-

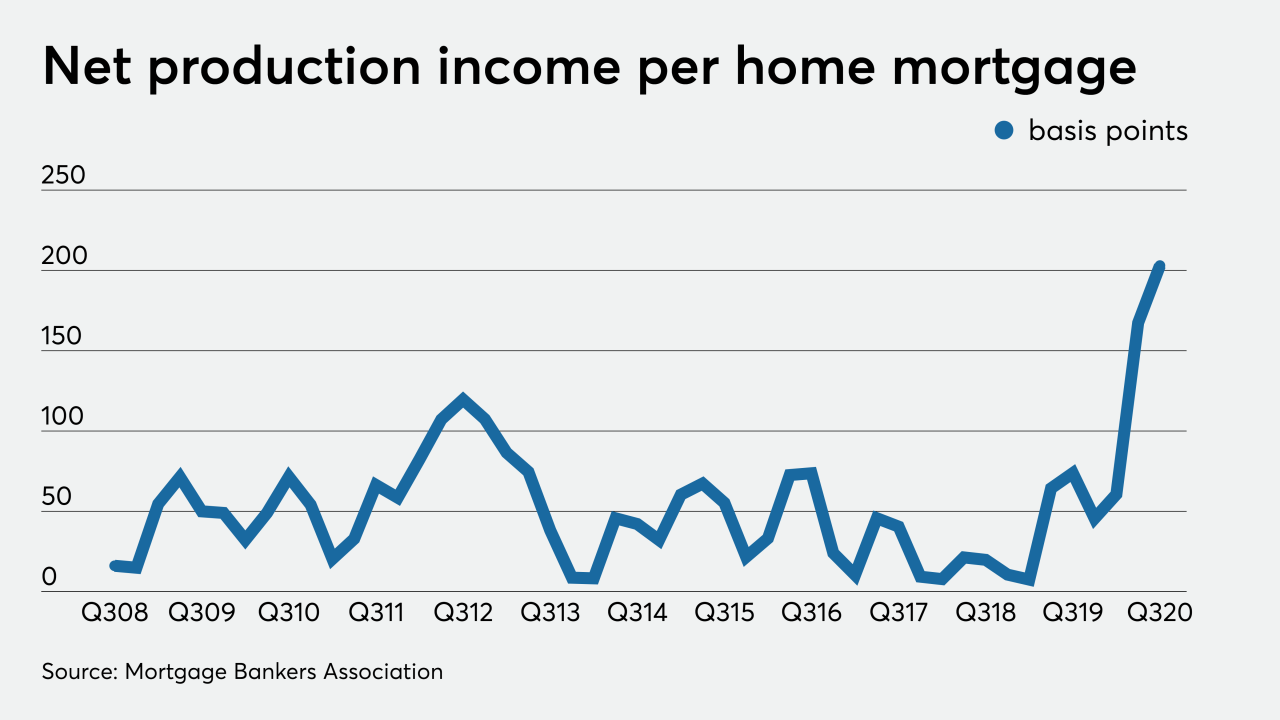

The money lenders are making on each home loan hit another survey-record high in the third quarter, but it may not be quite as high going forward.

December 3 -

The economic fallout from COVID-19 has highlighted systemic concerns about commercial real estate exposure, business debt and short-term wholesale funding, the Financial Stability Oversight Council said in an annual report.

December 3 -

The results are in the middle of the range provided before the company went public in October.

December 3 -

The transaction involving 345 high-balance mortgages is just the third sponsored by Morgan Stanley's mortgage acquisition and trading arm since the financial crisis more than a decade ago.

December 3 -

Originations from all sources, including commercial and reverse mortgages, total $9.2 billion.

December 2 -

Even government-sponsored enterprise loans, which have seen forbearance rates drop for 24 weeks in a row, saw a slight uptick.

December 1 -

Experts in the field predict how some aspects of the market will develop in the coming year.

November 30 -

Other portions of the casino-property loan have been previously assigned to nine other commercial-mortgage securitizations.

November 30 -

Bee Mortgage App will use blockchain and automation provided by Elphi to create "a COVID tool for real estate agents" to get fully digital mortgage approval in under three minutes.

November 25 -

Citigroup's realty arm is sponsoring a $1.06 billion RMBS of highly seasoned mortgage loans with troubled histories. All of the loans were acquired via a Fannie whole-loan auction.

November 25 -

The insurance company has previously sponsored three securitizations of reperforming/nonperforming loans since 2017.

November 24 -

The Structured Finance Association fears Treasury Secretary Steven Mnuchin may release the government-sponsored enterprises from conservatorship ahead of the change in administration, and that doing so could disrupt the mortgage-backed securities market.

November 24 -

Coronavirus-related disruptions at retail and hotel properties are fueling a surge in conduit CMBS delinquencies, according to Moody's Investors Service.

November 20 -

To truly manage risk, banks must invest in more sophisticated modeling, reporting and analytics to track market movements and ultimately maximize profitability, Vice Capital Markets’ Christopher Bennett says.

November 19 Vice Capital Markets

Vice Capital Markets -

The Term Asset-Backed Securities Loan Facility was brought back to inject $100 billion into the pandemic-battered economy, but only a fraction has been disbursed. Yet experts, pointing to its calming effects on markets, recommend that it be extended into next year.

November 17 -

Lenders also increased jumbo product availability as well as rolling out new SOFR-indexed ARMs.

November 16 -

There have been several extensions of the policy since it was put into place as a way to sustain originations amid a wave of forbearance allocated to borrowers with government-related loans.

November 13 -

The substantial Series D fundraise fuels speculation on whether Better.com will be the next mortgage company to hop on the IPO trend.

November 13 -

Freddie Mac representatives would not comment on the sudden resignation of Brickman. Interim CEO Michael Hutchins has served as Freddie’s executive vice president of investments and capital markets since January 2015.

November 13 -

The sector’s leaders are hoping for better in 2021, while not forgetting lessons learned about the market’s risks in 2020.

November 12