-

Nonbank mortgage employment estimates show payrolls in February leveled off after an unusually strong winter, but anecdotal reports of selective hiring persisted through March amid a broader coronavirus-related drop in U.S. jobs.

April 3 -

Community banks and credit unions could carve out an opportunity by refinancing mortgages from larger institutions.

April 3 Finastra

Finastra -

Bank employment of mortgage loan officers rose slightly last year, but that was before the coronavirus spread and resulted in social distancing measures that raised questions about broader employment prospects.

April 2 -

Mortgage rates dropped for the second consecutive week, falling 17 basis points, but that is not attracting homebuyers back into an uncertain market, according to Freddie Mac.

April 2 -

San Diego County's home market started 2020 with prices rising more than any other West Coast market and much of the nation.

April 1 -

Canada's mortgage rates are creeping up — even though the country's central bank has slashed borrowing costs to combat the COVID-19 pandemic.

March 31 -

While the housing market will suffer from the COVID-19 crisis, it's stronger than it was in during its last crash in 2008, according to First American Financial.

March 31 -

An index of contract signings for the purchase of previously owned U.S. homes unexpectedly increased in February to a three-year high, representing solid housing activity that's likely to retrench because of the pandemic.

March 30 -

Residential estate brokers and agents are scrambling to determine what Massachusetts Gov. Charlie Baker's emergency order means for their industry.

March 27 -

The actions taken by the Federal Reserve to calm the financial markets was key to the drop in mortgage rates this week, according to Freddie Mac.

March 26 -

With ambiguity surrounding the length of the COVID-19 outbreak and damage it will cause, consumers are becoming diffident in taking out a mortgage for a major purchase, according to Zillow.

March 25 -

There was a nearly 30% week-to-week decline in loan applications as Americans reacted to the uncertainty, both economic and medical, from the spread of COVID-19, according to the Mortgage Bankers Association.

March 25 -

Purchases of new homes in February held close to an almost 13-year high, showing momentum in the residential real estate market before economic activity fell victim to the coronavirus.

March 24 -

The $16 trillion U.S. mortgage market — epicenter of the last global financial crisis — is suddenly experiencing its worst turmoil in more than a decade, setting off alarms across the financial industry and prompting the Federal Reserve to intervene.

March 24 -

Additional mortgage-backed securities purchases by the Federal Reserve Bank of New York will address private investor skittishness about the asset class, but it will not necessarily lower rates.

March 20 -

Sales of previously owned homes surged in February to the fastest pace in 13 years, highlighting a flurry of activity in the housing market before the economic repercussions of the coronavirus.

March 20 -

Southern California's 2020 housing market got off to a good start before the pandemic shook the economy in mid-February, CoreLogic figures show, with both prices and home sales up in the six-county region from February 2019 levels.

March 19 -

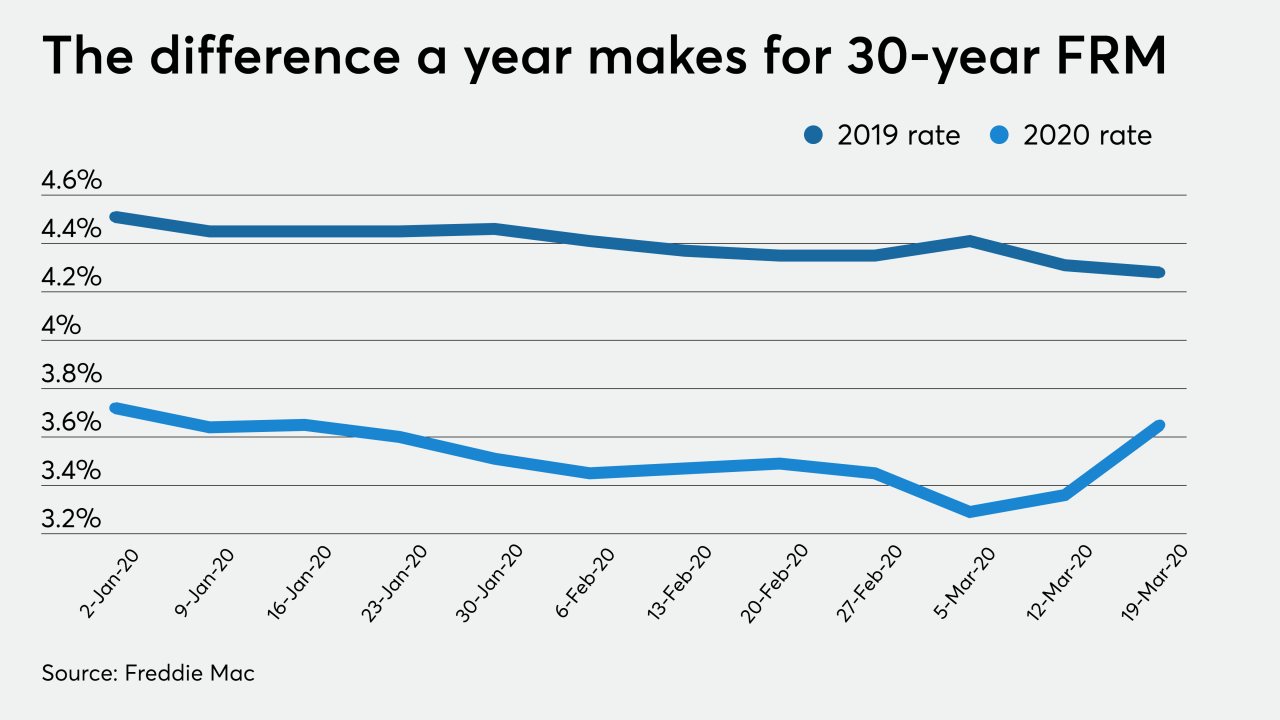

Mortgage rates rose sharply this week as originators looked to manage the overwhelming demand from consumers, according to Freddie Mac.

March 19 -

A proposal to tighten financial requirements for government-sponsored enterprise counterparties that sought to lower risk in a volatile market should be suspended, a group representing smaller lenders said, arguing it would aggravate current distress.

March 18 -

New-home construction exceeded forecasts in February, underscoring momentum in the industry a month before the coronavirus pandemic injected uncertainty into the economy.

March 18