-

Instability among foreign relations typically drags down long-term interest rates and the latest crisis with Iran could be a catalyst for a drop in 2020, according to NerdWallet.

January 3 -

Issuance of Ginnie Mae mortgage-backed securities slipped after several months of gains, but high volume still pushed the year-to-date total for 2019 ahead of 2018’s full-year figure.

December 16 -

Star investor Jeffrey Gundlach and his team have generated strong returns by focusing on under-followed pockets of the market like mortgage securities, but his success may be hard to replicate.

December 13 -

The share of Department of Veterans Affairs-guaranteed loans in Ginnie Mae mortgage-backed securities issuance rose to 42% in the most recent fiscal year from almost 39%, and could continue to rise.

December 9 -

Mortgage-bond investors will need to absorb about 26% more agency MBS supply in 2020 as both home sales and prices continue to climb, according to the average estimate of six of Wall Street's biggest dealers.

December 5 -

The outperformance of mortgage-backed securities versus U.S. Treasuries has extended for a third straight month into November, buoyed in part by a decline in volatility.

December 2 -

Changing or eliminating the exemption to the qualified mortgage rule could harm consumers and put smaller lenders at a disadvantage to the big banks.

November 20 Freedom Mortgage Corp.

Freedom Mortgage Corp. -

The Federal Housing Finance Agency has extended its deadline for investor comments on a proposal aimed at better aligning pooling practices for loans in uniform mortgage-backed securities.

November 19 -

There's been chatter that investors are shying away from Fannie Mae and Freddie Mac mortgage-backed securities because Congress may not enact housing finance reform. Be skeptical of those claims.

November 19

-

The Federal Housing Finance Agency is seeking comment on a proposal that could pave the way for potential Fannie Mae and Freddie Mac competitors to use the uniform mortgage-backed security structure.

November 4 -

Early payment mortgage defaults went to the highest level in nearly a decade, particularly among loans included in Ginnie Mae securities, a Black Knight report said.

November 4 -

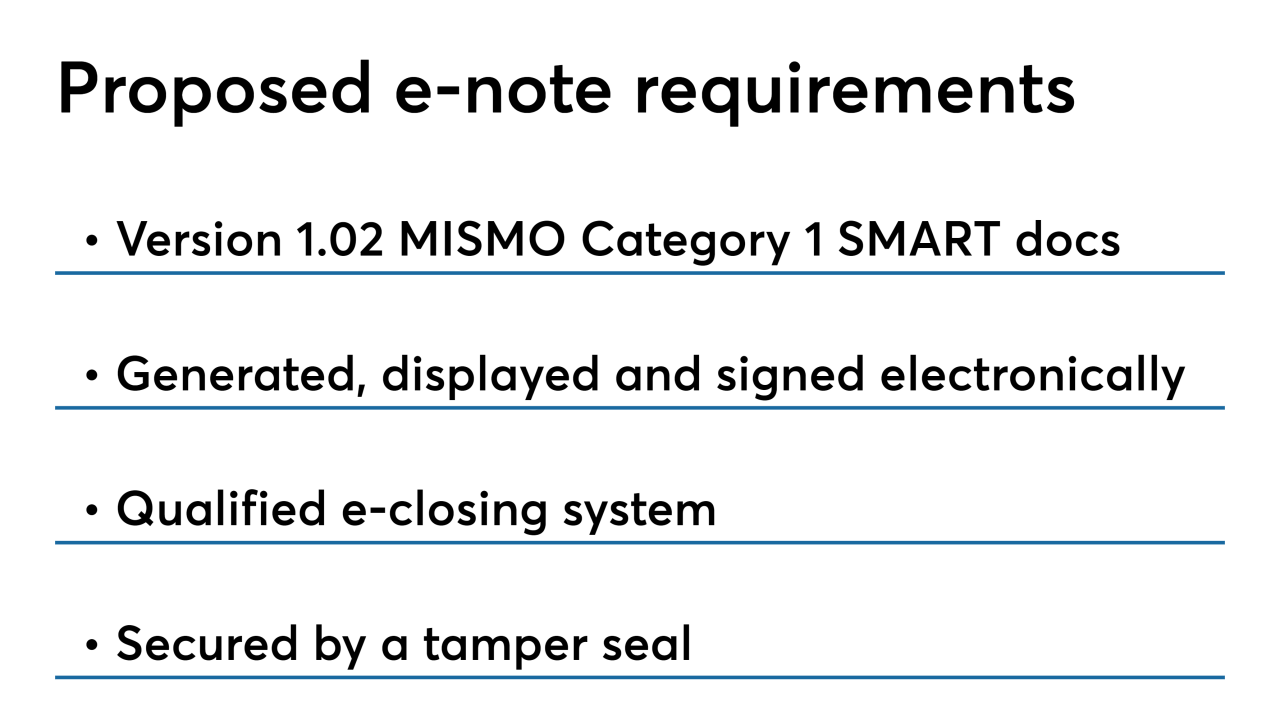

Ginnie Mae is looking for input on its proposed guidelines for electronic promissory notes and other mortgage documents that it plans to test through a digital collateral pilot.

October 28 -

For the mortgage industry, the question of whether the Fed can control its target range for interest rates is crucial for managing volatility.

October 16 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The end of the qualified mortgage patch should further accelerate non-QM origination growth, but is the mortgage industry ready?

October 8 -

Ginnie Mae's stress testing model was based on large issuers, and does not appear to adequately reflect important qualitative differences between larger and smaller issuers.

October 1 Hallmark Home Mortgage

Hallmark Home Mortgage -

The spike in overnight repurchase agreements may prompt the Federal Reserve to expand its balance sheet.

September 18 -

Live Well Financial CEO Michael Hild has been charged with misrepresenting the value of a bond portfolio in parallel actions by the U.S. Attorney's Office and the Securities and Exchange Commission.

August 30 -

The bank started buying more Treasurys and mortgage-backeds over a year ago, long before talk about rate cuts. What did it know that its rivals didn't?

August 25 -

Ginnie Mae followed through with plans to look more closely at secured debt ratios in its latest round of new and revised issuer requirements.

August 23 -

The monthly volume of new mortgage securities insured by Ginnie Mae remained higher than it has been in more than two years in July, rising slightly on a consecutive-month basis.

August 13