-

Contract closings decreased 7.2% in February from the prior month to an annualized 6.02 million, figures from the National Association of Realtors showed Friday.

March 18 -

All indicators show that the renting market is heating up, as would-be buyers of houses increasingly turn to rentals because they can’t find — and can’t afford — their dream houses.

March 15 -

Before the pandemic, the sprawling architecture and physical distance from neighbors, bars and restaurants seemed out of step with city-obsessed millennials. That’s changed.

February 23 -

Rising interest rates are likely to further slow the rate of appreciation, the Federal Housing Finance Agency said in its quarterly Home Price Index report.

February 22 -

-

Remote workers and young families fleeing coastal cities for the Sun Belt during the pandemic spurred double-digit increases in housing costs and squeezed supply.

February 15 -

But Boise and Austin homebuyers pay the biggest premiums, according to a ranking of the top overvalued markets.

January 26 -

A measure of home prices in 20 U.S. cities jumped 18.3%, down from 18.5% in October, the S&P CoreLogic Case-Shiller index showed Tuesday. It marked the fourth straight month that home-price appreciation has cooled off ever so slightly.

January 25 -

In October, those factors outweighed a smaller rise in annual wage growth, and the gap will keep widening, according to a new First American Real House Price Index report.

December 27 -

Economists at Realtor.com and Redfin predict that across the country, rents will grow about 7% in 2022, higher than the predicted 3% growth in median home listing prices.

December 23 -

First-time buyers comprised just 26% of November transactions, down from 32% a year ago and matching the lowest share since 2014, the National Association of Realtors report showed.

December 22 -

“Rent of shelter” — a category that makes up a third of the CPI basket of goods and services prices — is up 3.9% from November 2020. That’s the most in 14 years but still pales in comparison to many private-sector metrics.

December 13 -

Sales are on track to exceed 6 million this year, which would be the strongest since 2006.

November 22 -

Only eight states experienced annual appreciation viewed as sustainable, according to Fitch Ratings.

November 17 -

U.S. home prices jumped 19.8% in August, the latest in a string of massive gains in the pandemic real estate market.

October 26 -

Listing times, price appreciation and inventory of for-sale homes all made incremental gains in favor of buyers, according to Zillow

October 19 -

The lack of inventory pushed the median housing price to double-digit annual growth for the 14th straight month, according to Redfin.

October 15 -

The state, which has grappled for years with a shortage of affordable housing, will see prices rise 5.2% to a median of $834,000 in 2022, according to a forecast by the California Association of Realtors.

