Earnings

Earnings

-

Flagstar Bank expects to recover $1 million of its loan to defunct reverse mortgage lender Live Well Financial following the sale of the collateral that secured it.

September 19 -

Banks in Denmark have seen their aggregate profits sink this year, according to calculations by the industry's main lobby group, which has repeatedly urged monetary policy makers to provide relief from long-term negative interest rates.

September 16 -

For the third time in five months, the San Francisco bank made a downward revision Monday to its guidance on net interest income. An executive cited the impact of lower interest rates.

September 9 -

Independent mortgage bankers reported their highest average profit per loan originated in almost three years, benefiting from a large drop in production expenses, the Mortgage Bankers Association said.

August 29 -

Fannie Mae and Freddie Mac's corporate debt ratings shouldn't be downgraded in the near term as a result of the Treasury Department's to-be-released government-sponsored enterprise reform plan, Fitch Ratings said.

August 13 -

Lower interest rates and improved gain-on-sale margins helped Impac Mortgage Holdings record its first profitable three-month period since the first quarter of 2018.

August 9 -

Zillow Group shares were poised to fall to a six-week low after its results and updated forecasts suggested its entire "portfolio is faltering" at a critical time for the company looking to pivot its business, analysts said.

August 8 -

Black Knight's second-quarter earnings dropped 20% from the previous year as it took a hit from its indirect investment in Dun & Bradstreet, offsetting a 7% increase in revenue.

August 7 -

Steeper rate declines contributed to a deeper quarterly net loss at Ocwen Financial, forcing it to extend its timeline for returning to profitability.

August 6 -

Essent Group continued to benefit from the volatility in private mortgage insurers' market share, remaining in second place among the six active underwriters at the end of the recent quarter.

August 2 -

Fannie Mae's current tack could help it weather some of the new challenges confronting the government-sponsored enterprises, including the planned expiration of its qualified mortgage rule exemption and rate-driven earnings volatility.

August 1 -

Mr. Cooper Group reported a second-quarter net loss of $87 million as the company took a $231 million fair value hit to its mortgage servicing rights portfolio.

August 1 -

Taylor Morrison Home Corp. recorded earnings that outpaced analysts' estimates and announced a partnership in the growing rental market.

July 31 -

The oft-delayed sale of Genworth Financial might need new approvals from U.S. insurance regulators if and when it disposes of its Canadian mortgage insurance stake.

July 31 -

Freddie Mac continues to churn out steady financial returns, with the growth in first-time home buyers and credit risk transfers providing the GSE stable footing when a recession comes, according to new CEO David Brickman.

July 31 -

New Residential Investment Corp. took a $32 million net loss in the second quarter as it diversified its business lines and repositioned to protect its mortgage servicing rights from falling rates.

July 30 -

Title insurers benefited from the increase in origination volume — especially refinancings — during the second quarter, as open order counts increased compared with one year prior.

July 25 -

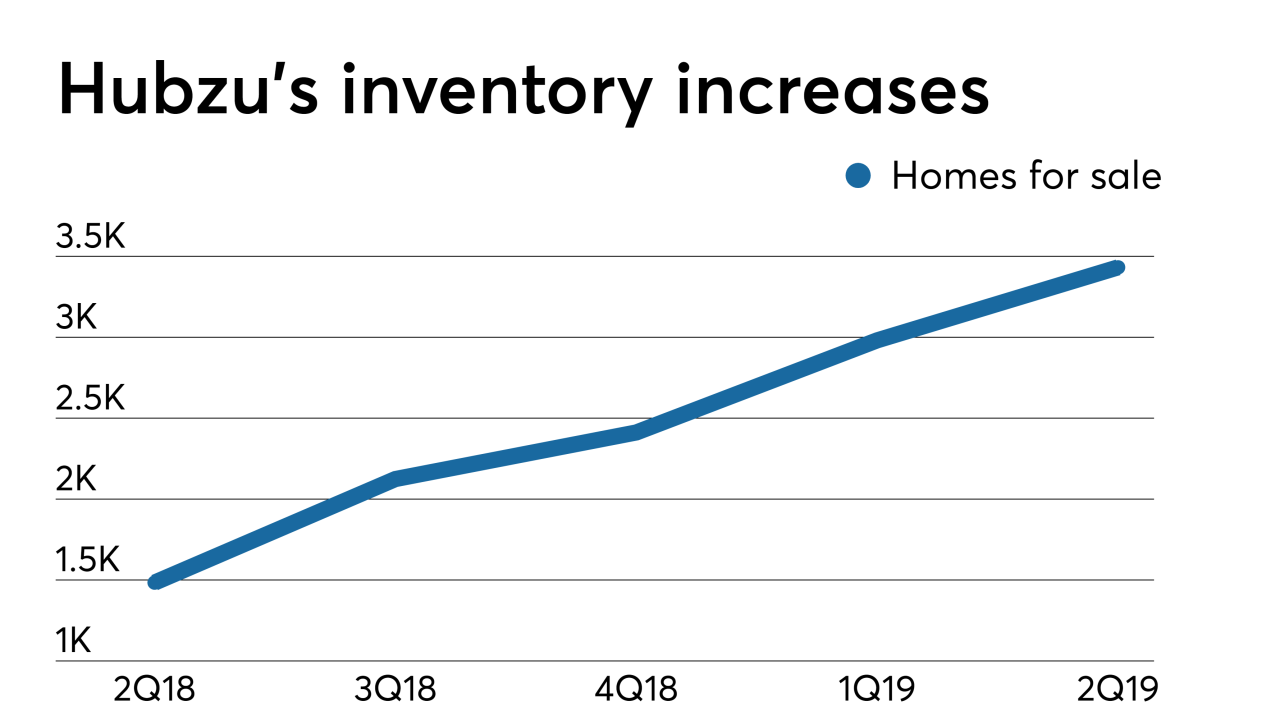

Altisource Portfolio Solutions cut its previous-quarter net loss by 49% in its most recent fiscal period, when property maintenance revenue and new Hubzu real estate auction site inventory increased.

July 25 -

MGIC reported higher-than-expected earnings, seen as a positive for the other mortgage insurers, plus Flagstar and KeyCorp had strong quarters for their mortgage businesses.

July 23 -

Pretax mortgage income at NVR Inc. surged 37% year-over-year in the second quarter while originations rose 1%, contrasting more tepid home-loan earnings results relative to originations at big banks.

July 19