-

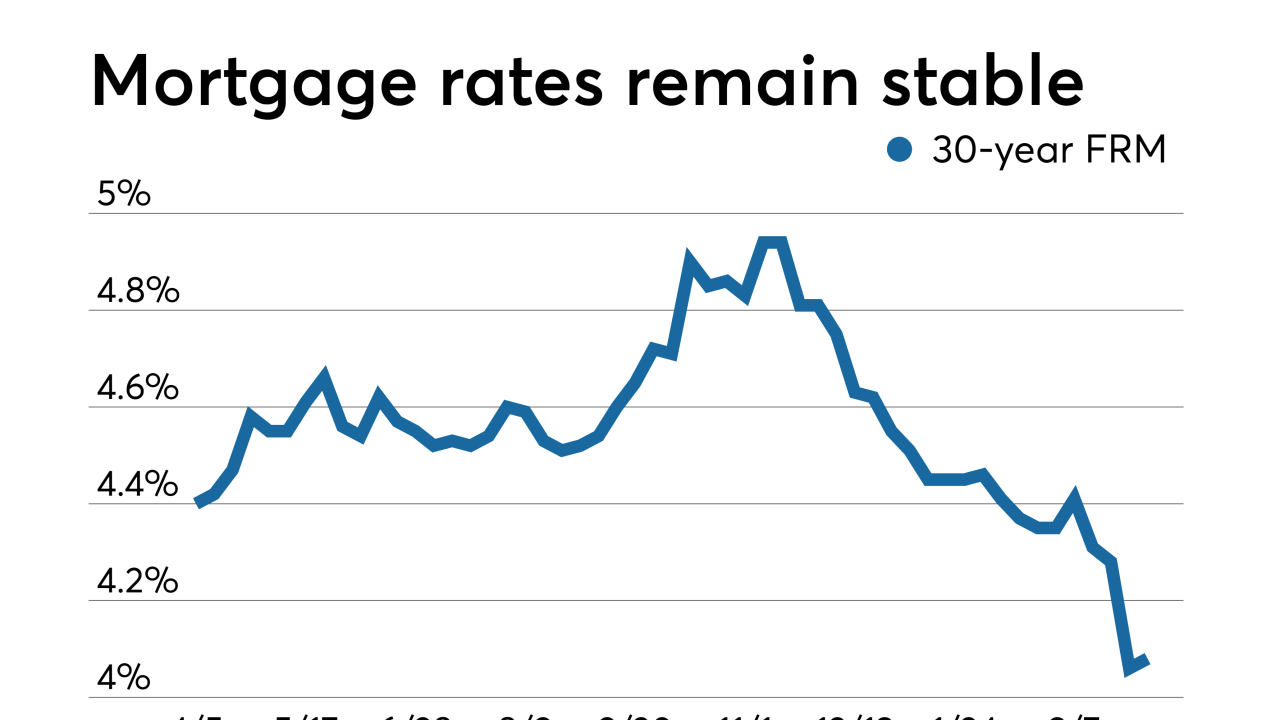

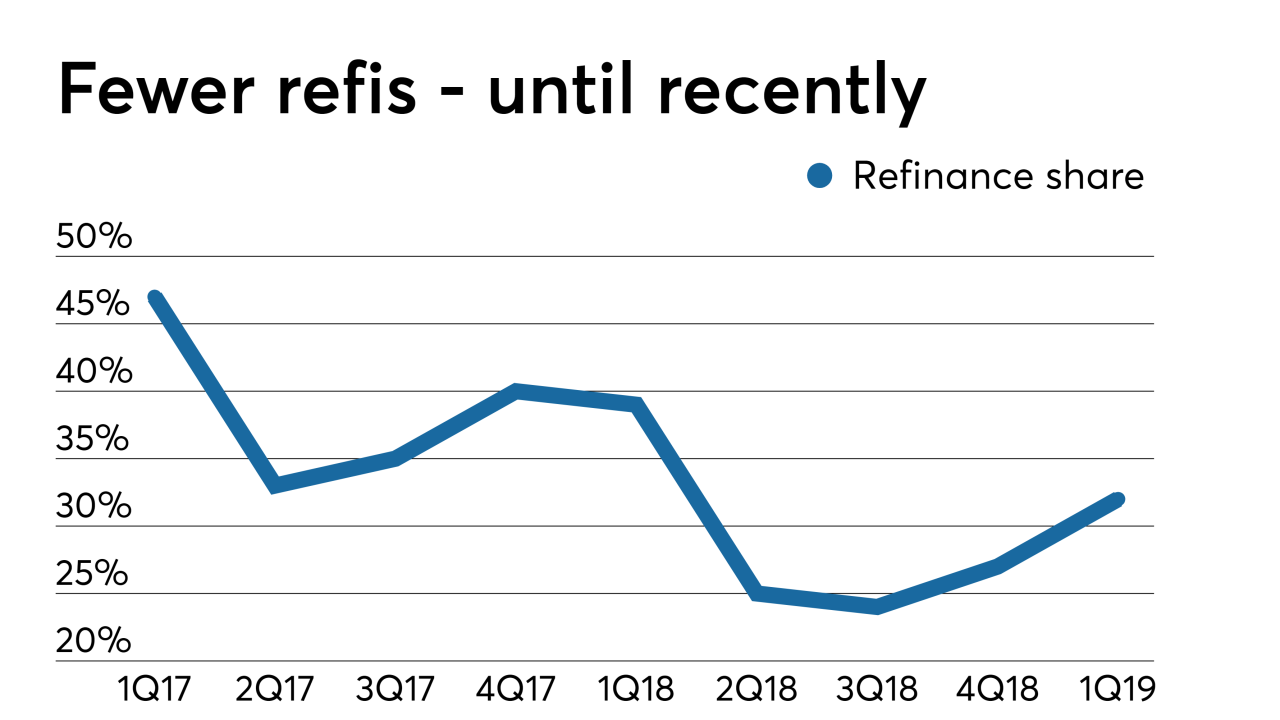

Mortgage rates continued to decline through the spring home buying season, driving up the share of refinance loans and overall closing rates, according to Ellie Mae.

April 17 -

Higher interest rates cut refinance mortgage application volume and reduced overall activity even as the purchase index reached a nine-year high, according to the Mortgage Bankers Association.

April 17 -

Canadian home sales and prices rebounded in March from a dismal showing a month earlier, but remained below historical averages.

April 16 -

Tax reform leaves mortgage-related deductions far too low to help the average homeowner this tax season, in contrast to last year, when they slightly exceeded the standard deduction.

April 15 -

From the middle of the country to the Pacific Northwest, here's a look at cities where consumers wield the most purchasing power for the upcoming home buying season, based on changes in housing values compared to local wages and mortgage rates.

April 12 -

Multifamily and commercial lenders had another banner year in 2018, when closed-loan originations rose 8% to a high of $574 billion.

April 11 -

Mortgage rates rose slightly for the second consecutive week, but should remain low for the foreseeable future, which will aid the purchase market, according to Freddie Mac.

April 11 -

Learning to understand the risk rather than adding steps to the mortgage application process is the way to mitigate fraud.

April 10 CoreLogic

CoreLogic -

Mortgage application volume fell 5.6% from one week earlier as rising interest rates put an end to the recent surge in refinancings, according to the Mortgage Bankers Association.

April 10 -

Home prices dipped from February — while annual growth remained suppressed — due to affordability and inventory issues, according to Quicken Loans.

April 9 -

Loan applications for newly constructed properties accelerated going into this year's peak home buying season, contrasting with the weakness seen in the market a year ago, according to the Mortgage Bankers Association.

April 9 -

Consumers believe softening home prices and mortgage rate declines are on the horizon, according to Fannie Mae. While these suggest positive sentiments on conditions for buyers, they signal rewards for those who wait.

April 8 -

Sacramento's home real estate market remained cool in the opening months of 2019, but there are hints a springtime buzz may be on the way.