October 8 -

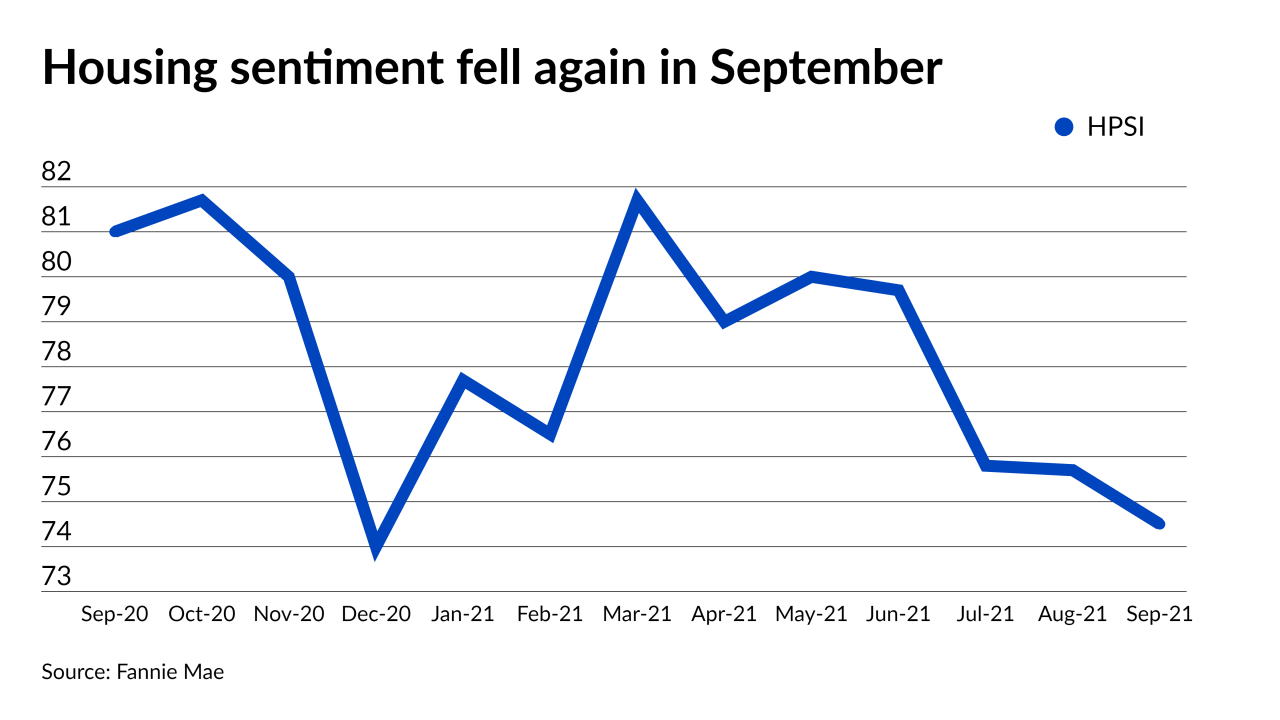

The share of borrowers who thought it was a good time to buy hit an all-time low, according to Fannie Mae.

October 7 -

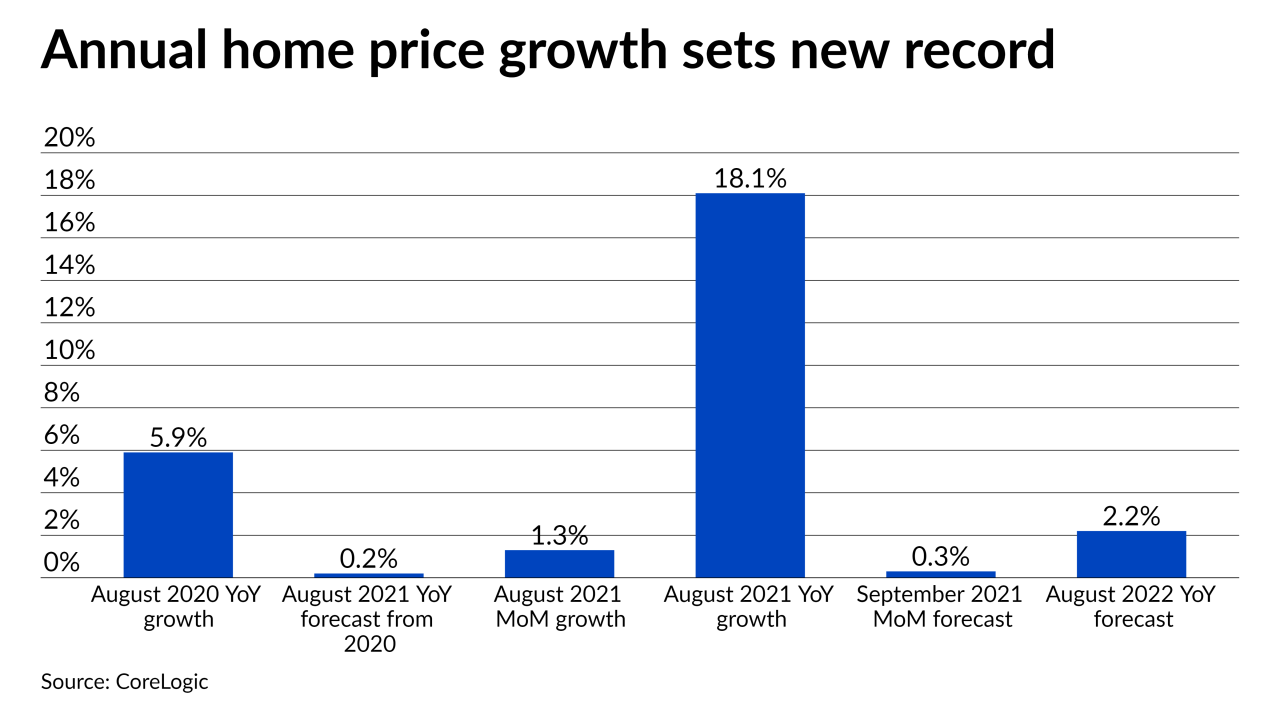

Appreciation more than tripled the year-ago rate, according to CoreLogic.

October 5