-

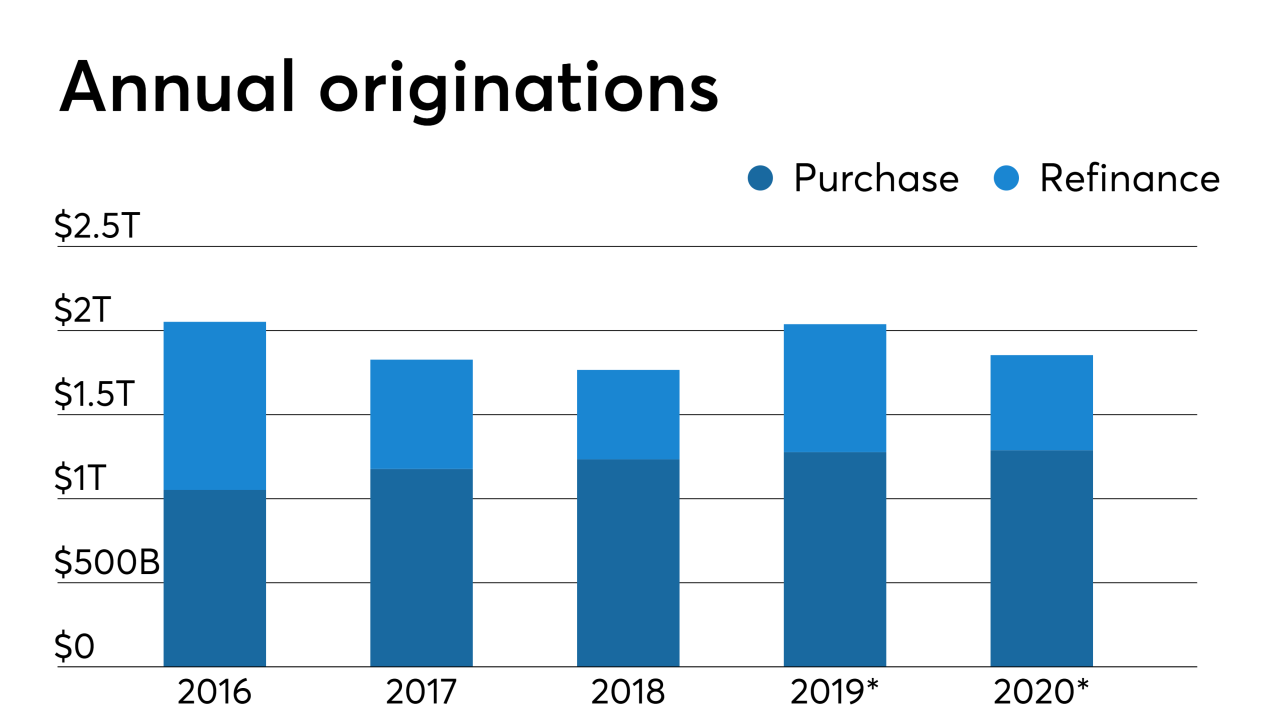

Single-family mortgage production this year is expected to be 3% higher than anticipated last month, according to Fannie Mae, which revised its estimates based partly on a stronger housing outlook.

October 17 -

Mortgage lenders prefer to invest in improvements to their consumer-facing technology because it offers a better return than similar spending on back-end processes, according to Fannie Mae.

October 16 -

The developer of the newly constructed Washington, D.C., headquarters for Fannie Mae is securitizing part of its $525 million, 10-year mortgage through a single-asset, mortgage-backed transaction.

