Fintech

Fintech

-

There is a real possibility of a large, nonmortgage brand coming into the industry and consolidating a disjointed loan origination process.

February 27 -

It is the start of a new decade, and here are six trends that will play a critical role in reshaping the mortgage industry.

February 19 -

State and local governments are clearing the policy hurdles that stand in the way of mortgage e-closings and that could pave the way for more progress toward this goal.

February 14 -

Fidelity and Essent reported higher year-over-year profits in the last three months of 2019 as refinancing increased business volume, but Black Knight took a hit on its Dun & Bradstreet investment.

February 14 -

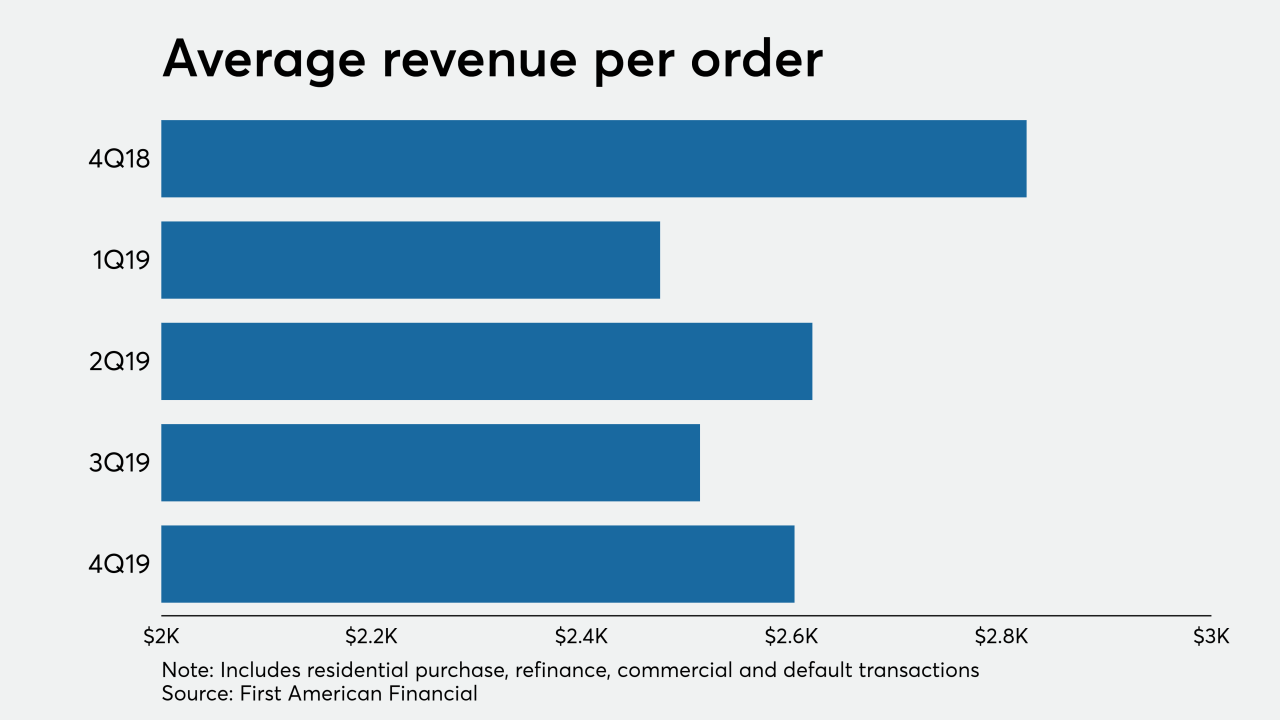

First American Financial, a title insurance underwriter and settlement services provider, is acquiring mortgage document firm Docutech for $350 million in cash.

February 13 -

Digitization presents opportunities for lenders to streamline the mortgage process in ways that benefit them and their borrowers, but three things stand in the path to full adoption.

February 12 -

PMI Rate Pro lets users compare mortgage insurance premium quotes from all six companies in the market.

February 10 -

The credit union service organization Member Driven Technologies has a laid-back work environment but works hard to translate its internal culture to employees who may be located hundreds of miles from headquarters.

February 4 -

Consideration of whether each job can be done remotely is part of Payrailz's holistic approach to developing its workforce. Currently, about two-thirds of the staff works remotely.

February 4 -

Companies that scored highest in this year’s Best Fintechs to Work For (a ranking compiled by our parent company, Arizent) go beyond the basics of strong pay packages, generous benefits and effective leadership to take a more holistic interest in their employees’ lives, according to the data.

February 4 -

Metrics and strategy are key at YCharts. So are mystery-flavored Oreos.

February 4 -

The companies on our third annual list of Best Fintechs to Work For (a ranking compiled by our parent company, Arizent) share an ability to create personal connections with employees, and offer top-tier benefits like generous sabbaticals, fully paid insurance, and parental leave on day one.

February 4 -

The prevention of wire fraud and cybercrime being perpetrated against the mortgage business is the latest passion for Regina Lowrie, longtime industry executive and the first woman to head up the Mortgage Bankers Association.

February 3 -

Many American homeowners count on the equity in their property to help fund their retirement years, but they might be overconfident by relying on that, according to Unison.

January 30 -

Rooted in increased regulations and general customer backlash, there is a growing emphasis on collecting consent and ensuring privacy of customer data, especially following enactment of the California Consumer Privacy Act.

January 28 -

Mortgage lenders' uptake of innovations in artificial intelligence, big data and other technologies has been relatively slow. It's an approach that may not be tenable in 2020.

January 16 -

ClosingCorp, a San Diego-based provider of closing cost data, has purchased the WESTvm mortgage loan order management technology from West, an affiliate of Williston Financial Group.

January 8 -

WeWork co-founder Adam Neumann's family office is in discussions to put additional capital in Peach Street Inc., a startup focused on mortgage servicing.

January 7 -

Sagent Lending Technologies has agreed to buy ISGN Corp. in a deal that would enlarge the company's loan servicing division.

December 24 -

There are no statutory restrictions on the books in any state prohibiting lenders from conducting mortgage closings electronically or remotely.

December 20