-

Palm Beach County, Fla., home prices retreated in June after jumping to a post-crash high in May.

July 25 -

Fewer consumers applied for mortgages last week even as interest rates declined by 3 to 4 basis points for all product types, according to the Mortgage Bankers Association.

July 24 -

Sales of new homes rose in June by less than forecast and purchases were revised lower in the three prior months, the latest sign of weakness for the housing sector.

July 24 -

Sales of previously owned homes declined in June, missing estimates in the latest sign of weakness for the housing market.

July 23 -

With housing supply constrained and mortgage rates on a downslope throughout the year, buyers jumped at purchasing a home when the opportunity arose in June, according to Redfin.

July 22 -

Two key economic forces are responsible for driving single-family housing forward, but their potential is limited, according to the National Association of Home Builders.

July 22 -

Through the first half of the year, there have has been 2,000 single-family homes sold countywide, a 6.45% decline from the comparable period last year when 2,138 homes were sold.

July 22 -

Forecasts for residential remodeling growth are looking dimmer, but this isn't necessarily a bad thing for the mortgage market.

July 19 -

The potential for home resales rose 1.1% month-to-month as mortgage rates fell, but buyers only became more entrenched as their purchase power increased, according to First American.

July 19 -

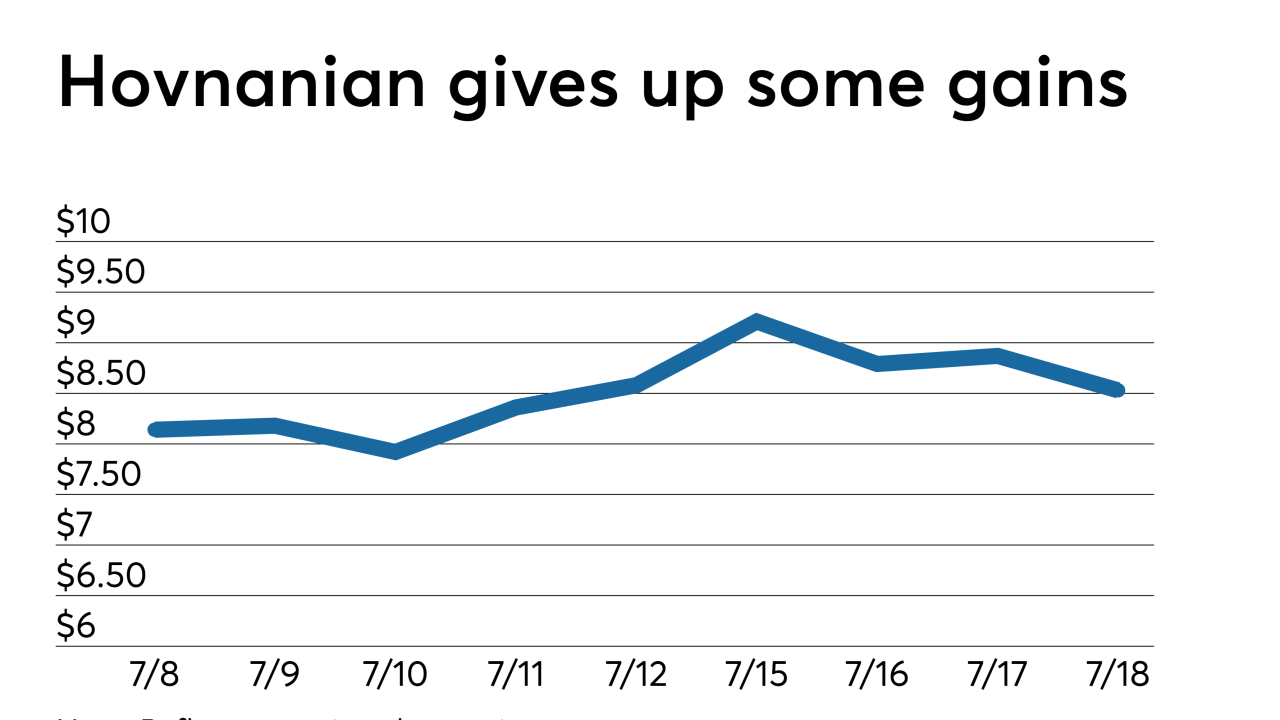

Hovnanian Enterprises, the corporate parent of homebuilder K Hovnanian Homes, received a new notice from the New York Stock Exchange indicating its low market capitalization could jeopardize its listing status.