October 10 -

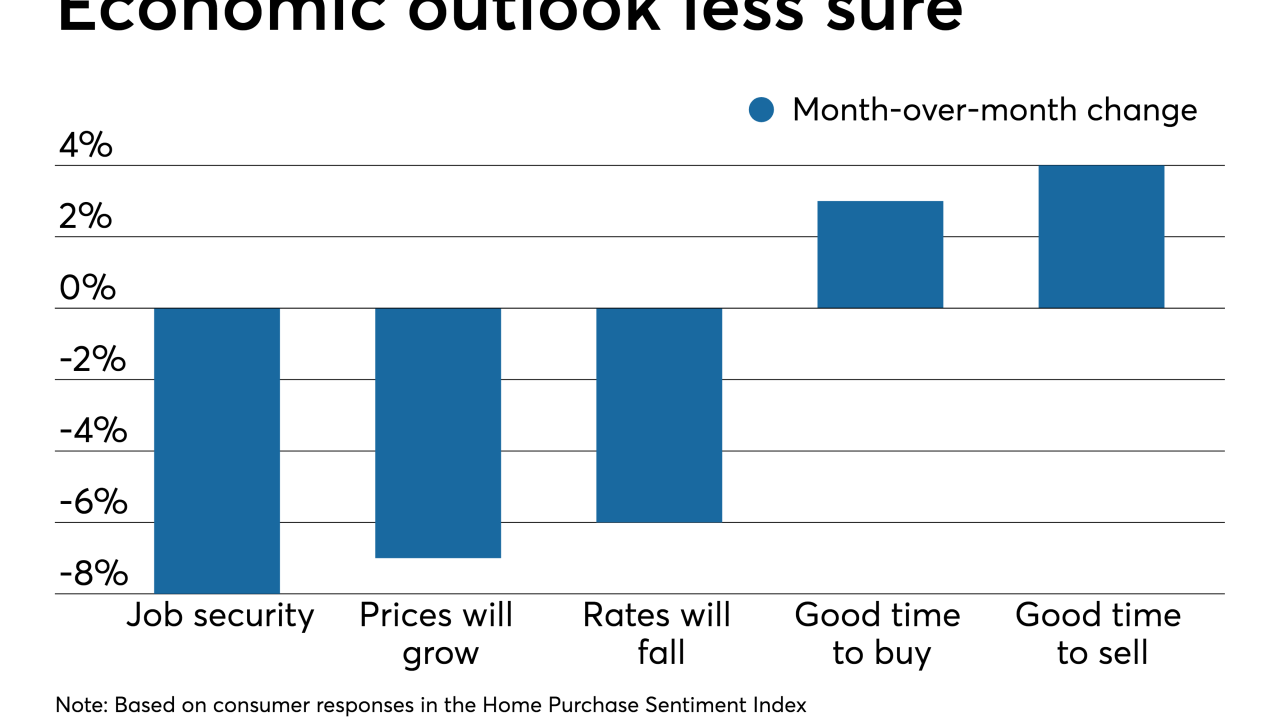

Consumer confidence in the housing market remains relatively strong, but economic uncertainty is testing its resiliency, according to Fannie Mae.

October 7 -

Fannie Mae is cracking down on homebuyer education requirements, particularly for first-time homebuyers and purchasers utilizing high loan-to-value mortgages.

October 4 -

Allowing the mortgage giants to retain profits resolves a short-term capital shortfall, but how much capital they would need after exiting conservatorship is still the bigger question.

October 4 -

The Trump administration's thinking on housing is filled with conflicts and contradictions, a quilt work of at times irrational proposals that seem to be at odds with the real world of mortgage finance.

October 2 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Guild Mortgage, which originated loans on some of the first manufactured homes eligible for new lower-rate Fannie Mae financing, anticipates demand for this housing type will continue to grow this year.

October 1 -

The move to alter the government's preferred stock purchase agreements is the first major one under FHFA Director Mark Calabria's tenure to wind down the conservatorship of the government-sponsored enterprises.

September 30 -

The shareholders' claims against Fannie Mae and Freddie Mac's regulator mirror arguments in cases challenging the Consumer Financial Protection Bureau.

September 26 -

While no one is suggesting that the plan will help banks regain the share they've ceded to nonbanks, bankers believe that stabilizing Fannie Mae and Freddie Mac could at least help them keep what they have.

September 24 -

Industry groups are calling on the consumer bureau to eliminate the debt-to-income limit for “qualified mortgages” and provide a short-term extension of special treatment for Fannie- and Freddie-backed loans.

September 24 -

Commercial and multifamily mortgage delinquency rates should stay at historically low levels in the near future even as economic uncertainty over trade affects U.S. businesses, according to the Mortgage Bankers Association.

September 24 -

The recapitalization of Fannie Mae and Freddie Mac prior to the 2020 election is unlikely even if the net worth sweep ends, according to a Keefe, Bruyette & Woods report.

September 23 -

With the mortgage industry inching closer to full digitization, lenders need to strike the right balance of man-versus-machine as borrowers still look to leverage human interaction during the origination process.

September 20 -

The Federal Housing Finance Agency is ending a Freddie Mac pilot that posed a competitive threat to the private market for mortgage servicing rights financing.

September 19 -

Senate Democrats are warning the Consumer Financial Protection Bureau to be careful as it considers changes to its mortgage underwriting rules.

September 17 -

The low mortgage rates of August drove new homebuyers to cannonball into the purchase market compared to the year before, according to the Mortgage Bankers Association.

September 17 -

Lower rates and signs that more affordable housing inventory is being built drove Fannie Mae's 2019 origination numbers higher in its latest forecast.

September 17 -

The FHFA can go beyond a recent Trump administration report to level the playing field between the private sector and Fannie Mae and Freddie Mac.

September 17 American Enterprise Institute Housing Center

American Enterprise Institute Housing Center