-

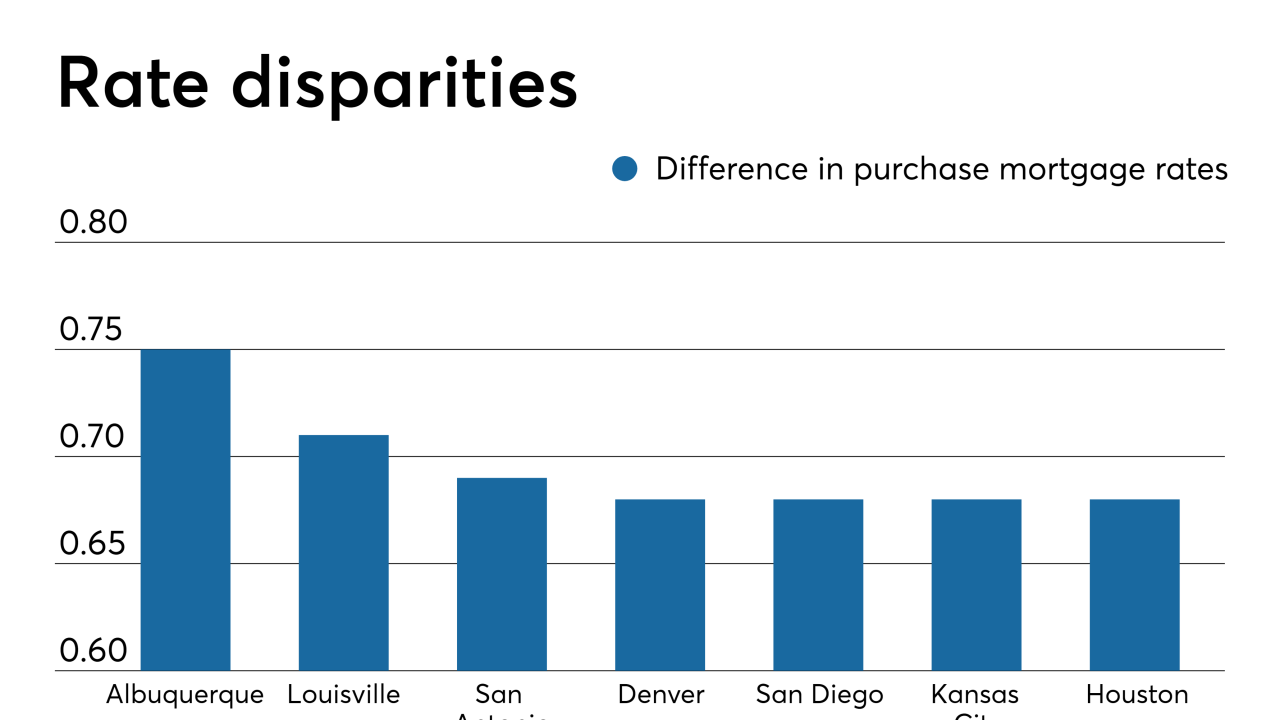

Lenders can help both the consumer save money and their own volumes by offering the most competitive rates or reducing their fees. Here's a look at the 12 housing markets borrowers save the most over the life of their loan by shopping around for a mortgage, according to LendingTree.

May 8 -

An increase in purchase activity drove the week-over-week rise in mortgage application volume as homebuyers entered the market while interest rates fell, according to the Mortgage Bankers Association.

May 8 -

Dallas-Fort Worth is still the country's top homebuilding market.

May 8 -

Consumer expectations of further mortgage rate drops leaves them seemingly in no rush to enter the purchase market which could be why their optimism on home buying is falling, a Fannie Mae report said.

May 7 -

Home price appreciation remained modest as affordability and tight inventory keep demand down, though prices are expected to accelerate in 2020, according to CoreLogic.

May 7 -

Regions Bank, like many lenders, has seen its refinancing volume shrink dramatically as a percentage of overall originations over the last few years, prompting it to refocus its mortgage bankers on very different purchase originations.

May 7 -

Customer retention for mortgage servicers hit an all-time low at the start of the year, and a sensitive mortgage rate environment is only creating more competition, according to Black Knight.

May 6 -

Tight housing inventory and some unexpected behaviors from potential buyers and sellers of homes have prompted Citizens Bank to make changes to its services and mortgage-loan products.

May 6 -

It's been a dreary spring for many homebuilders in the Twin Cities.

May 6 -

Mortgage application fraud risk came in hot at the start of the year, but two housing market conditions worked against each other to bring growth to a halt, according to First American Financial Corp.

May 3 -

Median home sale prices in the Bay Area dipped ever-so-slightly in March, marking the end of a record-breaking seven-year streak as even high salaries and low-interest rates failed to entice buyers into the country's most expensive market.

May 2 -

Mortgage rates dipped after four weeks of increases, finally mirroring the drop in the benchmark 10-year Treasury yield, according to Freddie Mac.

May 2 -

Millennials closed mortgage loans at their fastest pace in four years as lower interest rates pushed up purchasing power and incentivized them to pull the trigger, according to Ellie Mae.

May 1 -

Mortgage applications decreased 4.3% from one week earlier although concerns over the global economy resulted in falling interest rates, according to the Mortgage Bankers Association.

May 1 -

Military service members are a crucial market segment for lenders because they are younger than other demographics and a steady group of borrowers unfazed by independent economic concerns.

April 30 NewDay USA

NewDay USA -

Freddie Mac increased its origination forecast for 2019 by nearly 4% from last month as lower interest rates will result in more borrowers refinancing than previously expected.

April 30 -

Contract signings to purchase previously owned homes rebounded in March by more than forecast for the second gain in three months, adding to signs of stabilization in the housing market.

April 30 -

Growing wages combined with flat mortgage rates handed homebuyers' increased affordability with a 2.4% boost in purchasing power for February, according to First American Financial Corp.

April 29 -

Mortgage rates are low, the job market is on fire and, in a mysterious disconnect, Palm Beach County, Fla., home sales lagged again in March.

April 25 -

Mortgage rates posted a fourth consecutive week of increases, but Freddie Mac remains bullish in its outlook for this spring's home purchase season.

April 25