July 18 -

After three weeks of holding fairly steady, average mortgage rates ticked up this week, ironically due to investor optimism that the Federal Open Market Committee will cut short-term rates, according to Freddie Mac.

July 18 -

The onset of summer typically comes with the largest volume of home sales, however exorbitant prices kept potential buyers at bay, according to Remax.

July 17 -

After a jump in May home sales, North Texas housing activity retreated in June.

July 17 -

Higher interest rates led to a 1.1% seasonally adjusted decline in mortgage applications compared with the previous week, according to the Mortgage Bankers Association.

July 17 -

Homebuilders' optimism increased as low mortgage rates fueled demand. However, affordability constraints and the continuing scarcity of construction workers and land parcels remain concerns.

July 16 -

Fannie Mae increased its mortgage origination forecast as lower interest rates, driven by economic uncertainty, will lead to more refinance activity, but other factors will continue to hold back home purchases.

July 16 -

Despite a significant rise in first-mortgage production due to lower interest rates, profits from home lending in Citigroup's retail banking division fell slightly in the second quarter.

July 15 -

After two strong months, applications to purchase newly constructed homes retrenched a bit as broader policy issues weighed on consumers, according to the Mortgage Bankers Association.

July 12 -

While mortgage rates remained unchanged this past week, further drops are possible as signs from the Federal Reserve point to a short-term rate cut at its next meeting.

July 11 -

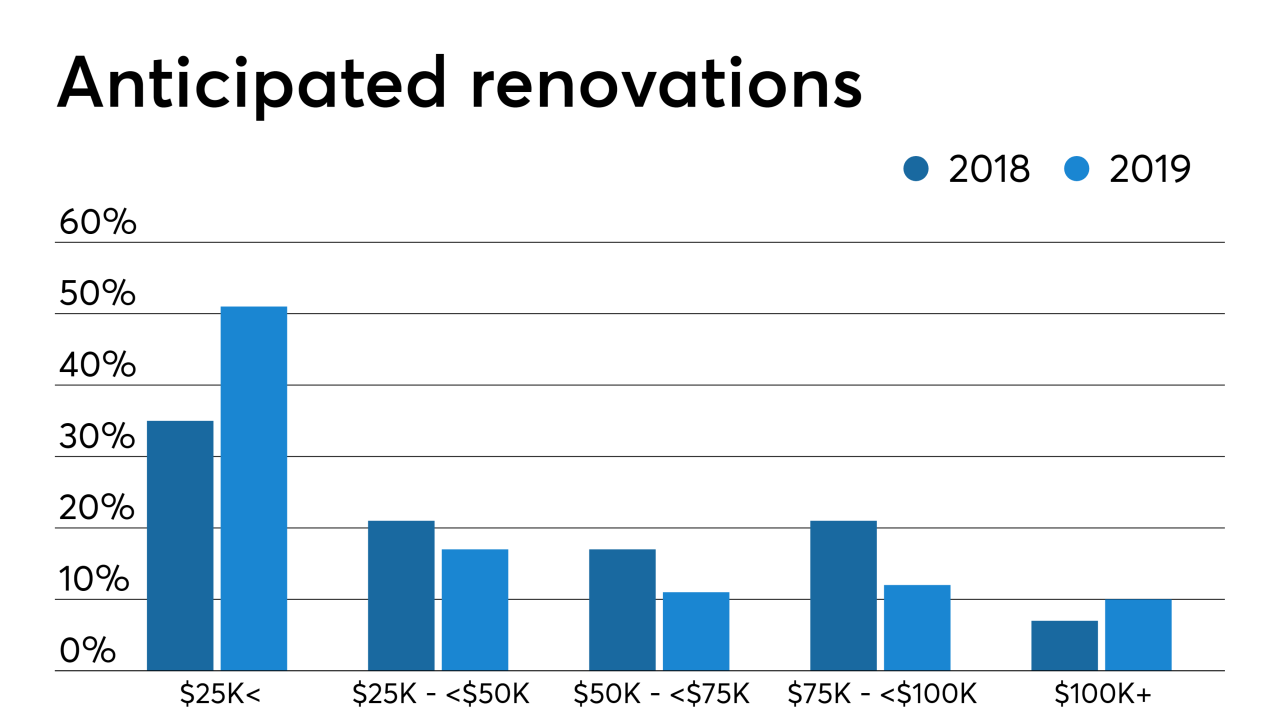

With nearly half of homeowners renovating in the next two years, HELOCs stand as the most likely form of lending sought out by consumers, according to TD Bank.

July 10