-

Home sale prices continue to shoot up across metro Detroit, delighting many sellers but causing nightmares for the would-be buyers who keep getting outbid for the few properties on the market.

July 16 -

From Cleveland to Pittsburgh, here's a look at 12 markets offering favorable costs for housing, helping turn renters into potential homebuyers by quickly saving for a down payment.

July 13 -

The average millennial borrower credit score remained unchanged in May, but values by city painted very different pictures, according to Ellie Mae.

July 11 -

With the supply of housing down and more jobs available in cities, millennials have flocked to urban neighborhoods at a comparable rate to the suburbs for the first time in decades.

July 6 -

The decline in homeownership among young adults can be attributed to a variety of financial headwinds like student loans and societal shifts like marriage rates, but rising housing costs are the core issue, according to research by Freddie Mac economists.

July 2 -

KB Home attributed significant growth in its building and mortgage income to first-time homebuyer activity and new lending technology in its fiscal second quarter.

July 2 -

From lowering expectations about their ideal home to moving faster to close a deal, here's a look at five ways house hunters say they would react to average mortgage rates reaching 5%.

June 29 -

Home prices in 20 U.S. cities continued to advance at a solid, albeit a touch slower, pace in April, reflecting lingering inventory shortages, according to S&P CoreLogic Case-Shiller data.

June 26 -

Purchases of new homes advanced in May to a six-month high as sales in the South increased to the fastest pace since 2007, according to government data.

June 25 -

Sales of previously owned homes unexpectedly fell in May for a second month as a lack of inventory and elevated asking prices weighed on demand, National Association of Realtors data showed.

June 20 -

Resale inventory is at its lowest level in 18 years and new construction supply continues being outpaced by high demand, according to CoreLogic.

June 19 -

Sentiment among homebuilders fell in June to match the lowest level this year, reflecting sharply elevated lumber costs, according to a report from the National Association of Home Builders/Wells Fargo.

June 18 -

Century Communities has acquired the 50% of regional builder Wade Jurney Homes it didn't already own to boost its mortgage and title operations and reach more first-time homebuyers.

June 15 -

Private mortgage insurance was used on approximately 4% fewer loans in 2017 when compared with 2016, according to the U.S. Mortgage Insurers.

June 8 -

In another sign that Palm Beach County finally has shaken off its long economic hangover, home prices hit another post-crash high in April.

May 29 -

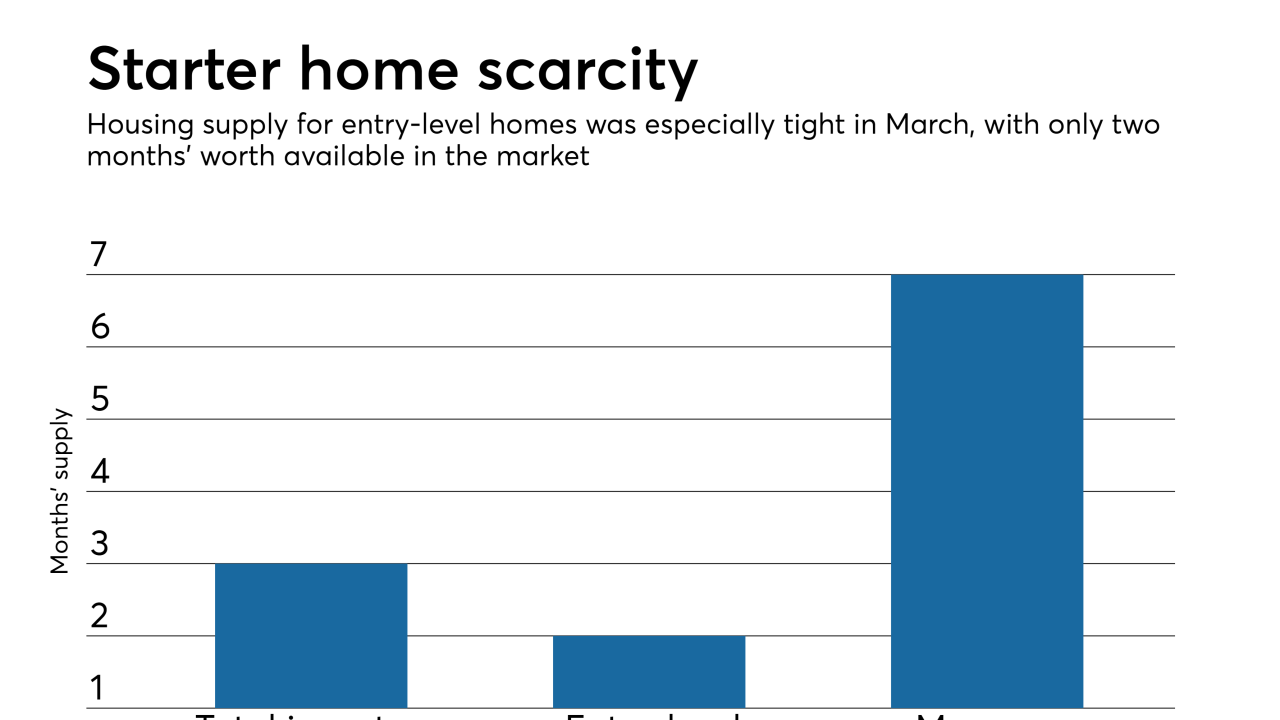

Home prices in 20 U.S. cities climbed more than forecast in March, driven by rising demand and a lack of inventory, according to S&P CoreLogic Case-Shiller data.

May 29 -

The number of single-family houses purchased by first-time homebuyers fell year-to-year as 2018 got underway, reversing a trend that has been in place since 2014.

May 25 -

Sales of previously owned homes fell in April to a three-month low as lean inventory continued to stand in the way of further progress while driving up prices.

May 24 -

A group of low- and moderate-income first-time homebuyers tracked in a Fannie Mae study did not properly prepare to get a mortgage, which created a prolonged and complicated purchase process.

May 24 -

San Diego County's median home price hit an all-time high of $570,000 in April, increasing 8.6% in a year.

May 24