage insurer earnings, but the companies will still have sufficient capital, a Keefe, Bruyette & Woods report said.

March 27 -

Title underwriters won’t be hit as hard by the coronavirus as other insurers, but related economic changes will challenge them, Fitch Ratings said, in assigning a negative outlook to the sector.

March 26 -

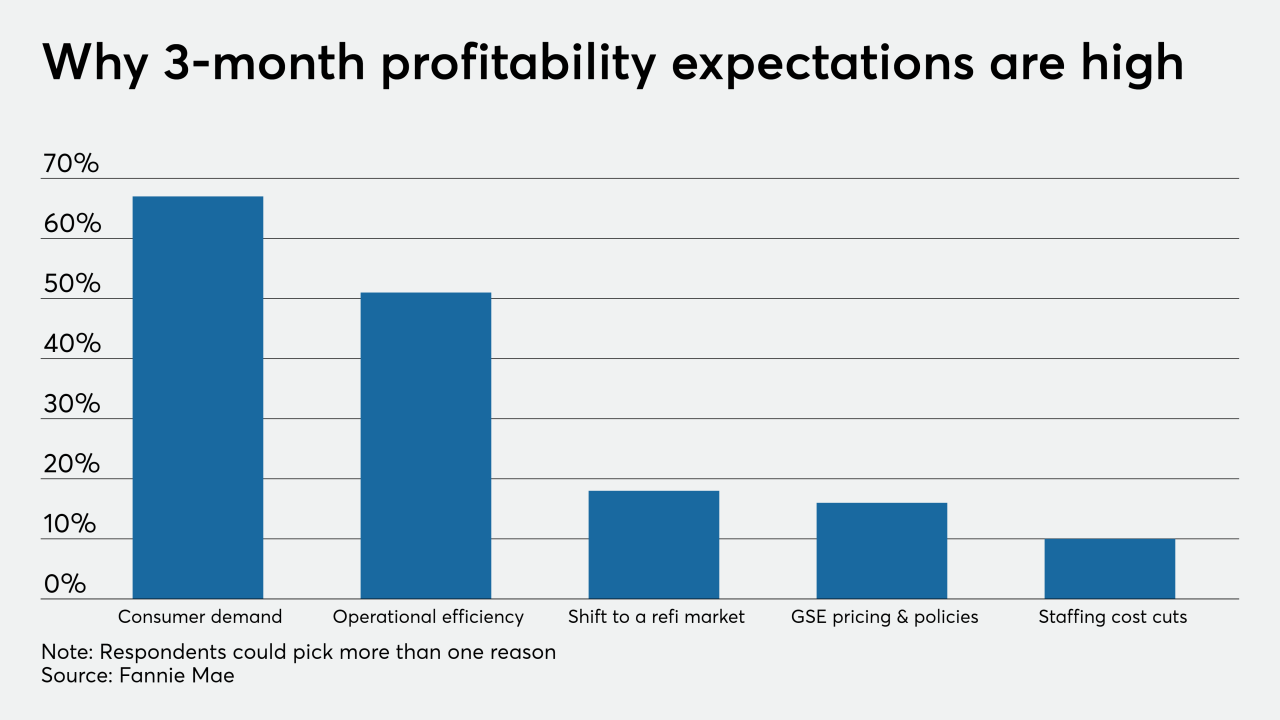

Independent mortgage bankers had their most profitable fourth quarter in seven years for originations, but the fallout from the coronavirus could upset the economics of the industry in the short term.

March 24 -

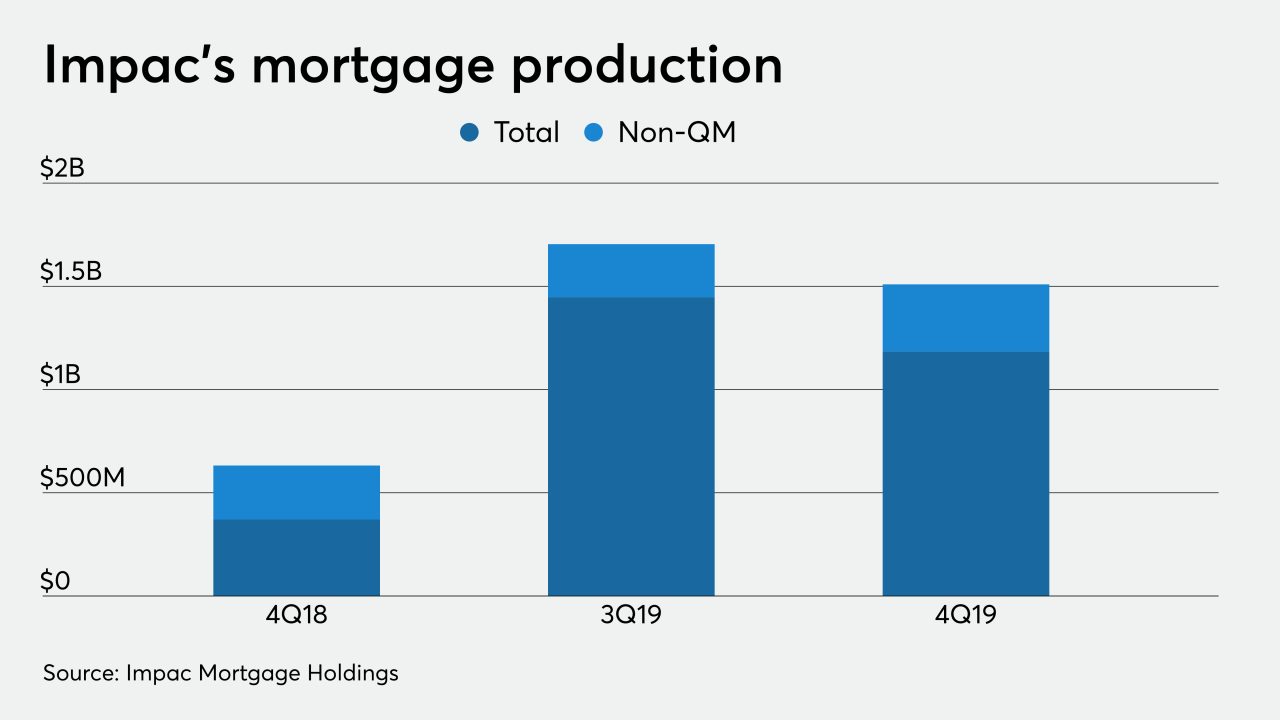

Impac Mortgage Holdings decided a year ago to emphasize its non-qualified mortgage lending operations and placed the company in position to succeed when the housing market returns to normal.

March 13 -

Companies in the mortgage business were already focused on processing a lot of loans and generating efficiencies before the latest uptick in business hit.

March 12 -

With the return of volume and profitability to mortgage lending, it is no surprise that commercial banks are coming back to the market.

March 11