-

The move is part of an effort by CFPB Director Kathy Kraninger to help smaller lenders by significantly raising loan thresholds for collecting and reporting mortgage data.

April 16 -

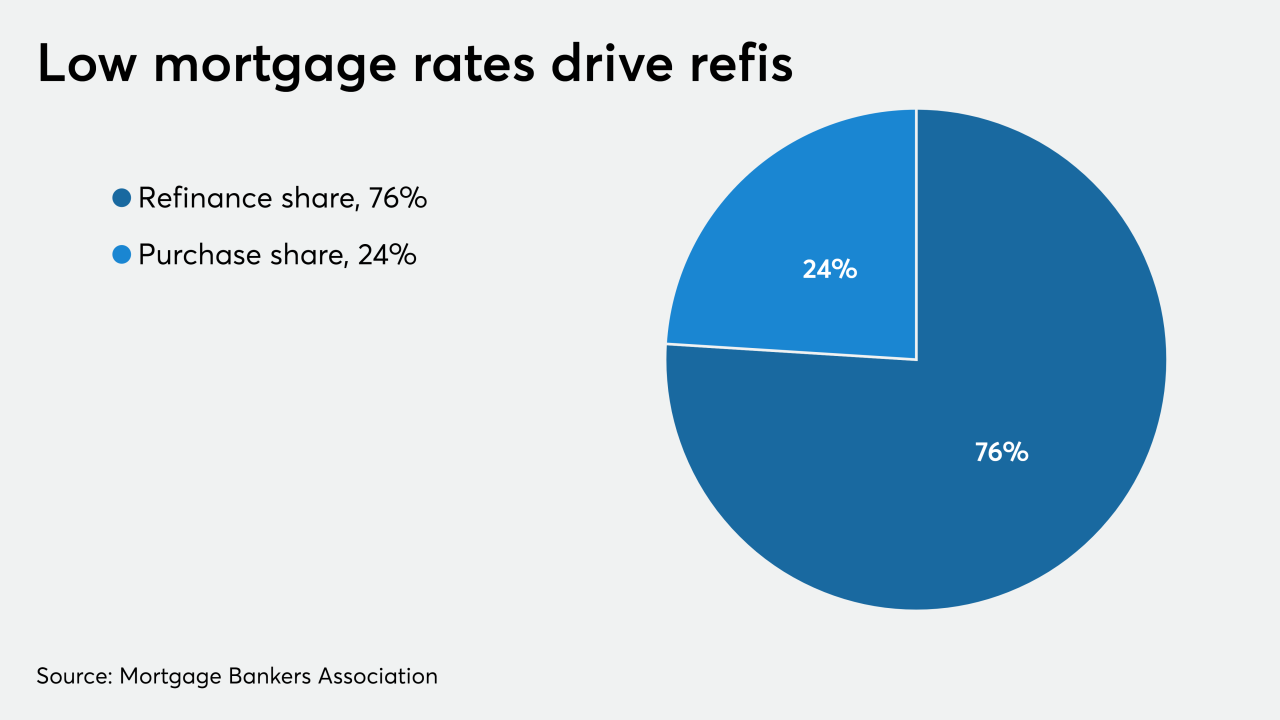

Mortgage application volume increased 7.3% over the prior week, as rates for the 30-year fixed loan reached the lowest level since the Mortgage Bankers Association started tracking this information.

April 15 -

Homebuilders in the Twin Cities kept the construction spigot open during March amid growing concerns about the COVID-19 pandemic.

