-

Mortgage applications decreased 0.1% from one week earlier, dropping for the seventh time in eight weeks even with scant movement in interest rates, according to the Mortgage Bankers Association.

September 5 -

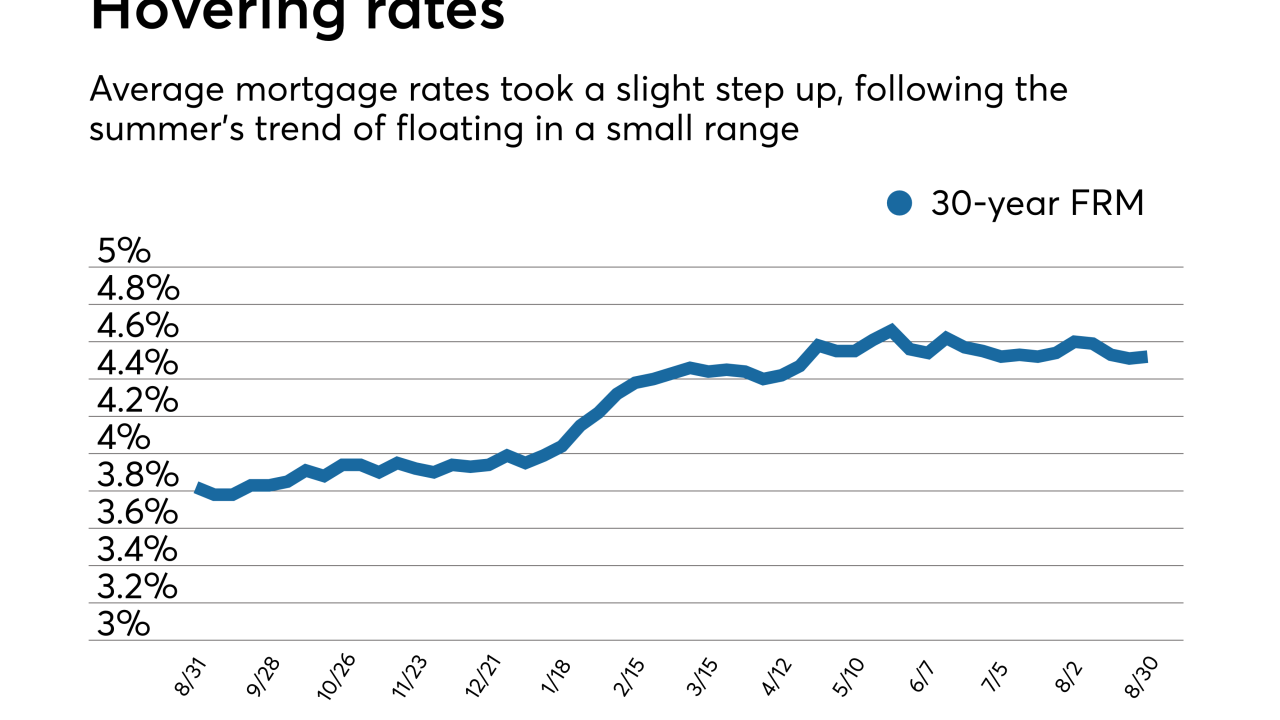

Mortgage rates took small steps up after hitting a four-month low, but continued hovering around the same range they have all summer, according to Freddie Mac.

August 30 -

Private mortgage insurance was the largest source of credit enhancement for new homeowners in the second quarter making a low down payment for the first time ever, according to Genworth Mortgage Insurance.

August 29 -

The vast majority of consumers start the mortgage process with internet research, but when it comes time to initiate contact with a lender, borrowers are nearly as likely to pick up the phone as they are to connect online.

August 29 -

After their first increase in six weeks, mortgage applications declined despite lower interest rates, according to the Mortgage Bankers Association.

August 29 -

The Congressional Budget Office has found that restructuring the mortgage market would save the government billions of dollars but may increase the cost of housing.

August 27 -

The 30-day delinquency rate dropped to a low not seen in over a decade in July, but foreclosure starts also increased to a three-month high.

