-

Mortgage rates continued their slide this week, which along with positive economic news should continue to pump up purchase demand, according to Freddie Mac.

February 6 -

Mortgage application volume increased 5%, led by refinancings, as interest rates continued to fall on fears that the coronavirus was spreading in China and elsewhere, according to the Mortgage Bankers Association.

February 5 -

While down from the year before, December's housing value appreciation kept churning and should climb in 2020 to a new all-time high, according to CoreLogic.

February 4 -

With steady home price appreciation and falling interest rates, by some measures the shares of distressed mortgages existing in the market shrunk to record lows, according to Black Knight.

February 3 -

Home prices were up 3.9% annually in the San Diego metropolitan area in November, outpacing all other West Coast markets, the S&P CoreLogic Case-Shiller Indices reported.

February 3 -

The mortgage securitization market can expect some changes, particularly in the specified pool and to-be-announced markets, alongside a continuation of trends in other areas.

January 31 Vice Capital Markets

Vice Capital Markets -

The U.S. homeownership rate rose to a six-year high in the fourth quarter, led by gains among young people and low-income Americans.

January 30 -

Mortgage rates continued sliding this week as investors put money into safer assets like bonds, contributing to the 30-year fixed-rate mortgage dropping 9 basis points, according to Freddie Mac.

January 30 -

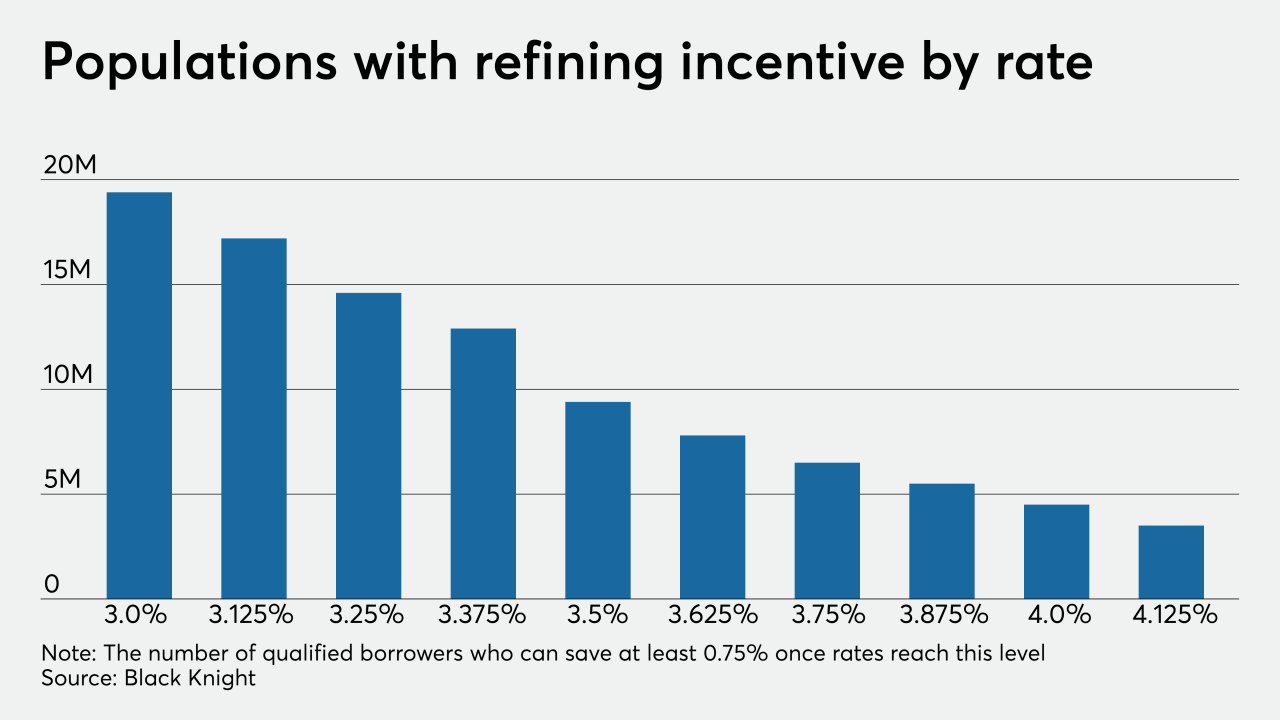

After being range-bound for several weeks, mortgage rates are fluctuating enough to spur significant changes in refi incentive, according to Black Knight.

January 29 -

Contract signings to purchase previously owned homes unexpectedly slumped in December, depressed by fewer listings of properties and representing a blemish after a recent spate of positive housing-market news.

January 29 -

Mortgage applications increased 7.2% from one week earlier as consumers reacted to falling interest rates related to news regarding the coronavirus, according to the Mortgage Bankers Association.

January 29 -

Home prices in 20 U.S. cities rose in November at the fastest pace in nine months against a backdrop of stronger demand and lean housing inventory.

January 28 -

Lower rates spurred a lot of unexpected mortgage business in 2019 but credit unions need to prepare themselves for what happens once the boom ends.

January 28 -

With housing prices continuing their years-long climb, home sellers cashed in on their highest returns since 2006, according to Attom Data Solutions.

January 24 -

Non-QM lending is expected to grow again in 2020, but it has some obstacles to navigate. Altisource CRO John Vella shares his insight into the sector and other hot topics.

January 23 -

December's potential for existing-home sales grew by 1.7% compared with November because of low mortgage rates, but in the future that factor could constrain the housing market, First American Financial said.

January 23 -

Mortgage rates fell to their lowest level in three months, possibly because investors became nervous following the spread of a coronavirus in China and elsewhere.

January 23 -

Sales of previously owned homes jumped in December to the best pace in nearly two years as historically low interest rates continued to lure buyers despite record-low inventory.

January 22 -

Mortgage application activity slowed down this past week from its fast start to 2020, with a decrease of 1.2% from one week earlier, according to the Mortgage Bankers Association.

January 22 -

With interest rates expected to stay low while wages and the overall economy grow in conjunction, Fannie Mae again boosted its single-family mortgage origination outlook for 2019, 2020 and 2021.

January 22