-

The Federal Housing Finance Agency in recent years has required Fannie Mae and Freddie Mac to contribute to the funds every March, but has yet to make a 2019 request. Housing groups see the delay as a troubling sign.

March 25 -

Starting March 26, Senate Banking Committee Chairman Mike Crapo will hold two days of hearings on his plan for returning Fannie Mae and Freddie Mac to private ownership.

March 25 -

In the second lawsuit of its kind, more than a dozen of the world's largest banks are accused of price fixing on roughly $486 billion of bonds issued by Fannie Mae and Freddie Mac.

March 22 -

Commercial and multifamily lending lags the technology available in the residential market. A look at how one expert thinks the gap could be closed.

March 22 -

David Brickman will take the helm of the mortgage giant at a time of transformation in the mortgage market and housing finance policy.

March 21 -

Mark Calabria has notably criticized the government’s role in housing, but some groups have taken him at his word when he told senators that he supported affordable housing initiatives.

March 20 -

Fannie Mae estimates the average 30-year fixed-rate mortgage to hold at 4.4% through 2019 and 2020 due to the overall slowdown in the economy, according to the March housing forecast.

March 20 -

There’s bipartisan consensus that the conservatorships of Fannie Mae and Freddie Mac are unsustainable, but that may not be enough for lawmakers to upend the current system.

March 19 -

As debate over the future of the mortgage finance system heats up, policymakers must ensure that small banks and credit unions maintain equitable access to the secondary market.

March 15

-

The Senate Banking Committee will hold two hearings at the end of March on Chairman Mike Crapo’s most recent framework for housing finance reform.

March 15 -

Mortgage lenders are optimistic about their business prospects during this spring's home purchase season even with the negative sentiments about demand in the previous three months, Fannie Mae said.

March 13 -

The Securities Industry and Financial Markets Association approved changes to its good delivery guidelines that ease the path to the government-sponsored enterprises issuing uniform mortgage-backed securities starting on June 3.

March 12 -

American Banker and National Mortgage News are offering an exclusive discussion of how policymakers may revamp Fannie Mae and Freddie Mac and what that will mean for mortgage lenders of all sizes.

March 11 -

Agency mortgage-backed security prepayment speeds increased in February with much of the refinance activity coming from newer loans and those with high coupons, a report from Keefe, Bruyette & Woods said.

March 11 -

Mark Calabria, who could be confirmed as early as this month, is expected to focus on changes to Fannie Mae and Freddie Mac’s conservatorships to let the mortgage giants keep more of their profits.

March 10 -

Consumers have much more confidence in the job market than they do on housing, and home prices could be the culprit, according to Fannie Mae.

March 8 -

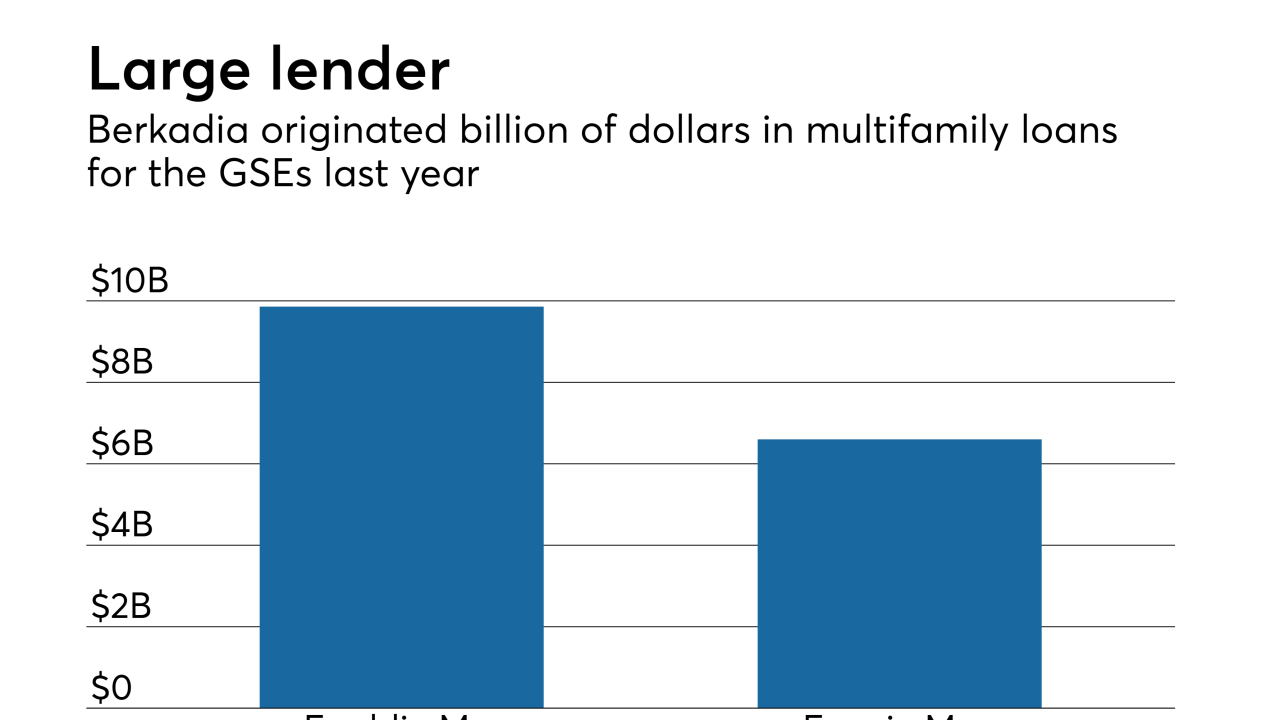

Berkadia, a joint venture run by Berkshire Hathaway and Jefferies Financial Group, is acquiring real estate capital advisory firm Central Park Capital Partners to diversify its capital sources.

March 6 -

AI Foundry is aiming to further cut the time it takes to originate a mortgage by adding artificial intelligence tools designed to improve on optical character recognition.

March 5 -

Freddie Mac closed its fifth LIHTC fund since 2018 and will make three investments in affordable housing through a partnership with National Equity Fund.

March 4 -

The Mortgage Bankers Association, National Association of Realtors and 26 other groups warned the agency not to pursue steps reducing the scope of Fannie Mae and Freddie Mac that could upset the mortgage market.

March 1