August 24 -

Wells Fargo & Co. is cutting 638 mortgage employees as the nation’s largest home lender contends with a slowdown in the business.

August 24 -

Home prices climbed 6.5% in the second quarter from a year earlier, a slower pace that adds to signs of a cooldown in the market.

August 23 -

Intensifying margin pressure could spur another wave of cost-cutting at nonbank mortgage lenders, unless other strategies, like consolidation or a mortgage servicing book that could increase in value, offset it.

August 23 -

Purchases of new homes unexpectedly dipped to the weakest pace in nine months as higher prices and mortgage rates sideline demand, adding to signs of a cooling in the housing market.

August 23 -

Mortgage rates decreased for the third straight week and reached their lowest level since mid-April, according to Freddie Mac.

August 23 -

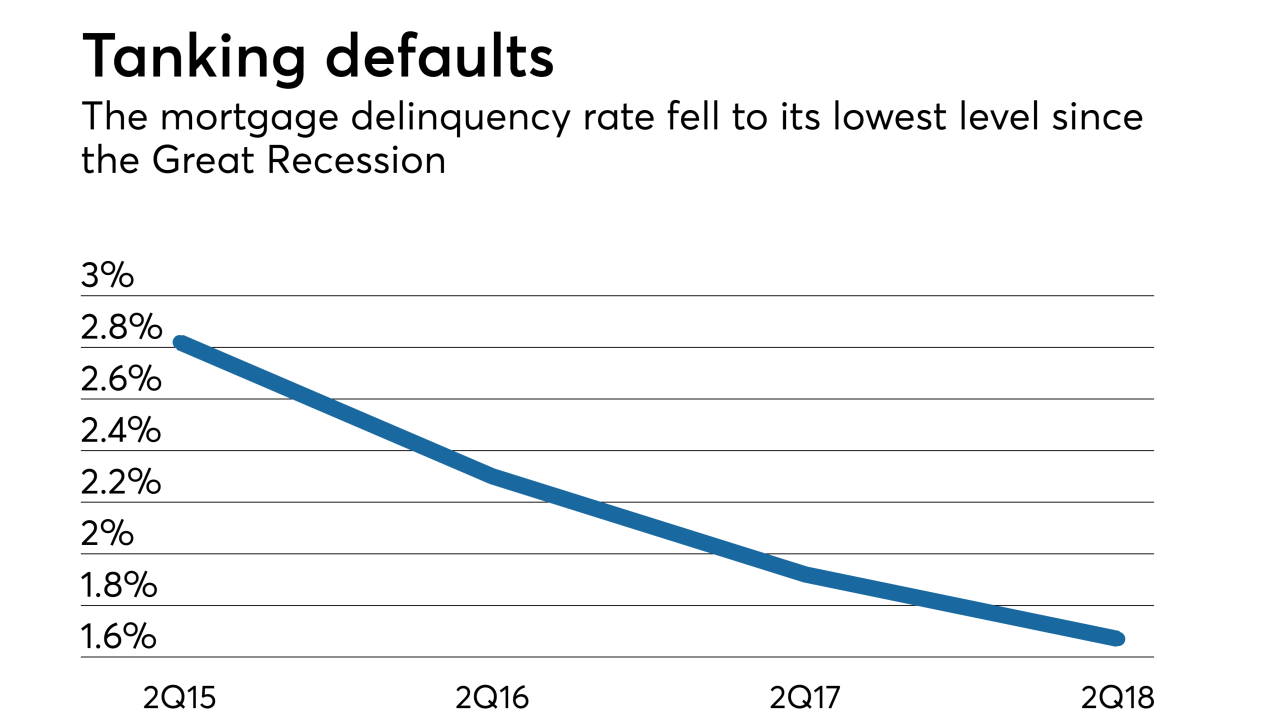

Better consumer credit quality helped push the serious mortgage delinquency rate to its lowest level since the Great Recession, but originations remain low due to tighter underwriting standards and eroding homebuyer affordability, according to TransUnion.

August 22 -

The expiration of Annaly Capital Management's offer to purchase MTGE Investment Corp. was delayed until Sept. 7 so the two real estate investment trusts have more time to satisfy deal conditions.

