-

Despite past missteps in the U.S. mortgage business, the bank is giving it another go, bringing servicing in-house and catering to millennials and international clients here, says HSBC’s Raman Muralidharan.

March 12 -

The bank will spend an additional $1.4 billion on technology in 2018 to gain share and boost efficiency, executives said Tuesday. But they were peppered with questions about whether the big investment will yield a big financial return down the road.

February 27 -

Darryl White sees an opportunity for Bank of Montreal to take more market share in the United States, and he’s betting on investments in mortgage lending, commercial banking and capital markets to get there.

February 9 -

The New York multifamily lender is making steady progress in a multiyear effort to reduce its dependency on commercial real estate.

January 19 -

The Arkansas company has spent two years trying to reassure nervous investors and analysts that it can rapidly book real estate loans using conservative practices.

January 18 -

Blue Lion Capital, which had a recent request for a board seat rejected, plans to nominate multiple people to run for the board at HomeStreet's next annual meeting.

January 17 -

Jeanne D'Arc Credit Union has begun thanking home buyers for their business by throwing housewarming parties for them once the process is complete.

January 5 -

Technology-focused mortgage lender loanDepot has created another joint venture with a homebuilder, this time with AV Homes.

January 5 -

PrimeLending is entering into an affiliated business arrangement with Dallas homebuilder Grand Homes that is expected to start producing loans in February.

December 18 -

The company will pay $186 million for First Bank Lubbock in a deal that also includes mortgage unit PrimeWest Mortgage.

December 13 -

When data doesn't tell the whole story about untapped market opportunities, mortgage executives must draw on their personal experiences and local expertise to craft unique strategies to reach new borrowers.

November 24 -

Carver Bancorp, which has spent 70 years serving minorities in Harlem and surrounding neighborhoods, is struggling to turn a profit. As black-run banks nationwide struggle to stay afloat, Carver's CEO insists the institution is on the right track.

November 20 -

One of the biggest challenges surrounding the ballot initiatives is voter turnout, which is often just 10 percent of registered voters in elections the year after a presidential contest.

October 27 -

The forecast for total originations of home equity lines of credit over the next five years is almost twice as high as the five-year total through 2017.

October 24 -

The U.S. subsidiary of Japanese-owned Orix Corp. is adding another housing finance firm in the commercial and multifamily space to its stable of companies with its purchase of Lancaster Pollard.

September 13 -

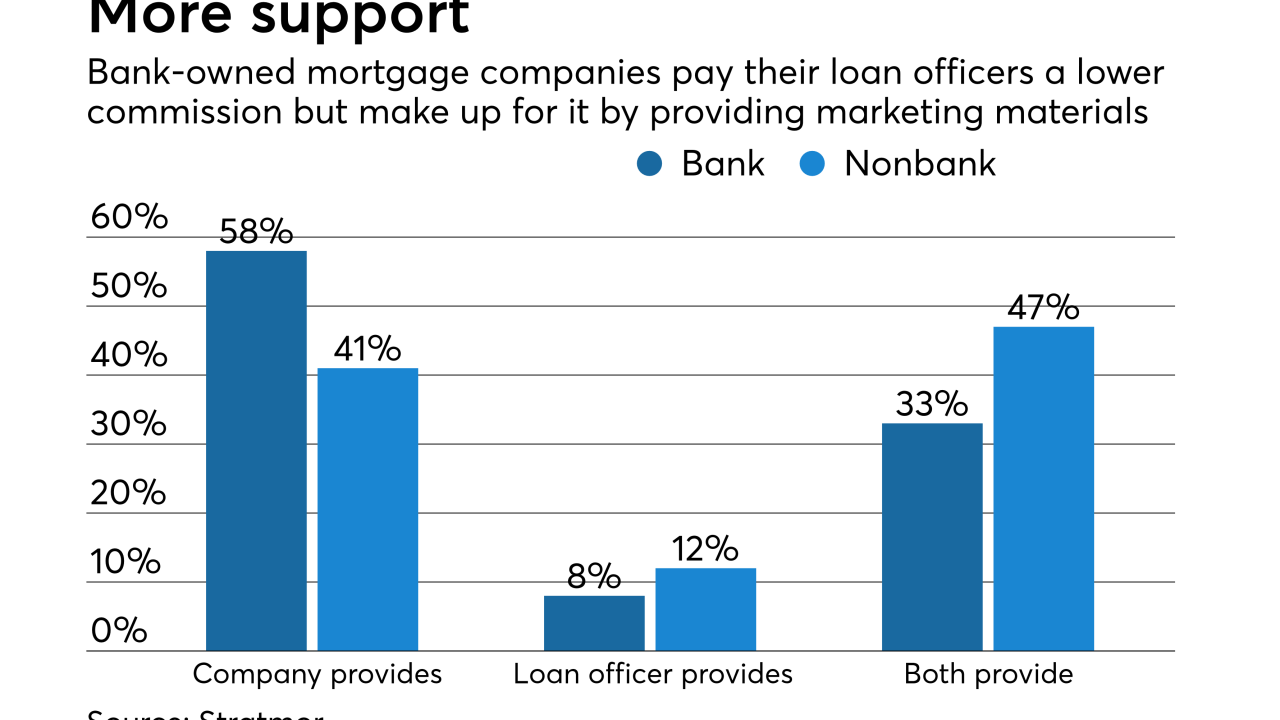

Banks pay their loan officers less than independent mortgage bankers do, but the level of sales support provided negates the difference, a study from Stratmor Group said.

July 28 -

Colony American Finance has been rebranded as Corvest American Lender in the wake of equity and asset acquisitions by funds affiliated with Fortress Investment Group.

July 19 -

New and used auto lending broke records, while HELOCs and second mortgages reached levels not seen since 2012.

July 3 -

Lenders can track the effectiveness of product pricing changes on a real-time basis using a new market share analytics tool from Optimal Blue.

March 30 -

The agreement comes three months after Astoria and New York Community Bancorp called off plans to merge.

March 7