-

Mortgage applications rose 1.6% from one week earlier as falling interest rates contributed to a boost in refinance activity, according to the Mortgage Bankers Association.

December 12 -

Mortgage applications rose for the second straight week as key interest rates fell back toward 5%, according to the Mortgage Bankers Association.

December 5 -

Mortgage rates held steady this week, remaining near their lowest levels in more than a month, according to Freddie Mac.

November 29 -

The rush in holiday shopping also boosted the housing market as mortgage applications increased 5.5% from one week earlier, according to the Mortgage Bankers Association.

November 28 -

Mortgage application activity decreased 0.1% from one week earlier as refinance volume tanked, although interest rates fell, according to the Mortgage Bankers Association.

November 21 -

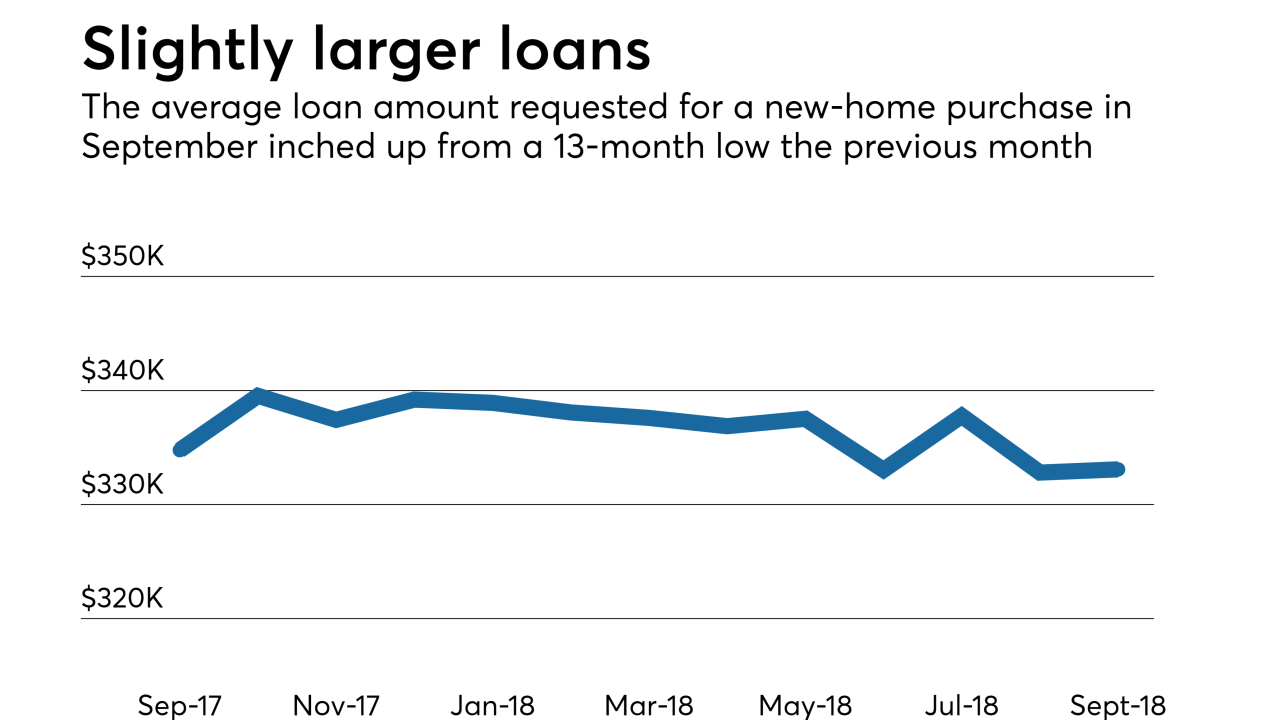

Borrowers buying new homes produced fewer loan applications than they did a year earlier due to October's rising interest rates.

November 16 -

Wells Fargo will lay off 1,000 workers primarily from its mortgage unit in the first major round of a previously announced plan to cut the bank's workforce by as much as 10% over the next three years.

November 15 -

Mortgage application activity decreased 3.2% from one week earlier as interest rates rose to eight-year highs and refinancings fell to an 18-year low, according to the Mortgage Bankers Association.

November 14 -

More veterans are turning to Department of Veterans Affairs loans to buy a house as the number of purchase mortgages shot up 59% compared to five years ago.

November 9 -

-

Mortgage application activity dropped to its lowest level since December 2014 as interest rates reached an eight-year high, according to the Mortgage Bankers Association.

November 7 -

Mortgage applications decreased 2.5% from one week earlier as purchase activity compared with 2017 fell for the first time in nearly three months, according to the Mortgage Bankers Association.

October 31 -

An increase in refinance activity in the period after Columbus Day drove mortgage applications 4.9% higher from one week earlier, according to the Mortgage Bankers Association.

October 24 -

Despite mortgage rates at a seven-year high and rising home prices and low inventory that are keeping consumers from buying homes, rental prices are declining in many markets.

October 18 -

Mortgage applications decreased sharply from one week earlier as key interest rates stayed above 5%, although purchase volume grew from a year ago, the Mortgage Bankers Association reported.

October 17 -

Hurricane Michael is putting mortgage transactions with a combined value of over $400 million in jeopardy, according to ClosingCorp estimates.

October 11 -

Mortgage borrowers buying new homes generated more loan applications this September than they did a year ago, even though interest rates are higher this year.

October 11 -

Mortgage applications fell last week as rates for the 30-year fixed conforming loan topped 5% for the first time since 2011, the Mortgage Bankers Association reported.

October 10 -

Mortgage application activity was relatively flat compared with the previous week, as long-term interest rates held steady following the recent Fed rate hike, according to the Mortgage Bankers Association.

October 3 -

Mortgage applications were up 2.9% from one week earlier, even as the rate for the 30-year conforming mortgage reached its highest point in over seven years, according to the Mortgage Bankers Association.

September 26