August 20 -

An improved economy, a healthy labor market and the large population of millennials should have accelerated home sales much higher, but all hope for more transactions this year is not yet lost, according to the NAR.

August 20 -

Fannie Mae decreased its 2018 origination forecast for the fourth time this year in anticipation of more upward pressure on rates, and housing weakness that persists despite increased overall economic strength.

August 16 -

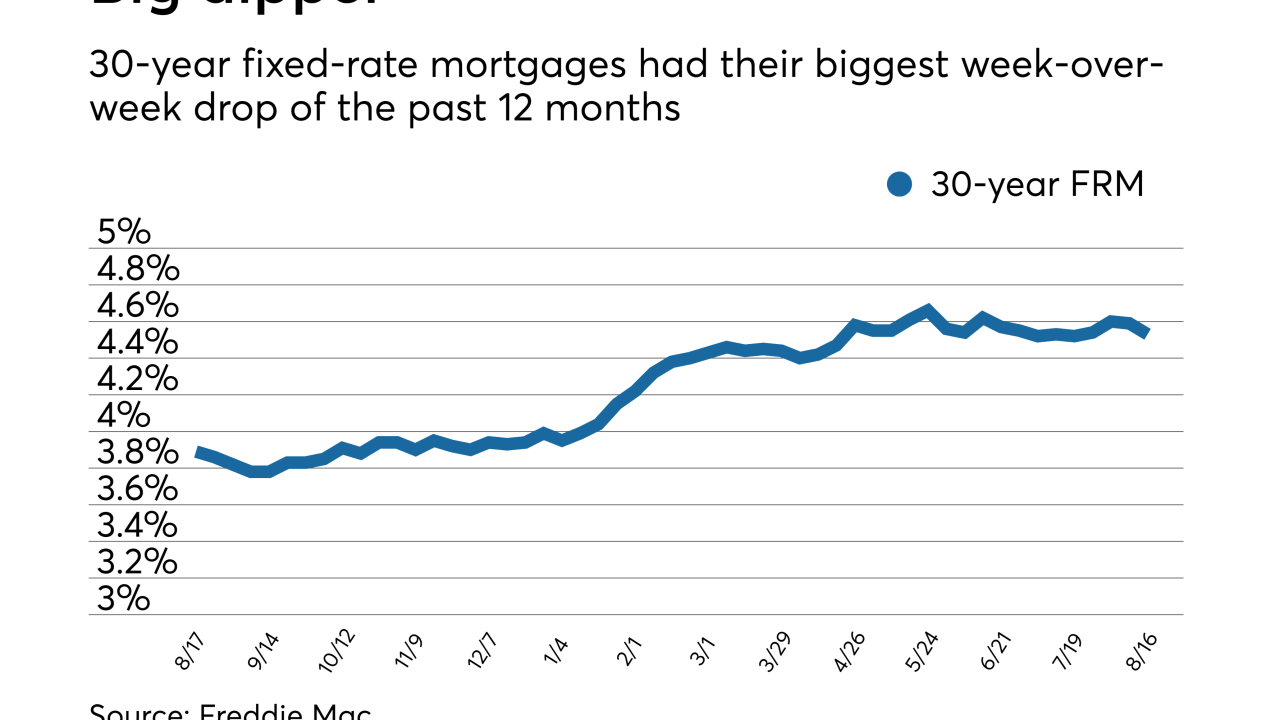

Average mortgage rates fell, including the largest week-over-week drop of the past 12 months, but homebuyer demand stays mum, according to Freddie Mac.

August 16 -

Mirroring a national trend of rebounding home prices and rising mortgage rates, Palm Beach County, Fla., saw housing affordability fall to a 10-year low in the second quarter.

August 16 -

New-home construction rose less than forecast in July amid a rebound in groundbreaking for single-family and multifamily houses, indicating the industry was trying to regain its footing at the start of the second half.

August 16 -

Purchase-loan share held steady month-to-month for the first time this year, even though it is still above year-ago levels in line with a seasonal decline, but growth remains in the forecast.

August 15