-

The Federal Housing Finance Agency's plan to combine Fannie Mae and Freddie Mac mortgages into a single security starting in June 2019 promises to bring both benefits and challenges to the mortgage sector.

April 27 -

Mortgage and title insurance companies licensed in New York need to file disaster response plans this year in line with increased state attention to business continuity planning.

April 25 -

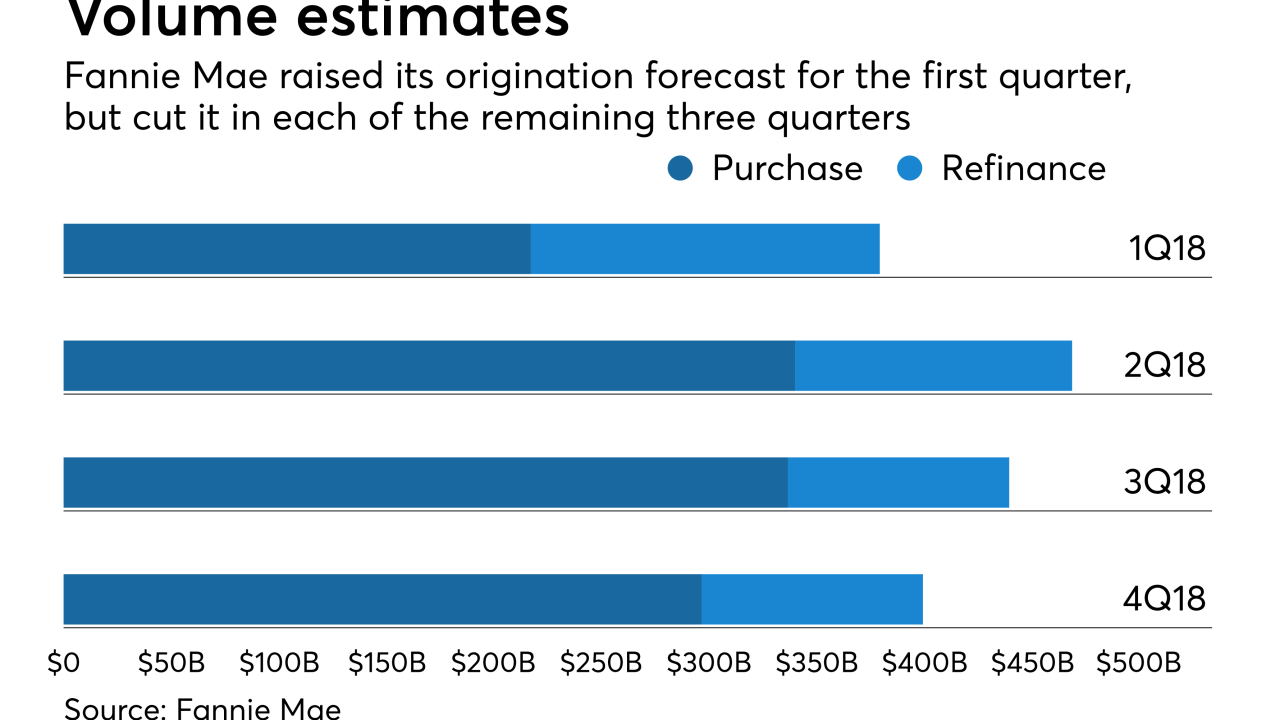

Fannie Mae increased its second-quarter mortgage origination projection by $7 billion as refinance volume is remaining stronger than previously expected.

April 16 -

Cloudvirga, in collaboration with Freddie Mac, has created the capability for loan officers to submit mortgage loan data to both government-sponsored enterprises' automated underwriting systems simultaneously with a single click.

April 12 -

The use of appraisal management companies does not result in higher quality property valuation reports, according to a working paper published by the Federal Housing Finance Agency.

April 11 -

The future secondary mortgage market entities will receive high investment grade ratings, even as there is no clarity on their scope or form, Fitch Ratings said.

April 10 -

The reserve bank's proposal to address banks and nonbanks that remain "too big to fail" does not include two of the largest such institutions: Fannie Mae and Freddie Mac.