April 10 -

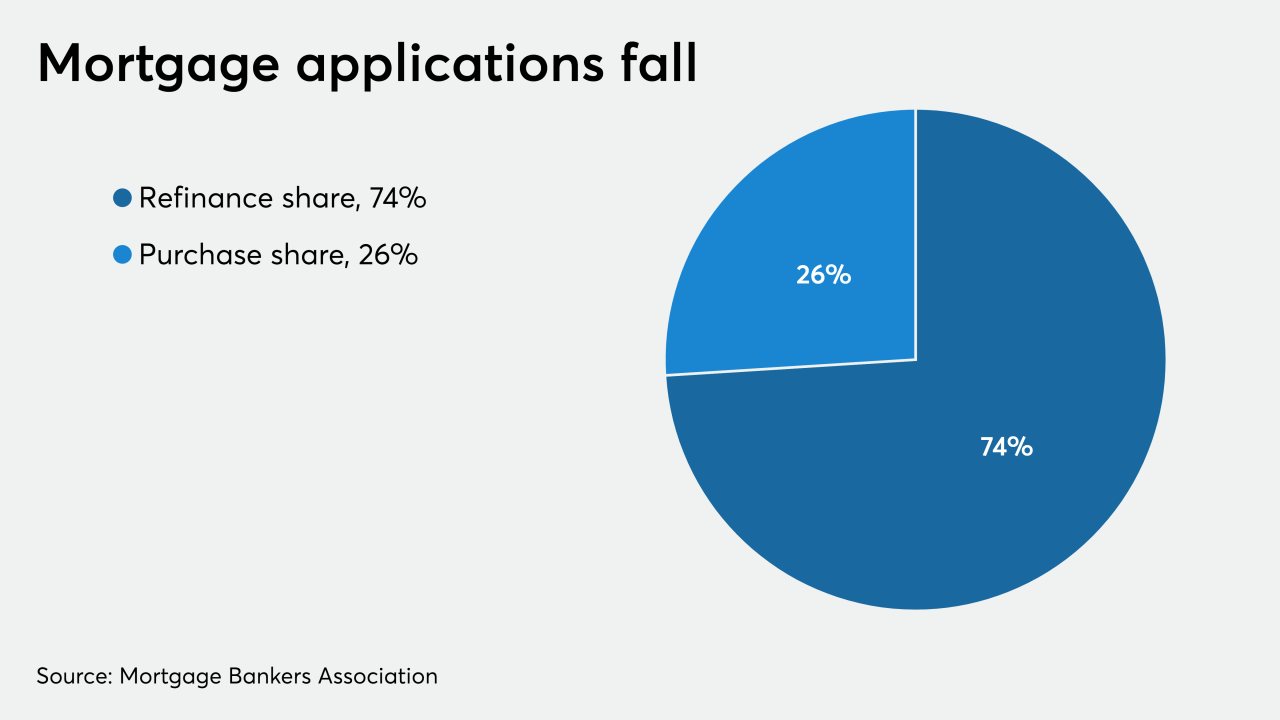

Mortgage applications decreased 17.9% from one week earlier, as coronavirus-related volatility affected consumer sentiment, according to the Mortgage Bankers Association.

April 8 -

Mortgage application activity increased from the prior week, driven by strong refinance volume after a 35-basis-point drop in conforming loan interest rates, according to the Mortgage Bankers Association.

April 1 -

There was a nearly 30% week-to-week decline in loan applications as Americans reacted to the uncertainty, both economic and medical, from the spread of COVID-19, according to the Mortgage Bankers Association.

March 25 -

Additional mortgage-backed securities purchases by the Federal Reserve Bank of New York will address private investor skittishness about the asset class, but it will not necessarily lower rates.

March 20 -

Refinancing activity is surging, existing borrowers are inquiring about loan modifications, loan closings are being delayed by more complex credit checks — and banks are short on people to handle it all.

March 19 -

Mortgage application volume decreased 8.4% compared with one week earlier as lenders managed activity by raising rates even as 10-year Treasury yields fell below 1%, according to the Mortgage Bankers Association.

March 18 -

Mortgage applications to purchase new homes took a small step back in February from record levels during the previous month, but further positive momentum could be blunted by the coronavirus.

March 17 -

Paradoxically, mortgage rates actually increased this past week, even as the 10-year Treasury yield plumbed new depths, likely because lenders are too busy to handle the influx of applications.

March 12 -

The Mortgage Bankers Association raised its refinance projections for 2020, a move precipitated by an application volume increase of 55.4% from one week earlier.

March 11 -

Mortgage interest rates dropped this week to the lowest level on record, fueling an already hot spring housing market and triggering a refinance boom in the Twin Cities.

March 6 -

Mortgage rates hit their lowest point since Freddie Mac began tracking this data in 1971, as the 10-year Treasury yield fell below 1% after the Federal Open Market Committee's surprise short-term rate cut.

March 5 -

Mortgage application volume increased 15.1% from one week earlier, and with interest rates still falling, even higher refinance demand is probable in the short term, according to the Mortgage Bankers Association.

March 4 -

Mortgage application volume rose last week, but with the 10-year Treasury yield tanking in recent days, growth in refinancings for the current period is quite likely, according to the Mortgage Bankers Association.

February 26 -

A dip in conventional mortgage refinance demand drove mortgage application volume down compared with one week earlier, according to the Mortgage Bankers Association.

February 19 -

Newly constructed home purchase application volume continued its upward momentum during January, with unexpectedly low mortgage rates encouraging consumers to start shopping now, according to the Mortgage Bankers Association.

February 18 -

Mortgage rates ticked up slightly, marking the first increase in four weeks, but they remain at levels which encourage borrowers to refinance, according to Freddie Mac.

February 13 -

Refinance application activity last week was the highest in nearly seven years, with more than triple the volume from one year ago, according to the Mortgage Bankers Association.

February 12