-

Sales of previously owned homes declined to a five-month low in November, indicating lean inventories are holding back a residential real estate market that's been supported by low mortgage rates and job growth.

December 19 -

Dallas-Fort Worth home sales and construction totals are expected to rise only modestly in 2020, but the expected increases could still be enough to push area home numbers to new highs.

December 19 -

With housing projected to grow hand-in-hand with the economy, Fannie Mae boosted its single-family mortgage origination outlook for 2019, 2020 and 2021.

December 18 -

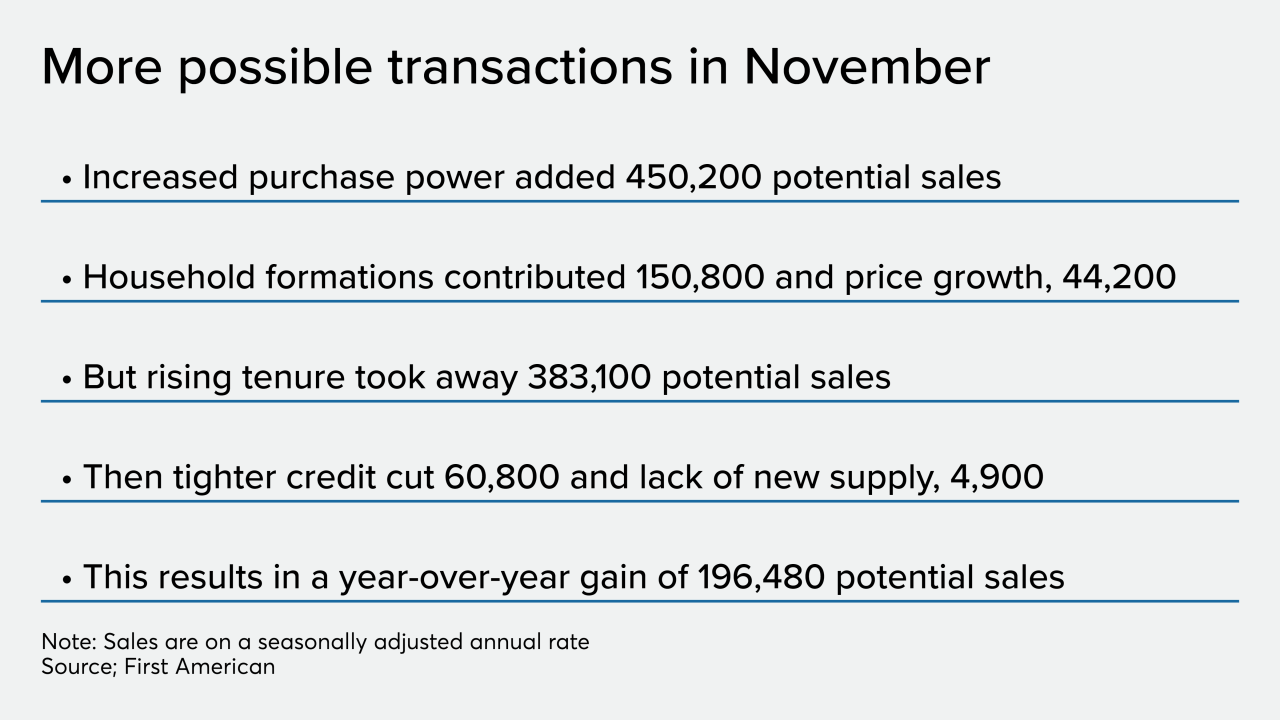

November was another month in the latter part of 2019 where actual existing-home sales outperformed their potential, but that momentum seems unlikely to continue in 2020, First American said.

December 18 -

Mortgage applications decreased 5% from one week earlier as, absent any rate incentive, activity slowed because of the holiday season, according to the Mortgage Bankers Association.

December 18 -

Construction of new homes increased more than forecast in November and permits to build climbed to a 12-year high as the housing market strengthened amid low mortgage rates, solid job growth, and optimistic buyers and builders.

December 17 -

Even with an increase in both new and existing home construction activity during November, the slowdown over the previous 11 months will constrain inventory going into 2020, according to BuildFax.

December 16 -

Houston's feverish housing market is poised for another record year as low mortgage rates, population growth and a relatively healthy economy fuel sales throughout the region.

December 13 -

Mortgage lenders became slightly bearish on their profitability outlook in the fourth quarter, with the competitive landscape and shift to a purchase market cited as the main concerns, according to Fannie Mae.

December 12 -

Mortgage rates rose slightly with a stronger-than-expected jobs report starting the week and the Federal Open Market Committee decision to hold the line on short-term rates ending it, according to Freddie Mac.

