-

Signed purchase agreements dropped 20%, but the sales that closed in April showed buyers still paying top dollar.

May 22 -

With mortgage rates reaching all-time lows in the opening quarter, refinance originations were up in 97% of housing markets during 1Q, according to Attom Data Solutions.

May 21 -

Home sales in Volusia and Flagler counties in Florida declined in April, but prices continued to rise, area Realtors' associations reported.

May 21 -

Mortgage rates declined this past week, further continuing to help attract previously reluctant buyers back into the purchase market, according to Freddie Mac.

May 21 -

Sales of previously owned homes fell in April by the most since mid-2010 as the coronavirus hollowed out demand across the country at the start of the key spring selling season.

May 21 -

From the Midwest to mid-Atlantic, here's a look at 12 housing markets where first-time homebuyers find the most affordability, according to NerdWallet.

May 20 -

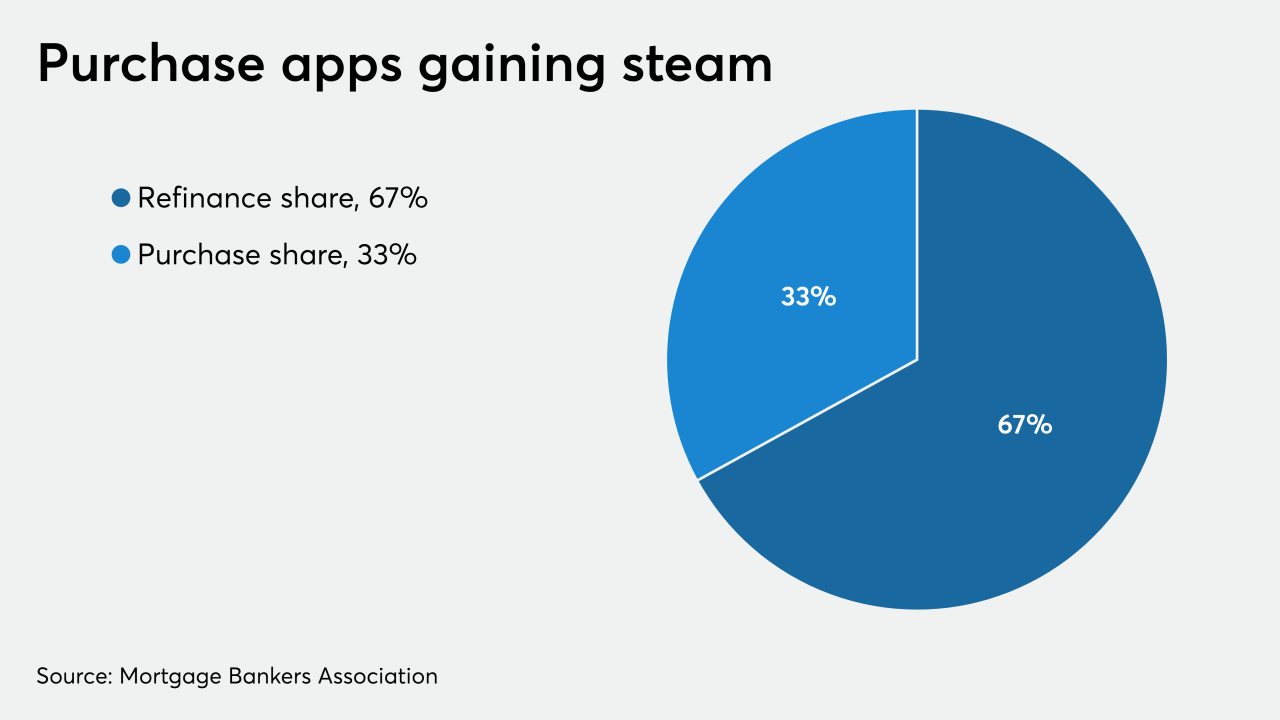

Mortgage applications decreased 2.6% from one week earlier, as tighter underwriting drove the refinance index to its lowest level since March, according to the Mortgage Bankers Association.

May 20 -

The Mortgage Bankers Association's forecast anticipates tremendous coronavirus stimulus-related debt coming on to the market.

May 19 -

Homebuilder sentiment rose in May by more than forecast following a record slump a month earlier as a pickup in sales and demand expectations pointed to stabilization in the real estate market.

May 18 -

While most work activities were halted in April to reduce the spread of the coronavirus, people continued to buy and sell real estate.

May 14 -

The economic contraction will keep mortgage rates low for the foreseeable future.

May 14 -

Mortgage rates remained generally steady this past week, even with the continuing market volatility, and that is helping the purchase market, according to Freddie Mac.

May 14 -

While overall mortgage application volume remained flat, purchase activity continued to rebound — and that should be the case through the remainder of the spring, according to the Mortgage Bankers Association.

May 13 -

Hiring by nonbank mortgage and brokers held up unusually well through the early days of the coronavirus outbreak in March, but April's all-time high in unemployment suggests that's unlikely to last.

May 8 -

Mortgage rates are at record lows, but borrowers hoping to take advantage are running into the toughest loan-approval standards in years.

May 8 -

Consumer sentiment for home buying fell to its lowest point since November 2011, according to Fannie Mae.

May 7 -

Mortgage rates ticked up slightly this week, but whether consumers are able to take advantage of them for purchases and refinancings depends on who looks at the data.

May 7 -

Houston home sales plunged more than 20% in April from year-ago figures as sellers took properties off the market and buyers stayed home through the coronavirus-induced shutdown.

May 7 -

With mortgage rates plummeting, the refinance share of closed loans from millennial borrowers rose for the third straight month, to the highest level since Ellie Mae began tracking the data in 2016.

May 6 -

Purchase mortgage activity rose for the third consecutive week, although the total volume was flat compared with the previous seven-day period, according to the Mortgage Bankers Association.

May 6