April 8 -

Nondepositories in the mortgage business cut 2,900 more jobs in February, bringing industry employment to its lowest point in nearly three years.

April 5 -

Sales of existing single-family homes in Maine eased slightly, although prices remained strong, rising 2.85% comparing February 2019 to February 2018.

April 5 -

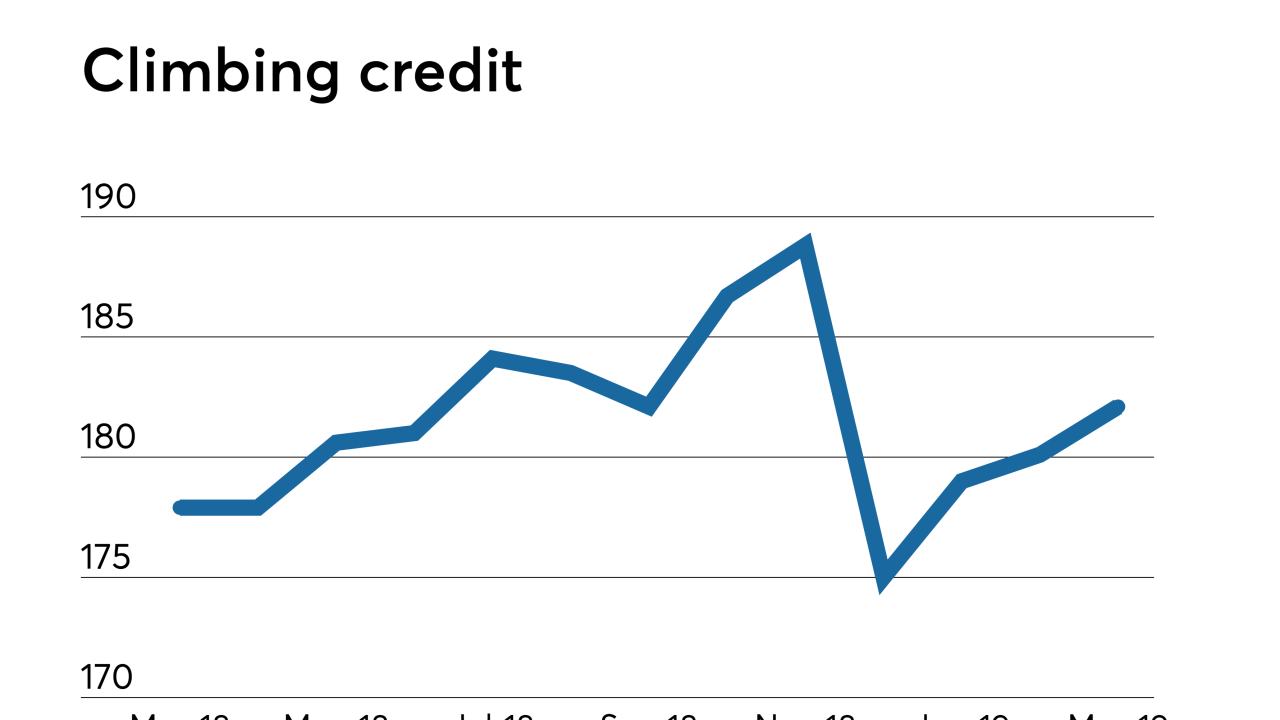

Mortgage lending standards loosened in March, as a swell in jumbo credit helped drive an expansion in availability for the third straight month, according to the Mortgage Bankers Association.

April 4 -

Mortgage rates held steady after several weeks of declines, during which there was the largest weekly drop in more than 10 years, according to Freddie Mac.

April 4 -

From where to find borrowers that competitors overlook, to how to adjust strategies when interest rates change course, top producers are adapting when market conditions change.

April 3 -

With interest rates down, purchase mortgages accounted for the vast majority of millennial homebuyers' loans in February, according to Ellie Mae.

April 3 -

Homebuilders in the Twin Cities metro had their sleepiest March in four years with single-family and multifamily construction falling sharply.

April 3