-

Although the company’s revenue and incomes spiked from year-ago levels, most benchmarks showed a decline from the fourth quarter.

April 21 -

Fannie Mae and Freddie Mac’s new limits on loans secured by investor properties and second homes may put pressure on applicants to misrepresent their occupancy status.

April 21 -

First quarter volume was up 3% among eight depositories that reported so far, compared with models that predicted industry-wide drops as large as 13%.

April 20 -

The mortgage real estate investment trust has been a first-mover regarding innovations in the private securitized market, and others tend to follow its lead.

April 19 -

Gene Thompson goes to deciding what the company's next steps are, rather than implementing them.

April 16 -

An interactive dialogue with Founder and CEO of NorthOne on the fintech industry, the growing needs of challenger banks, and the future of SMB banking.

-

The company expects loan growth in the “mid-teens” this year, despite concerns that a housing supply crunch could stymie new mortgage originations. “As soon as COVID fades into the background we'll pick up volume,” CEO and Chairman Jim Herbert said.

April 14 -

Oaktree Re VI 2021-1 will market $531 million in CRT notes that will provide NMI with partial reinsurance on a $45B pool of GSE-eligible loans.

April 14 -

Hild, 46, schemed with other Live Well executives to increase the reported value of a pool of bonds used as collateral for loans, Assistant U.S. Attorney Jordan Estes told jurors in opening statements on Wednesday.

April 14 -

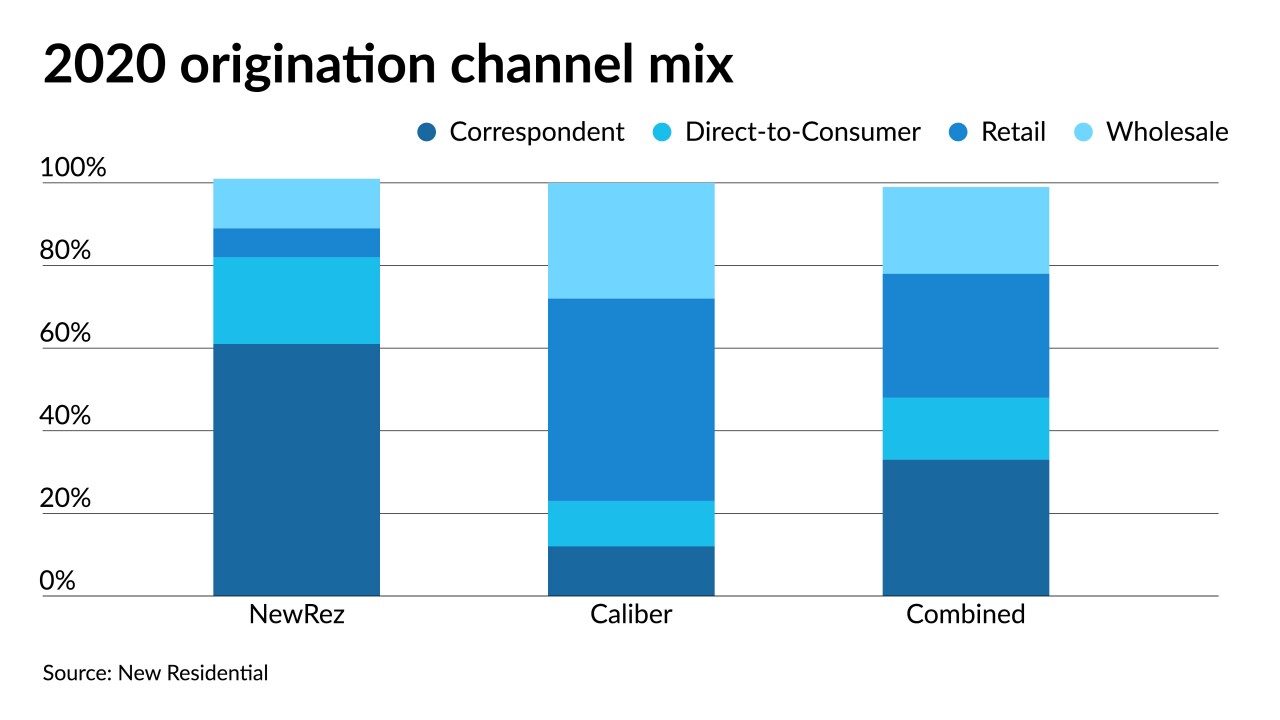

The REIT is planning its own stock sale to pay for the all-cash purchase from Lone Star Funds.

