-

Buyers are rushing into the housing market to take advantage of falling borrowing costs. Now, they're facing rising prices.

February 12 -

Refinance application activity last week was the highest in nearly seven years, with more than triple the volume from one year ago, according to the Mortgage Bankers Association.

February 12 -

Banks' lowering of origination fees and loosening of underwriting standards often foreshadow a downturn.

February 11 Nations Lending Corp.

Nations Lending Corp. -

Oahu's housing market started a new year on all major positive notes, according to new data that showed median prices and sale volumes rose in January after some weakness last year.

February 11 -

Despite a drop in multifamily loan volume, industrial, health care, office and retail originations pushed overall multifamily and commercial mortgage lending to unprecedented heights, according to the Mortgage Bankers Association.

February 10 -

Consumer sentiment about purchasing a home nears its record high as almost half of those surveyed said mortgage rates will stay at the current low levels, according to Fannie Mae.

February 10 -

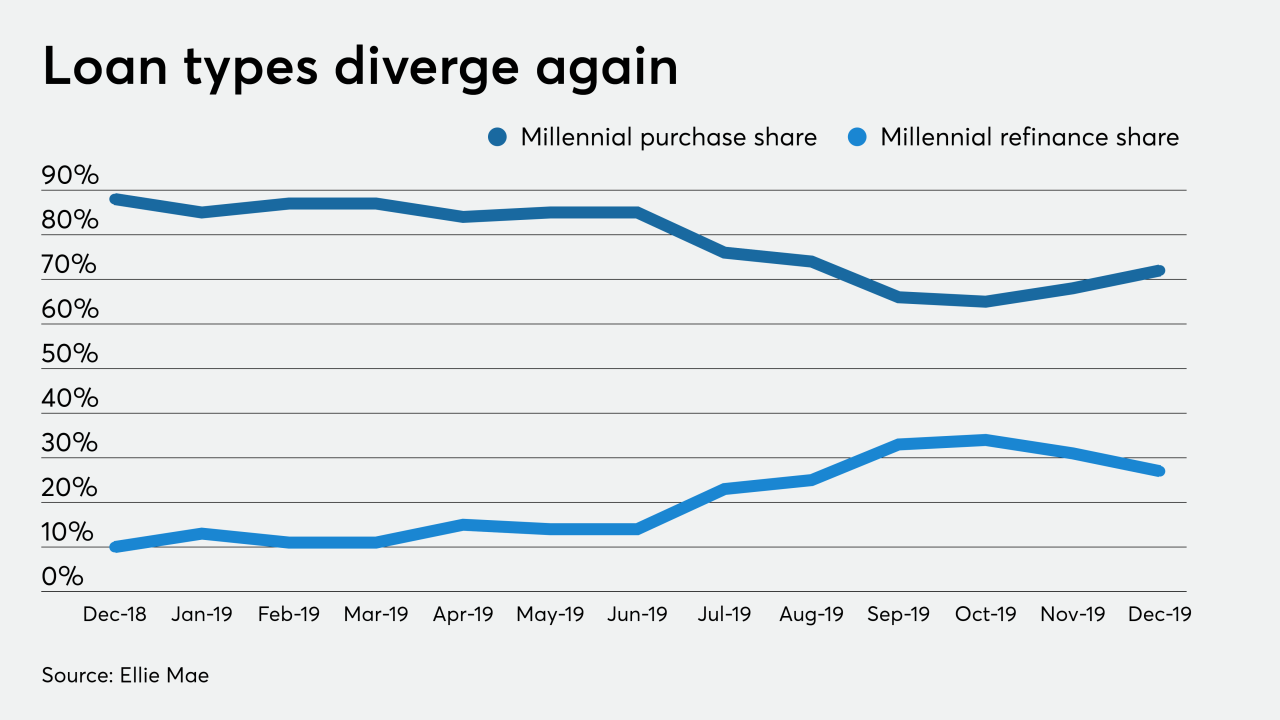

A larger percentage of newly originated mortgages to millennials shifted toward purchase loans as interest rates stayed low, according to Ellie Mae.

February 7 -

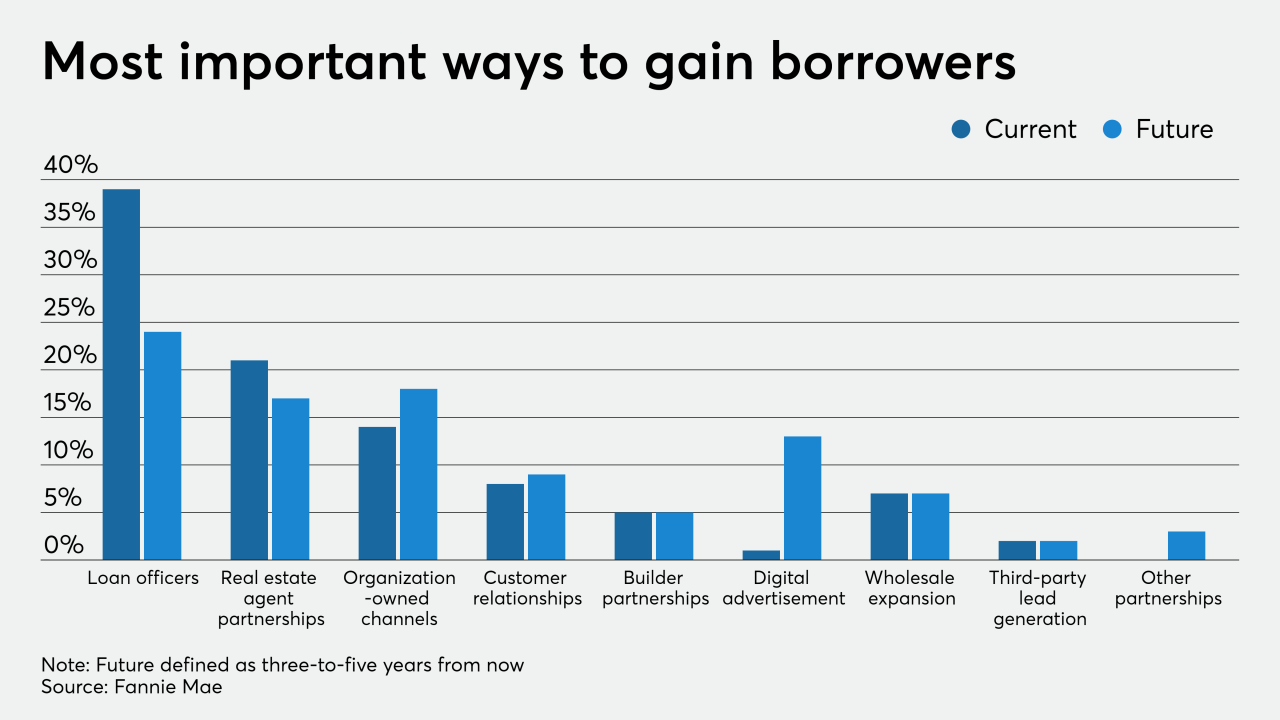

While loan officers will remain mortgage lenders' leading business development tool in the future, those originators believe business will come from a more diversified source pool, a Fannie Mae survey found.

February 7 -

Mortgage rates continued their slide this week, which along with positive economic news should continue to pump up purchase demand, according to Freddie Mac.

February 6 -

Mortgage application volume increased 5%, led by refinancings, as interest rates continued to fall on fears that the coronavirus was spreading in China and elsewhere, according to the Mortgage Bankers Association.

February 5