-

Cleveland-area home sales perked up in October after their September slowdown, posting a modest gain even as interest rates edged higher.

November 15 -

As interest rates rise, mortgage originators need to teach millennial homebuyers about the product options outside of conventional loans, Ellie Mae said.

November 14 -

The decelerating pace of home price growth in October is helping offset the rise in mortgage rates, according to Quicken Loans.

November 14 -

Mortgage application activity decreased 3.2% from one week earlier as interest rates rose to eight-year highs and refinancings fell to an 18-year low, according to the Mortgage Bankers Association.

November 14 -

Beazer Homes USA is working to encourage competition among its approved lenders in order to help control upward pressure on home prices and lending rates that could slow sales.

November 13 -

After more than doubling local home starts in the last decade, don't expect Dallas-Fort Worth builders to increase construction by much in 2019.

November 13 -

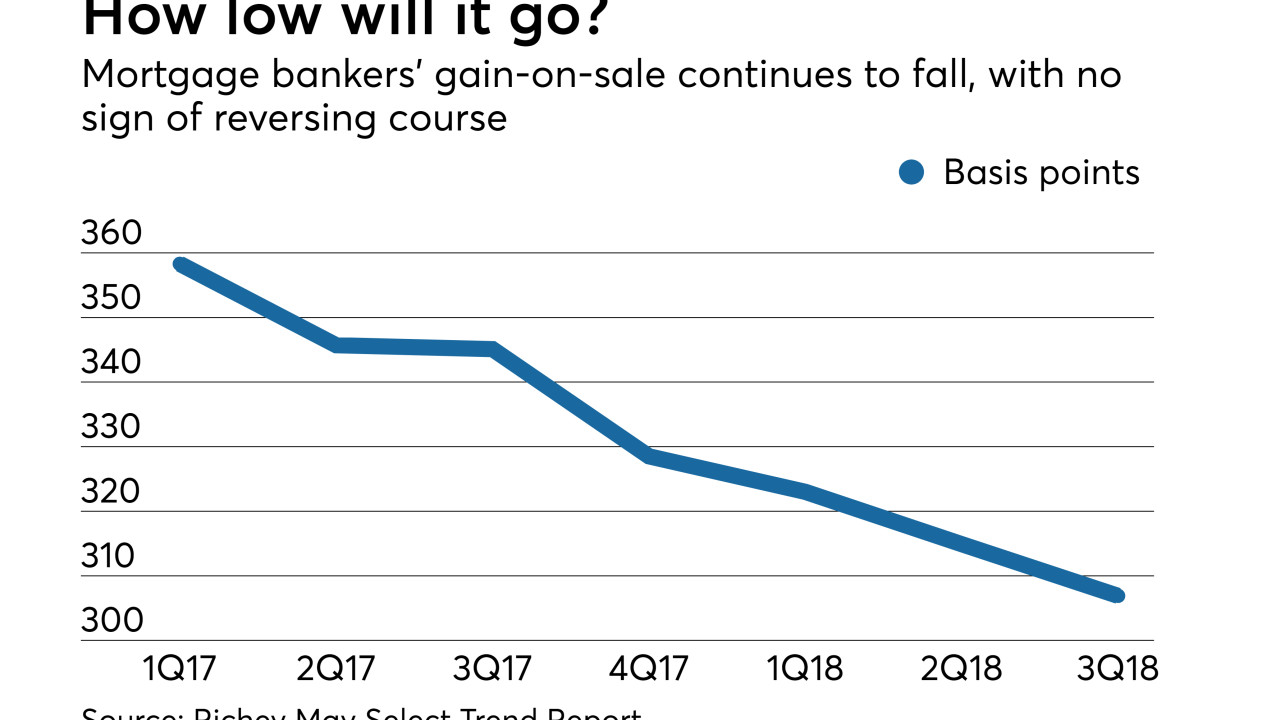

If falling volume and rising costs weren't bad enough for nonbank mortgage lenders, an extended run of tight gain-on-sale margins is further eating into their profits.

November 9 -

Rising home prices and climbing mortgage rates pulled down affordability to the lowest point since before the housing market crash.

November 9 -

The number of homes sitting unsold in King County has doubled in the past year as buyers continue to retreat from the once-hot market — pushing prices in the city of Seattle down even further.

November 9 -

D.R. Horton Inc. fell the most in more than three years after executives at the builder said the market for homes is getting "choppy" and that the pace of order growth may slow next quarter.

November 8 -

Mortgage rates rose significantly across the board as the economy continued to show resilience with strong business activity and growth in employment, according to Freddie Mac.

November 8 -

Mortgage application activity dropped to its lowest level since December 2014 as interest rates reached an eight-year high, according to the Mortgage Bankers Association.

November 7 -

The prospect of growing mortgage rates took a negative hit on consumer perception of home buying and selling during October, according to Fannie Mae.

November 7 -

After hitting severe turbulence and taking a dive in September, metro Denver's housing market stabilized at a lower altitude in October, according to the Denver Metro Association of Realtors.

November 7 -

Mortgage industry executives claim sparse affordable housing supply is the most impactful hurdle for first-time homebuyers entering the market in 2019, but the majority don't think regulatory policy will help the cause.

November 6 -

Ocwen Financial Corp. recorded a deeper quarterly loss of $40 million after acquiring PHH Corp., but still expects the deal's economies of scale to eventually lower costs and restore profitability.

November 6 -

Eighty percent of millennials said they plan on moving within the next five years, while nearly three-quarters claim affordability as their biggest hurdle in the buying a home.

November 6 -

The Southern California housing market has been on a nearly seven-year tear, with prices in many communities reaching all-time highs.

November 6 -

Napa County, Calif., home prices continue to rise while the number of homes sold declined year-over-year, according to Bay Area Real Estate Information Services Inc.

November 6 -

Returns on mortgage-backed securities in October lagged Treasuries by 37 basis points, the most since November 2016.

November 5