December 12 -

Mortgage application activity increased 3.8% from one week earlier, with refinance volume for Federal Housing Administration-insured loans taking the spotlight, the Mortgage Bankers Association said.

December 11 -

Florida-based depository Capital City Bank has struck a deal to purchase a 51% share in regional lender BrandMortgage.

December 11 -

Hometap, a fintech company providing an alternative to traditional home equity lending, secured $100 million in new financing as it looks to expand its geographic reach.

December 11 -

President Trump lets his thoughts be known through Twitter and those tweets can have a direct impact on the economy and interest rates, according to Clever Real Estate.

December 11 -

With more consumers believing it’s a great time to buy a home, the Home Purchase Sentiment Index had its best November since the index's release in 2011, according to Fannie Mae.

December 9 -

More than half of the third quarter refinance activity was the cash-out variety, with borrowers removing the most total equity from their homes in nearly 12 years, according to Black Knight.

December 9 -

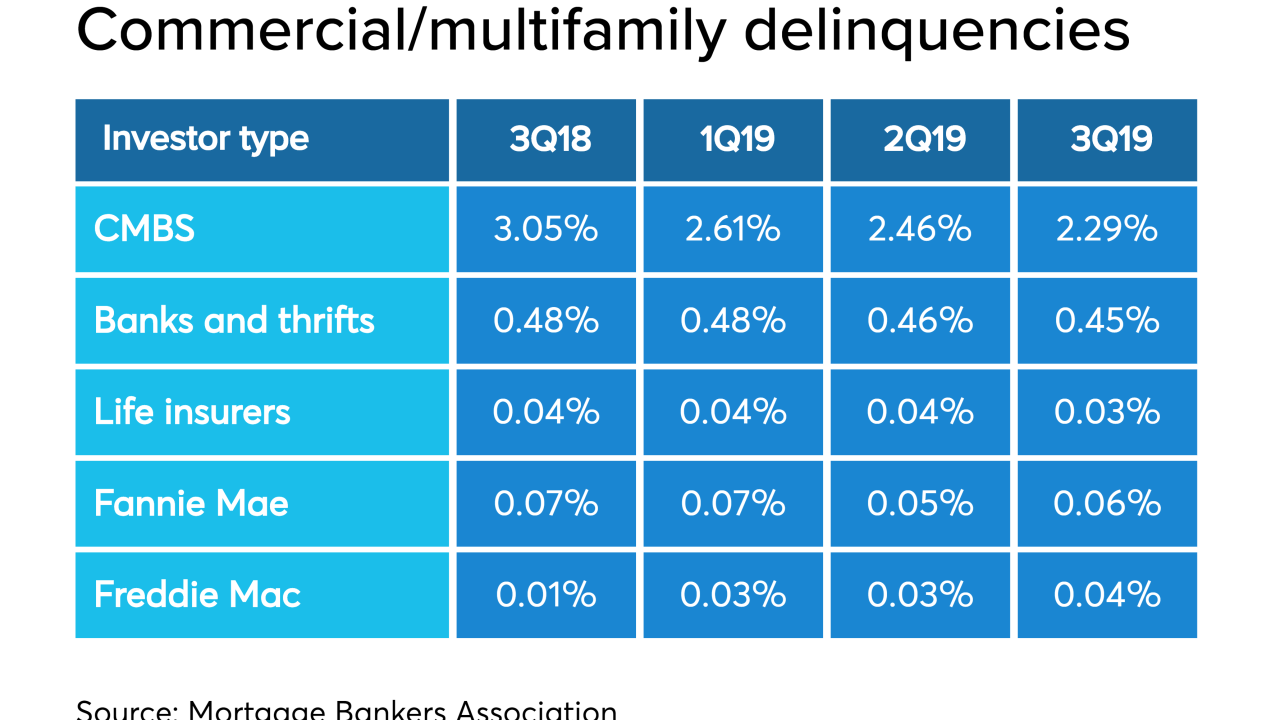

Most commercial and multifamily loan delinquency rates remained near record lows in the third quarter extending a long run of declines in the securitized market, according to the Mortgage Bankers Association.

December 6 -

Last month, brokers anticipated local residential markets swinging, if ever so slightly, to give buyers more bargaining power.

December 6 -

Southern California appreciation rates rebounded in October, hitting the highest levels since last spring, according to the latest CoreLogic Home Price Index.

December 6 -

Despite an uptick in homebuilding and favorable financing rates, Hovnanian Enterprises' latest earnings results remained in the red due to a charge the company took to reposition debt.

December 5