-

Millennial homebuyers took advantage of a winter lull in interest rates, using the opportunity to refinance their loans, according to Ellie Mae.

March 6 -

Home price appreciation tapered as buyers battling tight inventory and rising housing costs pulled back from the market, according to CoreLogic.

March 5 -

Home purchaser affordability declined in the fourth quarter, which also negatively affects the amount Americans have to spend on cost-of-living expenses, a report from Zillow said.

March 5 -

Sales of new homes unexpectedly rose in December after a downwardly revised November reading, as lower mortgage rates and more-affordable properties offered some relief for buyers.

March 5 -

While millennials comprise the largest cohort of homebuyers, the aging baby boomer generation has created 7.86 million more homeowners and 2.82 million renters age 60 and older — growth rates higher than any other demographic.

March 4 -

The number of homes sold in Marin County, Calif., in January dipped 5.4% to 141 over the 149 homes sold in January 2018, according to CoreLogic.

March 4 -

Rises in the amount of low down payment loans and private mortgage insurance due to tight affordability led to the most first-time homebuyers since 2006, according to Genworth Mortgage Insurance.

March 1 -

Freddie Mac again increased its origination forecast for the next two years, as the rate drops of the past few months are expected to boost refinance volume.

March 1 -

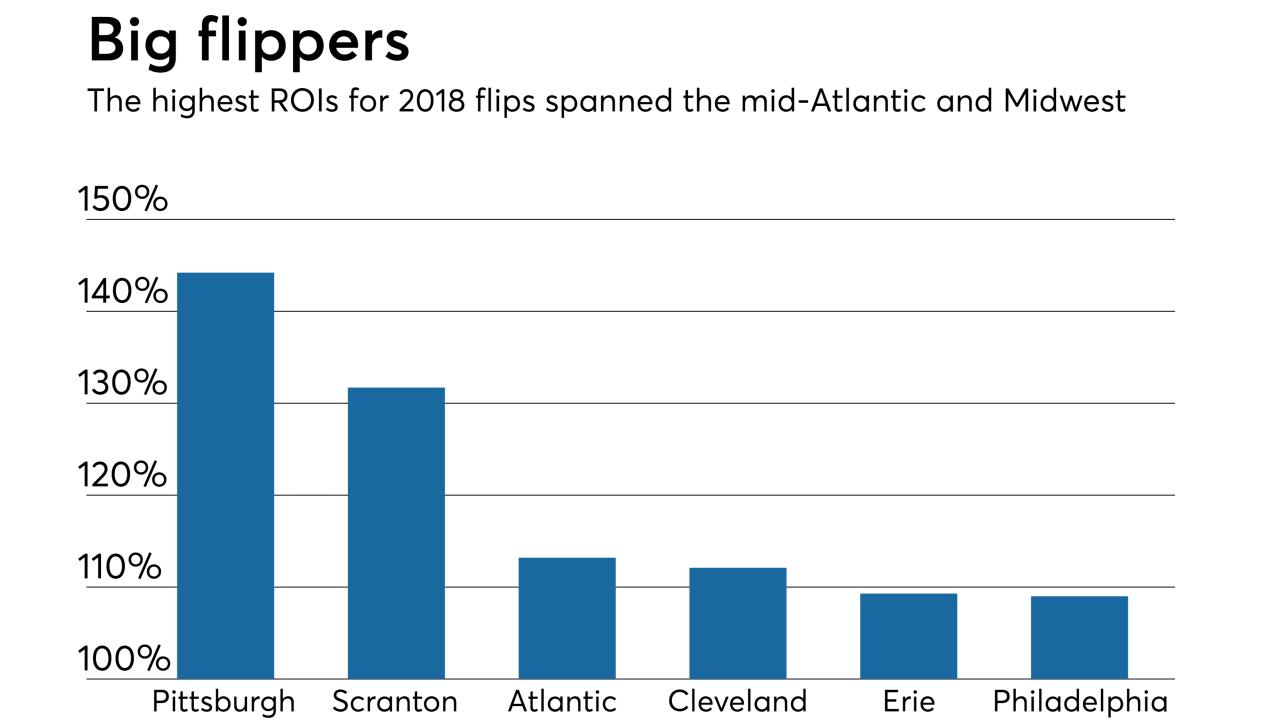

Financing poured into purchasing homes to flip in 2018, reaching the highest total since 2007, according to Attom Data Solutions.

February 28 -

A strong spring home purchase season is likely to further increase mortgage loan application defect risk, which already spiked in the past two months, according to First American.

February 28