The demographic famously lags behind preceding generations in homeownership and asset accrual. And while owning property is one of the key ways to build wealth, it can seem (and often is) more financially burdensome than renting.

But an analysis from title insurer First American shows that in some U.S. cities, it is "cheaper" in the long term to buy a home, once you weigh in appreciation over time.

"Many rent-versus-buy analyses do not factor in a critical benefit of homeownership, the potential for house price appreciation, which helps a homeowner build equity," Odeta Kushi, First American's deputy chief economist, said in a press release.

When accounting for 2019's price appreciation, purchasing a home was less expensive than renting in 46 of the 50 largest metropolitan areas in the U.S., the analysis found. After removing that factor, buying would only make financial sense in 22 of the 50 cities. While the coronavirus pandemic will no doubt impact the rate of price of appreciation for 2020, the 2019 rates provide a glimpse

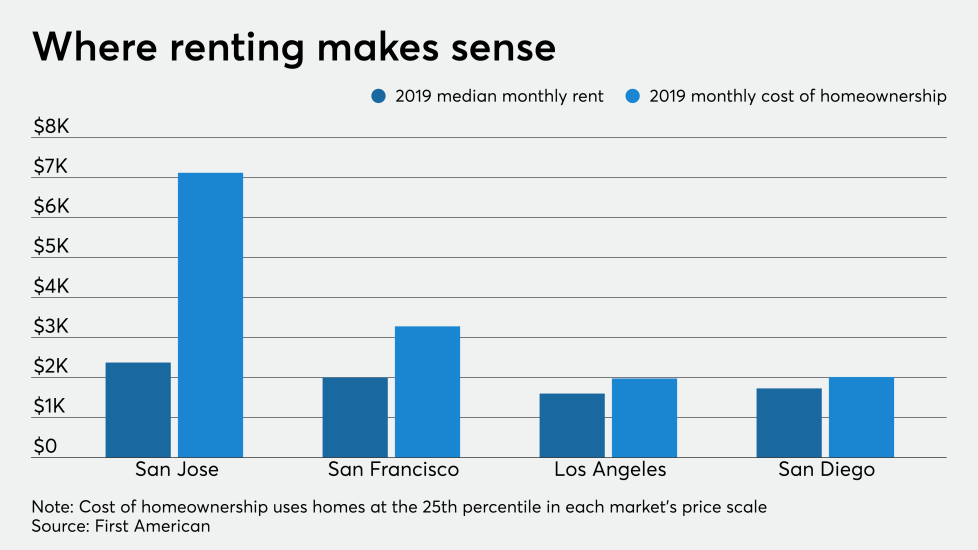

The First American analysis compares 2019's median rent prices to the starter home prices (considered the lowest quarter of the price scale) in each market. Monthly homeownership costs factor in property tax rates and price appreciation while assuming 5% down payments, 3.94% 30-year fixed interest rates and private mortgage insurance rates of 0.75% along with annual homeowner's insurance at 0.4% of home value and annual repair costs at 1% of home value.

The smaller the difference in cost is between buying and renting, the more beneficial it is for consumers to purchase a home. The buying-versus-renting ratios below 1 correspond to a buyer's advantage. In some markets, the housing value appreciation rose so high, owners actually gained more in equity than their total costs. And in the West Coast tech hubs of San Jose and San Francisco, where home prices have skyrocketed over the years, it’s more affordable to rent, the study found.

From the crossroads of America down to the bayou, here's a look at 12 housing markets where it's the most financially prudent to buy a home rather than rent, according to First American.

No. 12 New Orleans, La.

2019 monthly appreciation-adjusted cost of a starter home: $166

2019 median monthly rent: $963

No. 11 Jacksonville, Fla.

2019 monthly appreciation-adjusted cost of a starter home: $166

2019 median monthly rent: $1,129

No. 10 Orlando, Fla.

2019 monthly appreciation-adjusted cost of a starter home: $189

2019 median monthly rent: $1,274

No. 9 Columbus, Ohio

2019 monthly appreciation-adjusted cost of a starter home: $123

2019 median monthly rent: $969

No. 8 Birmingham, Ala.

2019 monthly appreciation-adjusted cost of a starter home: $117

2019 median monthly rent: $940

No. 7 Las Vegas, Nev.

2019 monthly appreciation-adjusted cost of a starter home: $127

2019 median monthly rent: $1,168

No. 6 Tampa, Fla.

2019 monthly appreciation-adjusted cost of a starter home: $123

2019 median monthly rent: $1,145

No. 5 Phoenix, Ariz.

2019 monthly appreciation-adjusted cost of a starter home: $120

2019 median monthly rent: $1,170

No. 4 Memphis, Tenn.

2019 monthly appreciation-adjusted cost of a starter home: $81

2019 median monthly rent: $940

No. 3 Atlanta, Ga.

2019 monthly appreciation-adjusted cost of a starter home: $98

2019 median monthly rent: $1,216

No. 2 Salt Lake City, Utah

2019 monthly appreciation-adjusted cost of a starter home: -$100

2019 median monthly rent: $1,137

No. 1 Indianapolis, Ind.

2019 monthly appreciation-adjusted cost of a starter home: -$158

2019 median monthly rent: $926