-

Mortgage rates dropped slightly for the second time in the past three weeks as yields on the benchmark 10-year Treasury note remained flat for most of the period, according to Freddie Mac.

November 1 -

A combination of moderate rises in mortgage rates and dipping growth in home prices are projected to boost existing and new housing sales through 2020, according to Freddie Mac.

October 31 -

Mortgage applications decreased 2.5% from one week earlier as purchase activity compared with 2017 fell for the first time in nearly three months, according to the Mortgage Bankers Association.

October 31 -

As potential homebuyers anticipate mortgage rates to keep rising, September was a strong month for housing demand, according to Redfin.

October 30 -

The homeownership rate in the U.S. increased in the third quarter, a sign that first-time buyers may be seeing the cooldown in housing as a buying opportunity.

October 30 -

Home-price gains in 20 U.S. cities cooled in August to the slowest pace since 2016, as high borrowing costs and property values limit buyer interest, according to S&P CoreLogic Case-Shiller data.

October 30 -

Student debt continues to weigh down potential homebuyers, as the share of first-timers decreased for the third-consecutive year, according to the National Association of Realtors.

October 29 -

Despite rising mortgage rates and a dismal start to the fall, homebuilders in the Twin Cities are picking up the pace.

October 29 -

Thousands of homeowners in San Francisco, Los Angeles and Chicago are headed out of town.

October 26 -

Fannie Mae has priced more securities that support a transition away from the London interbank offered rate.

October 26 -

Contracts to buy previously owned homes rose for the first time in three months, indicating that the recent market slump may be starting to stabilize, National Association of Realtors data showed.

October 25 -

High property values and low mortgage rates pushed commercial and multifamily originations beyond their projected totals in 2017 to a new market peak, according to the Mortgage Bankers Association.

October 25 -

Mortgage rates increased slightly across the board, even as the Dow Jones Industrial Average fell nearly 1,000 points over the past few days, according to Freddie Mac.

October 25 -

Home price appreciation is continuing to decelerate due to affordability concerns that are unlikely to let up even though recent market developments have put some downward pressure on mortgage rates.

October 25 -

Purchases of new homes fell more than estimated in September to the weakest pace since December 2016, adding to signs that a lack of affordability is crimping demand, according to government data.

October 24 -

An increase in refinance activity in the period after Columbus Day drove mortgage applications 4.9% higher from one week earlier, according to the Mortgage Bankers Association.

October 24 -

A typical homebuyer has already lost over 6% of purchasing power because of rising interest rates since the start of the year, a study by Redfin found.

October 24 -

Southern California home sales fell in September by the biggest rate since the depths of the Great Recession, the latest housing report by the California Association of Realtors shows.

October 24 -

The number of central Ohio homes for sale in September broke a 91-month streak of year-over-year inventory declines, according to the Columbus Realtors trade group.

October 23 -

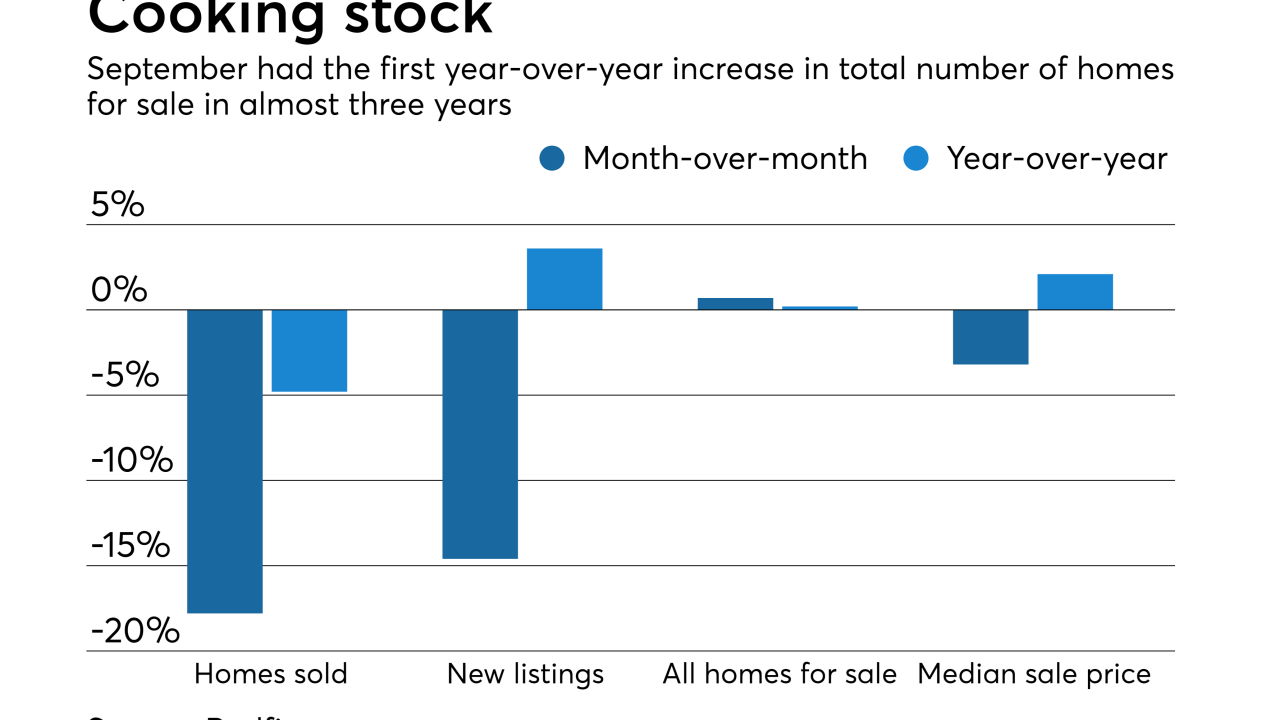

Declining home sales and high mortgage rates led to a year-over-year increase in housing stock in September, according to Redfin.

October 22