April 14 -

The conduit transaction will carry a $120 million portion of a $750 million debt financing package for Facebook's newly built Oculus R&D center near San Francisco.

April 13 -

However, companies were largely unable to use that cash infusion to make investments that lower their costs, since they had to pay out more in compensation.

April 13 -

The diverse group of loans in the servicing rights portfolio offers a potentially attractive recapture opportunity and would be a sizable transaction for their era.

April 12 -

The inaugural securitization includes 447 30-year loans with average balances of $863,206.

April 12 -

With independent title companies scoring the largest market share gain last year, the sector saw a 22% increase in premiums overall, the American Land Title Association said.

April 9 -

The digital lender’s valuation ballooned to $6 billion from $4 billion less than five months after closing a $200 million fundraise.

April 8 -

Banks can mitigate damage from slowing origination activity by putting excess cash to work, Keefe, Bruyette & Woods said.

April 6 -

One year after its internal merger, the fintech and fulfillment services provider’s COO Debora Aydelotte discusses the company’s support for community banks and its placement in the ranking of Best Fintechs to Work For.

April 6 -

Horizon Land Co. is securitizing a $488 million single-asset, single-borrower loan that will fund its purchase of 93 rent-site communities in the Midwest and Southwest regions.

April 5 -

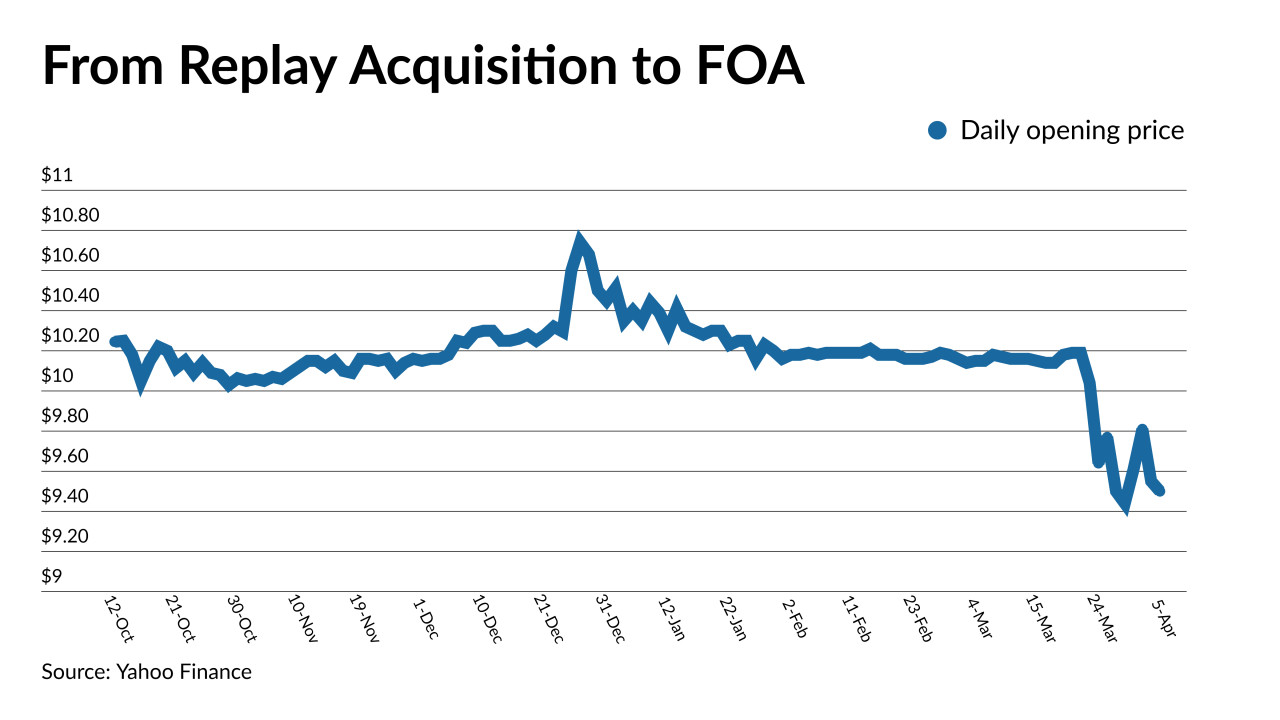

The forward and reverse mortgage lender completed its merger with blank check company Replay Acquisition Corp. on April 1.

April 5