April 9

-

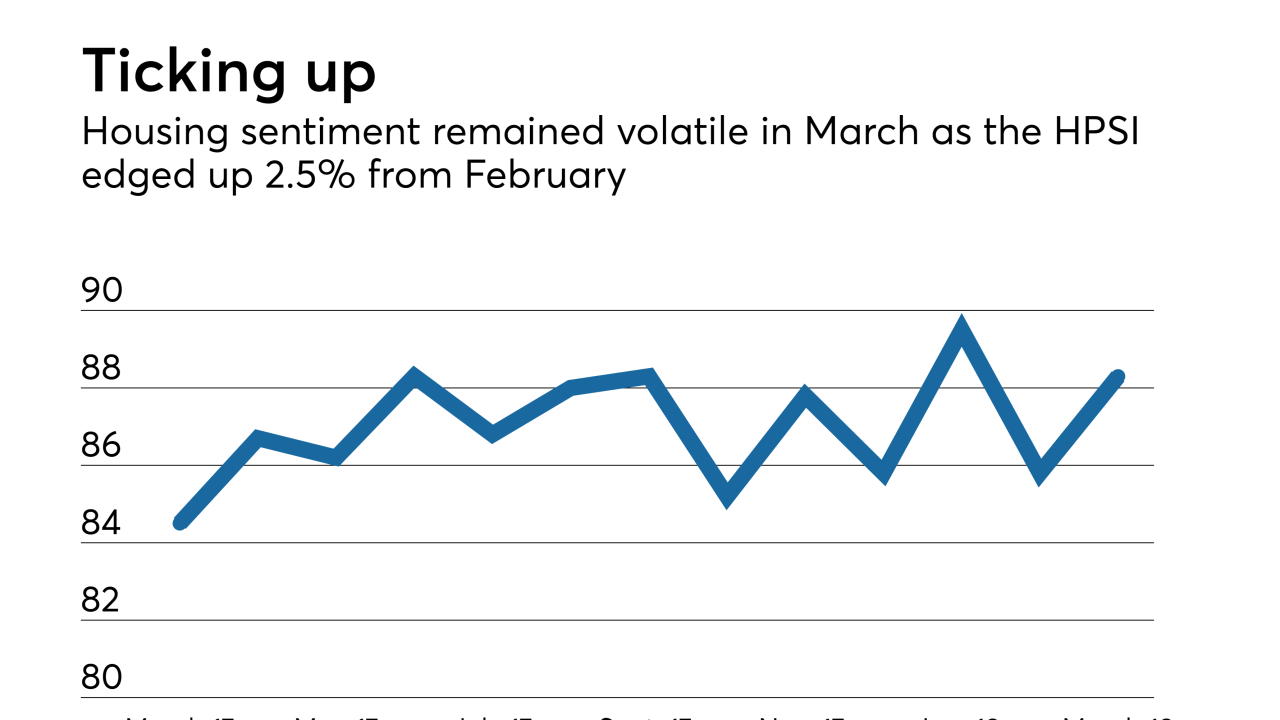

Housing sentiment remained volatile in March as consumers reporting that now is a good time to buy a home rose from the previous month, according to Fannie Mae.

April 9 -

The annual progress report on the Fannie Mae and Freddie Mac conservatorships reiterated that a new credit score model will likely not be operational until after the implementation of a new Single Security Initiative.

March 29 -

After several years of preparation, Fannie Mae and Freddie Mac will start issuing a new, common mortgage-backed security starting June 3, 2019, the Federal Housing Finance Agency said Wednesday.

March 28 -

Despite soaring home prices, other factors needed to inflate a housing bubble are absent from the real estate market. But experts warn falling home values and rising mortgage defaults are inevitable, even if conditions naturally cool off.

March 28 -

Servicers are still trying to figure out how they can best take advantage of the growing use of electronic notes and other digital mortgage tools by lenders and the secondary market.

March 27 -

Fannie Mae and Freddie Mac had a 9% increase in total foreclosure prevention actions taken during 2017 as a result of three September hurricanes, according to the Federal Housing Finance Agency.

March 26 -

News that the GSEs need an infusion from Treasury to cover quarterly losses underscores problems with the government’s 2012 decision to “sweep” the housing giants’ profits.

March 23 The Delaware Bay Company

The Delaware Bay Company -

As tight housing inventory continues challenging prospective borrowers, Newfi Lending has launched a new portfolio lending platform in an effort to make homeownership more attainable.

March 22 -

As policymakers take another crack at housing finance reform, federal leaders and the housing lobby are once again perpetuating the false notion that ending government guarantees would cause the 30-year, fixed-rate mortgage to vanish.

March 21 American Enterprise Institute

American Enterprise Institute -

A stronger than expected refinance market led Fannie Mae to increase its origination projections for the first quarter by nearly 4% in its March outlook.

March 19 -

Fannie Mae is about to roll out a new underwriting system that will address some concerns about layered risk that cropped up after it raised its maximum debt-to-income ratio.

March 16 -

Mortgage lenders are growing more pessimistic about their profitability, with the highest percentage ever seen in Fannie Mae's first-quarter industry sentiment survey expecting a decline in margins.

March 15 -

The security that was incorporated into the index is backed exclusively by loans on green building certified properties; the GSE is still working on acceptance of financing for green upgrades.

March 15