Freddie Mac 3Q earnings growth backed by record single-family volume

Agencies formally propose rule to weaken role of guidance

Title insurers' 3Q results are released

CFPB issues its debt collector rule

AmeriHome joins home lender Caliber in delaying IPO

Fannie Mae finalizing plans for switch to hedge accounting

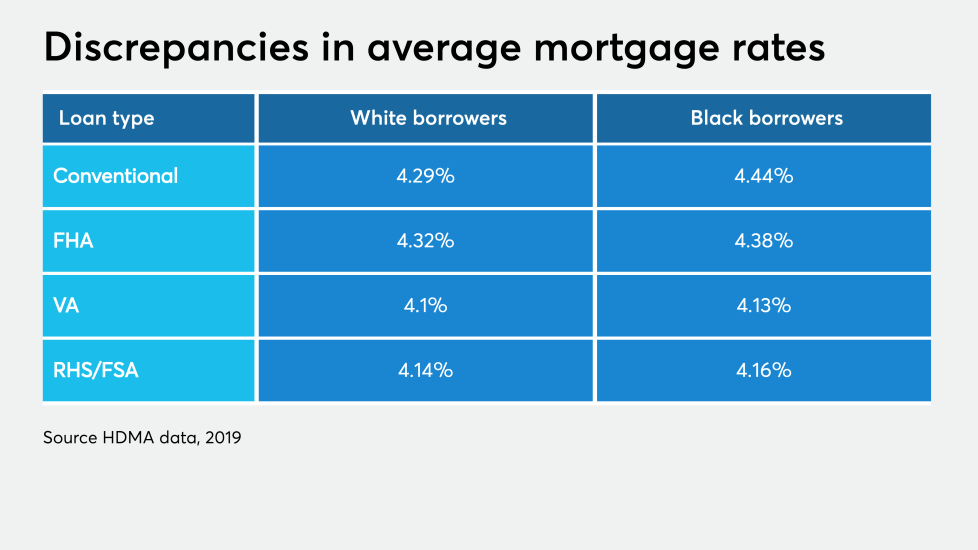

Black homeowners lose about $14K over the life of a mortgage

The analysis of 2019 HMDA data found that Black borrowers locked in an average mortgage rate of 4.44% for conventional loans — 15 basis points higher than white borrowers. Though not as stark, Black consumers paid higher average interest rates across all loan types compared to their white counterparts. (Read full story

CFPB fines ninth lender for misleading VA marketing practices

All the cases involved companies that used direct mail to market their products. The investigation was started by the CFPB after the Department of Veterans Affairs expressed concern over

The slowing decline of forbearances reflects an uneven recovery