-

The company says its first quarter net income nearly doubled from its showing in Q4 2020, due in part to cost-cutting and servicing income. It also revealed more information about unauthorized payment drafts by its vendor.

April 29 -

Only $89 billion of the $362 billion in new single-family volume came from purchase mortgages.

April 29 -

The Consumer Financial Protection Bureau has moved ahead with an earlier proposal to postpone the full adoption of the qualified-mortgage ability-to-repay rule, citing a need to maximize borrowers' credit access.

April 28 -

A new commercial-mortgage loan for seven facilities operated by the self-storage REIT is the largest of 41 loans in the conduit deal.

April 27 -

System updates, which may be a result of changes to the Preferred Stock Purchase Agreements, have Community Home Lenders Association members saying loans that were approved previously are getting rejected when put back through.

April 26 -

However, conditions for commercial mortgages overall worsened slightly due to persistent concerns in the hotel and office sectors, a Moody’s Investors Service report found.

April 26 -

Despite falling from quarter to quarter, Flagstar’s mortgage revenues remained strong, while its servicing portfolio grew.

April 26 -

More than two-thirds of the economists surveyed expect the Federal Open Market Committee will give an early-warning signal of tapering this year, with the largest number — 45% — looking for a nod during the July-September quarter.

April 26 -

Thanks to a series of government measures, the pandemic did not cause the massive wave of distressed debt flooding the market that many expected, but certain property types remain vulnerable.

April 23 -

Though the government-sponsored enterprises have some of the lowest forbearance rates in the market, they expect to contend with a significant population of borrowers who face steep financial setbacks after the pandemic ends.

April 22 -

Although the company’s revenue and incomes spiked from year-ago levels, most benchmarks showed a decline from the fourth quarter.

April 21 -

Fannie Mae and Freddie Mac’s new limits on loans secured by investor properties and second homes may put pressure on applicants to misrepresent their occupancy status.

April 21 -

First quarter volume was up 3% among eight depositories that reported so far, compared with models that predicted industry-wide drops as large as 13%.

April 20 -

The mortgage real estate investment trust has been a first-mover regarding innovations in the private securitized market, and others tend to follow its lead.

April 19 -

Gene Thompson goes to deciding what the company's next steps are, rather than implementing them.

April 16 -

An interactive dialogue with Founder and CEO of NorthOne on the fintech industry, the growing needs of challenger banks, and the future of SMB banking.

-

The company expects loan growth in the “mid-teens” this year, despite concerns that a housing supply crunch could stymie new mortgage originations. “As soon as COVID fades into the background we'll pick up volume,” CEO and Chairman Jim Herbert said.

April 14 -

Oaktree Re VI 2021-1 will market $531 million in CRT notes that will provide NMI with partial reinsurance on a $45B pool of GSE-eligible loans.

April 14 -

Hild, 46, schemed with other Live Well executives to increase the reported value of a pool of bonds used as collateral for loans, Assistant U.S. Attorney Jordan Estes told jurors in opening statements on Wednesday.

April 14 -

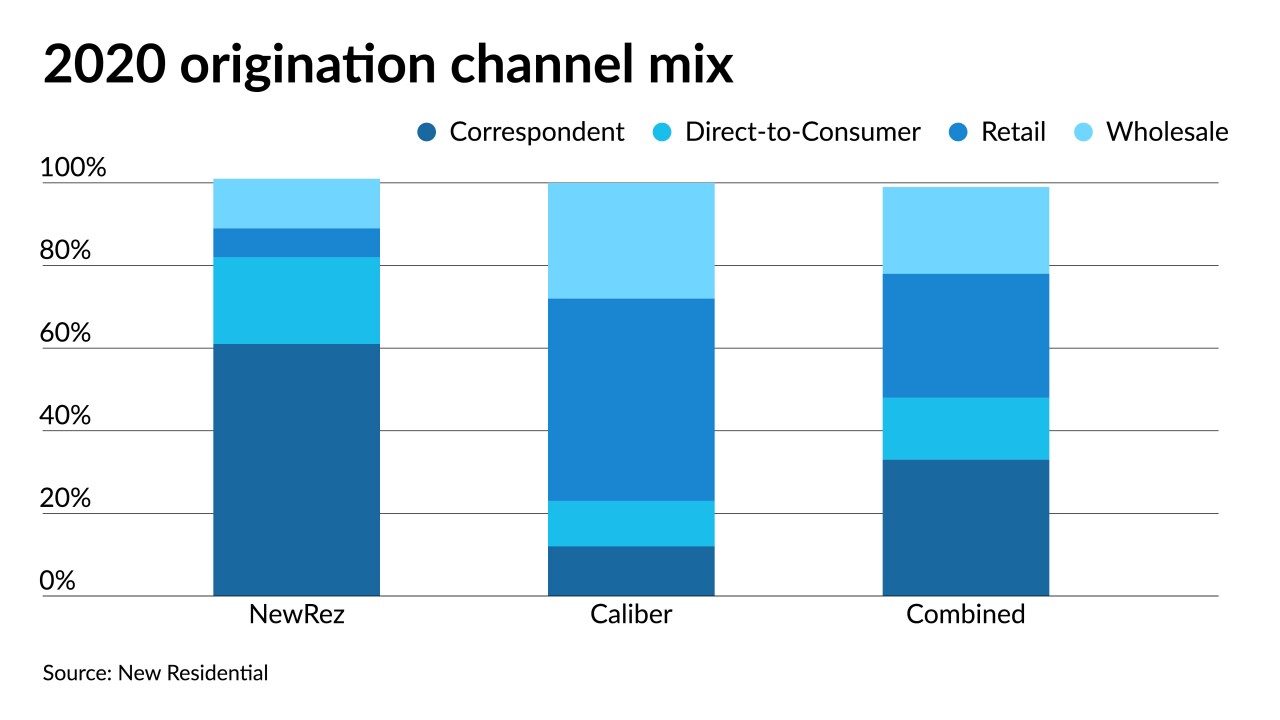

The REIT is planning its own stock sale to pay for the all-cash purchase from Lone Star Funds.

April 14