-

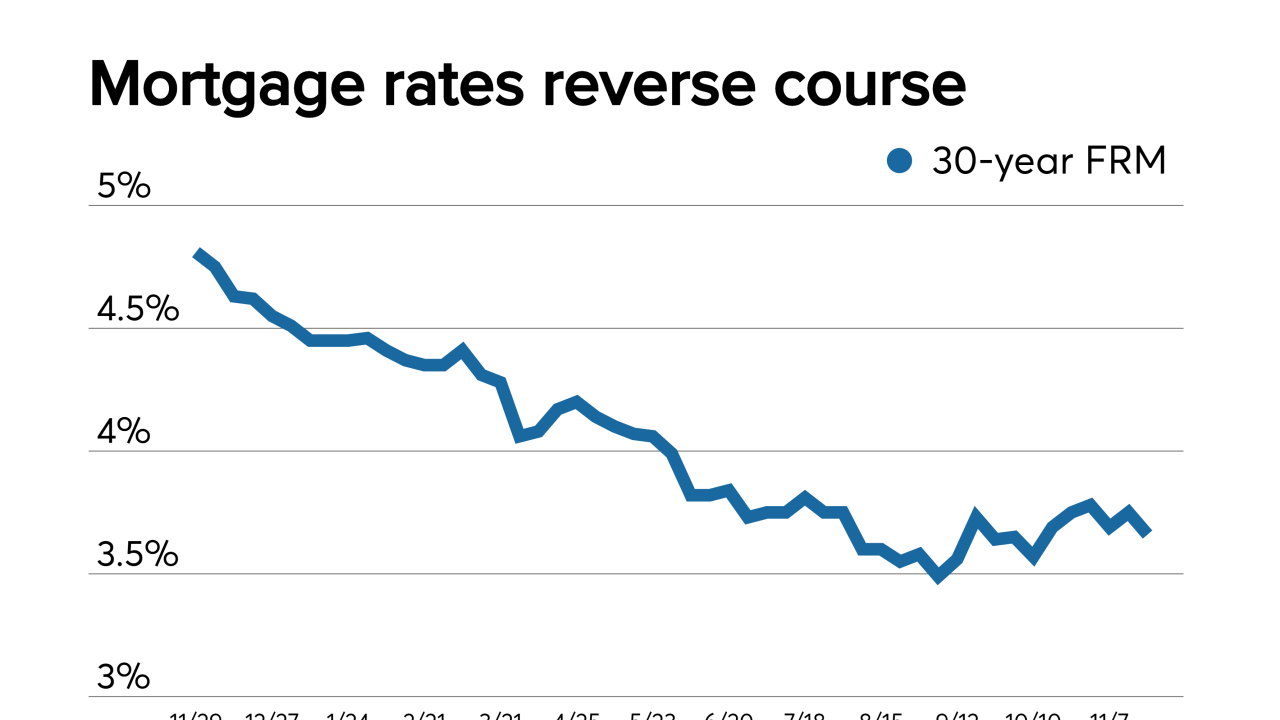

Mortgage rates remained unchanged this week, after moving back and forth during the period on economic and trade news, according to Freddie Mac.

December 5 -

Millennials took advantage of the low mortgage rate landscape in October, boosting their refinance share to a survey-record high, according to Ellie Mae.

December 4 -

Toronto's home prices extended gains in November, and are now accelerating at the fastest annual pace since 2017 as demand continues to outpace a dwindling supply of listings.

December 4 -

October's deceleration in housing values could be followed by acceleration in 2020, but a growing subset of millennials nevertheless plan to become homeowners in the new year, according to CoreLogic.

December 3 -

Northeast Ohio home sales for the year are on track to outpace 2018 levels, and local real estate experts don't foresee any signs of a major slowdown in the coming months.

December 3 -

Loan defect risk in purchase applications stopped falling and plateaued in October, according to First American Financial Corp.

December 2 -

The outperformance of mortgage-backed securities versus U.S. Treasuries has extended for a third straight month into November, buoyed in part by a decline in volatility.

December 2 -

San Diego County's median home price was $573,500 in October, lifted by a big increase in sales.

November 29 -

While affordability remains a challenge with the continued strain on housing supply, purchasing power took a big leap in September thanks to a rise in income and descending interest rates, according to First American Financial Corp.

November 27 -

Mortgage rates resumed their upward movement this week, but it's not putting a damper on real estate sales activity, noted Freddie Mac.

November 27 -

Contract signings for previously sold U.S. homes fell by the most since July while remaining healthy on an annual basis.

November 27 -

Mortgage application activity rose 1.5% compared with one week earlier as interest rates remained below 4%, according to the Mortgage Bankers Association.

November 27 -

Buyers snapped up new homes over the past two months at the fastest pace in more than 12 years, adding to signs of sturdy housing demand amid lower prices and borrowing costs.

November 26 -

The median price of a home in metro Atlanta dropped slightly last month, to just under $250,000, but was still higher than a year earlier, according to a report from Remax.

November 26 -

Mortgage prepayment levels were at their highest in over six years during October, as existing homeowners took advantage of the lower rates to refinance, or to a lesser extent, purchase a new residence, Black Knight said.

November 25 -

Palm Beach County, Fla., home prices continued their trend of modest appreciation in October, and sales volumes dipped despite a robust economy.

November 22 -

San Diego's home market got better for sellers in September.

November 22 -

Sales of previously owned homes increased in October as buyers responded to falling mortgage rates, extending a recovery in the residential real estate market this year that’s providing a modest boost to economic growth.

November 21 -

Mortgage rates fell this week, reversing a gradual upward trend, to reach their lowest level in six weeks, according to Freddie Mac.

November 21 -

Entry-level home buyers outnumbered sellers in the Twin Cities metro in October, boosting prices and stifling sales of houses priced at less than $300,000.

November 21