-

The number of mortgage borrowers with an interest rate incentive to refinance fell 40% during the first six weeks of the year and now sits at the lowest level in more than nine years.

March 5 -

As housing demand continues outpacing supply, tight inventory is plaguing potential buyers and putting upward pressure on home prices. Here's a look at the housing markets where supply is shrinking the most.

March 5 -

The new Federal Reserve Board chairman's testimony in Congress was the driver of this week's mortgage rate increase, according to Freddie Mac.

March 1 -

A gauge of contracts to purchase previously owned homes unexpectedly declined in January to a more than three-year low, reflecting a shortage of inventories and rising mortgage rates.

February 28 -

Despite growth in both mortgage rates and home prices, housing demand kicked off 2018 with its strongest January on record, according to Redfin.

February 28 -

Sales of new homes unexpectedly fell in January to the lowest level since August as borrowing costs rose and winter weather depressed demand.

February 26 -

Low home inventory continues to put upward pressure on home prices, but affordability strains may be overstated, according to First American Financial Corp.

February 23 -

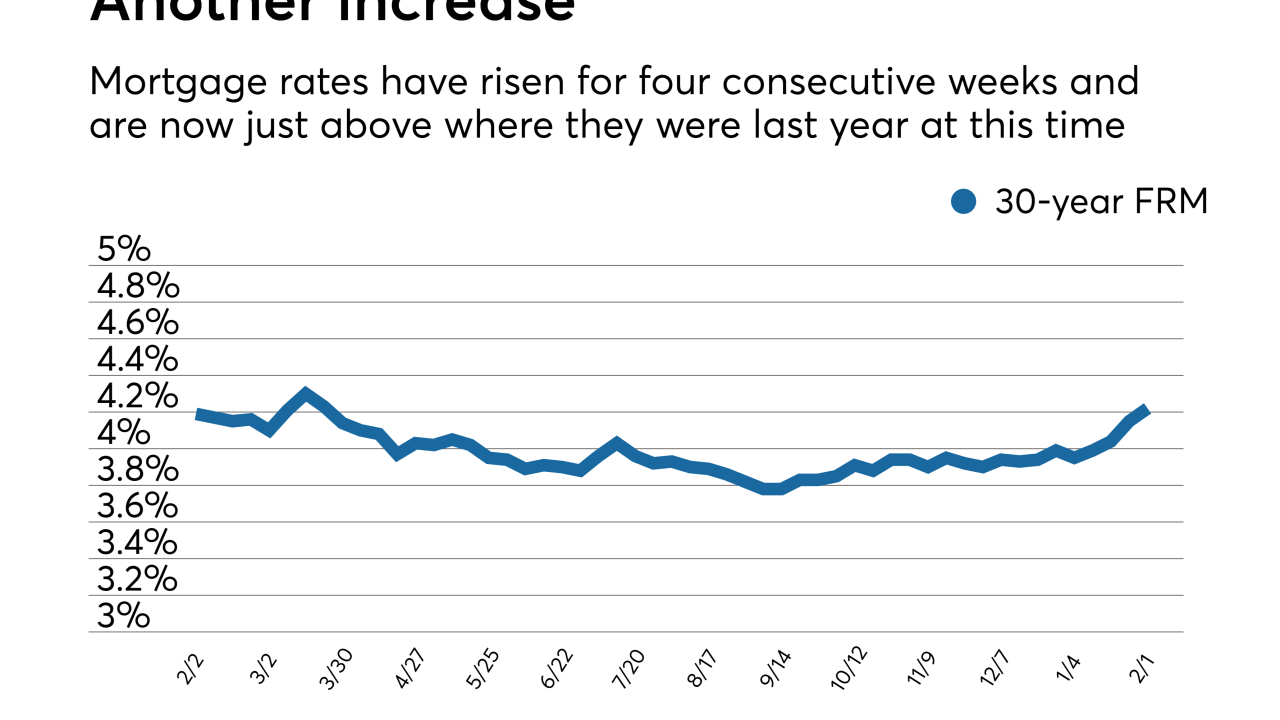

The 30-year fixed mortgage rate moved up for the seventh consecutive week with further increases possible as bond yields rise over concerns about higher inflation.

February 22 -

Refinance mortgages accounted for 45% of mortgage volume, the highest share in a year, according to Ellie Mae.

February 21 -

As inflation fears put upward pressure on 10-year Treasury bonds and mortgage rates nationally, borrowers could start to take more notice of what lenders are charging them locally.

