-

A rise in coronavirus cases and the removal of a 50-basis-point adverse market fee designed to protect Fannie Mae and Freddie Mac during the pandemic contributed to the largest weekly drop so far this year.

July 22 -

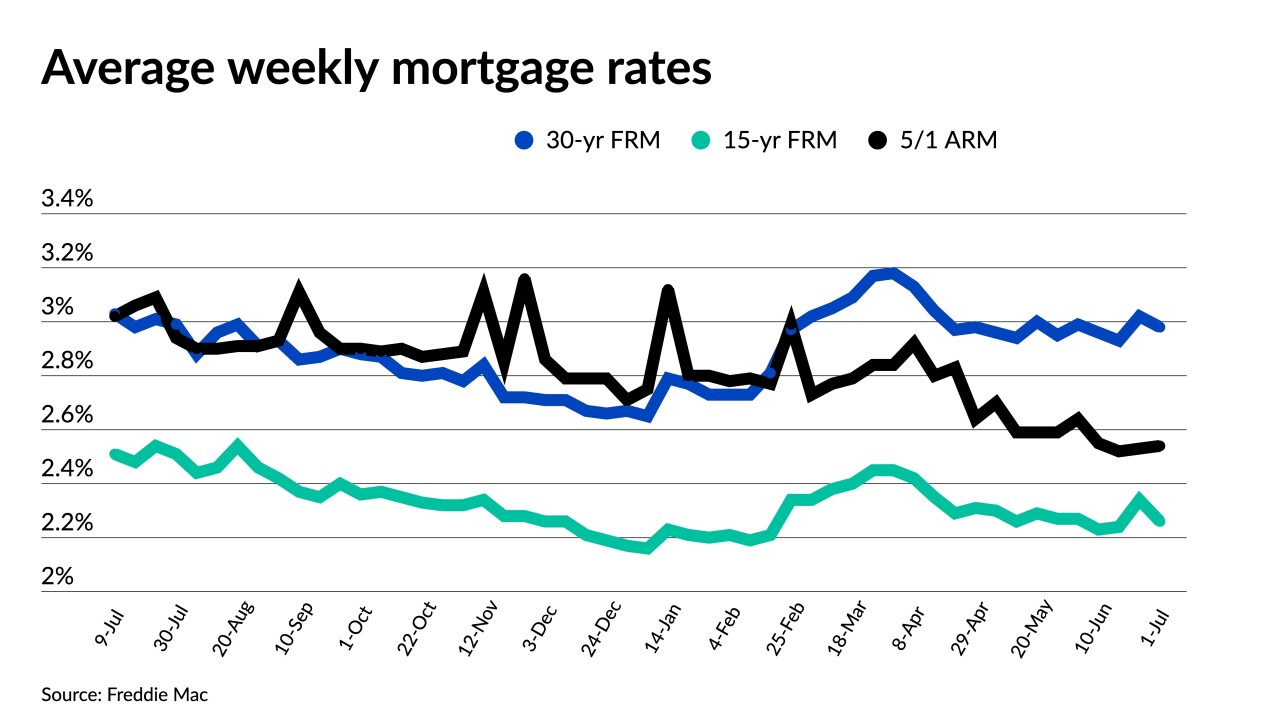

With talk of an overheating economy abating, economists see few signals that would indicate near-term rate spikes.

July 8 -

Estimates suggest public funds in aggregate may be adequate to cover arrears and potentially keep many in their homes as the eviction ban ends, but may not be evenly distributed.

July 1 -

Markets react calmly to inflationary worries, but short supply and rising home prices loom as a greater concern.

July 1 -

Corresponding Treasury yields seesawed over the past week, as some experts see “transitory” inflation persisting.

June 24 -

The justices on Wednesday threw out a key part of a challenge brought by firms including Paulson & Co., Pershing Square Capital Management and Fairholme Funds to the government’s collection of more than $100 billion in profits from Fannie Mae and Freddie Mac.

June 23 -

Signs from the Fed regarding tapering and interest rate hikes could spell the end to the year’s low rates.

June 17 -

Recent reports show inflation rising, but employment underperforming, while interest rates dropped across the board.

June 10 -

The government-sponsored enterprises have been returning to normal underwriting and are buying more loans than last year, but annual limits they have in place could become a concern.

June 8 -

The steady pace of refinance activity has also continued, as borrowers seek to take advantage of sub-3% rates.

May 27 -

DeVito takes over on June 1, replacing interim CEO Mark Grier, who returns to his seat on the government-sponsored agency's board.

May 26 -

A week of light data could possibly lead to further mortgage-rate volatility ahead depending on what monetary officials say in the coming days.

May 20 -

Inflation concerns may reverse the trend that has seen the 30-year rate decline six out of the last seven weeks.

May 13 -

Promising jobs numbers and favorable economic data are an encouraging sign for the post-pandemic future, but rising interest rates are sure to follow.

May 6 -

Only $89 billion of the $362 billion in new single-family volume came from purchase mortgages.

April 29 -

After two straight months on an upward trajectory, rising interest rates pushed homebuyer demand down to a third of where it stood at the start of 2021, according to Freddie Mac.

April 1 -

But the 10-year Treasury yield began backing down after the weekend as investors reacted to turmoil in Europe.

March 25 -

Also: How 9.3 million renters could enter the purchase market, lessons from Flagstar’s data breach and a possible 15-year plan for Fannie and Freddie.

March 19 -

The government-sponsored enterprise greenlit the use of CoreLogic and LoanCraft’s tools that validate self-employed borrowers’ incomes, and it certified Finicity, a firm that facilitates the equivalent for W-2 employees’ payroll data.

March 18 -

New assistance for renters may help but past efforts, while necessary, failed to get relief to renters in an expedient way, said David Brickman, who is now the head of a new agency lending platform backed by Barings and Meridian Capital.

March 17