February 20 -

The 2018 spring home buying season could be even more competitive than last year's, marked by fewer listings, quicker sales, and a higher percentage of homes selling above the asking price in January.

February 15 -

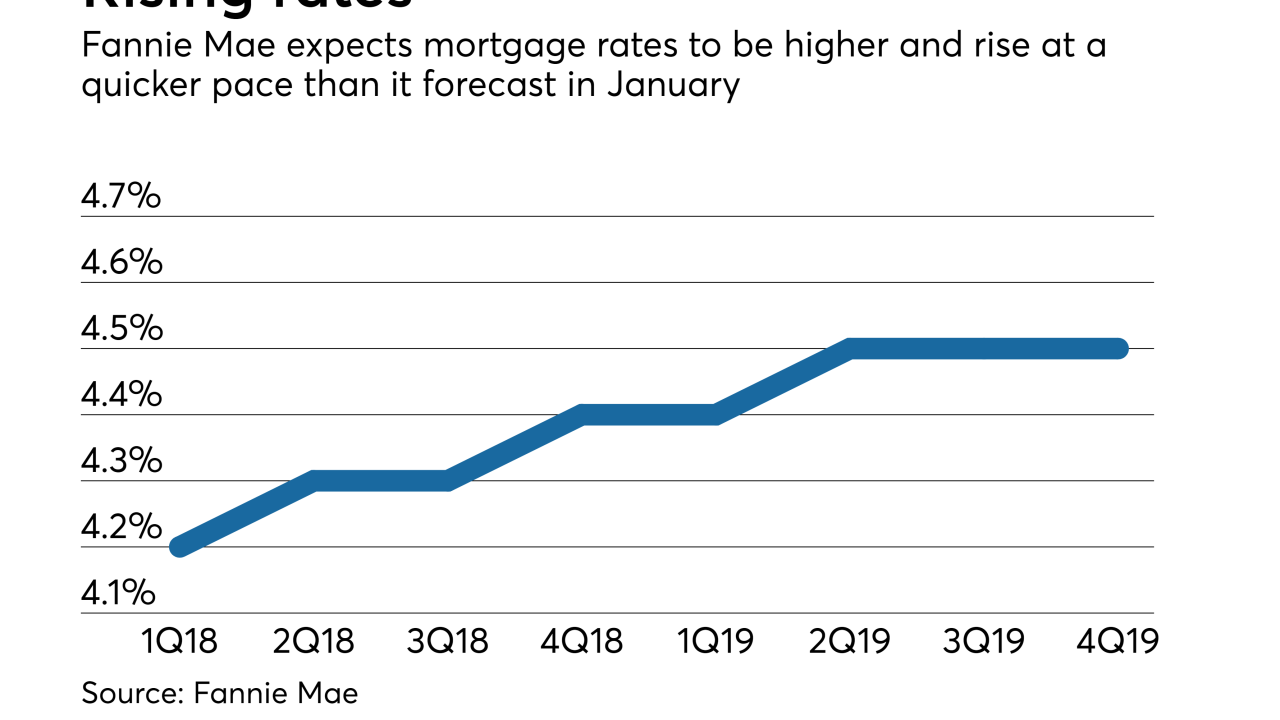

The recent bond market volatility will cause mortgage rates to rise to a higher level than previously projected, according to Fannie Mae.

February 15 -

Mortgage rates rose to their highest level in almost four years, as worries over inflation drove the 10-year Treasury yield to just shy of 3%.

February 15 -

Here's a look at the 10 housing markets with the biggest gap between growth in home prices and wages that could indicate a housing bubble is forming.

February 13 -

Homebuyers are most likely to slow their purchases or stay on course if mortgage rates rise above a certain benchmark, but some could act more quickly or drop out.

February 12 -

Mortgage rates hit their highest mark since December 2016 as bond yields were affected by the roller coaster stock market, according to Freddie Mac.

February 8 -

Recent stock market volatility may further constrain jumbo lending, while inflation concerns have lenders paying close attention to rising mortgage rates.

February 6 -

Shares of homebuilders are now in their 10th straight day of decline, the longest losing streak for the sector since 2002, when it lasted 11 days.

February 5 -

The pace of Colorado Springs-area homebuilding soared in January, picking up where a strong 2017 left off.

February 5 -

Mortgage rates, which are significantly higher since the start of the year, are likely to rise for weeks to come, according to Freddie Mac.

February 1