-

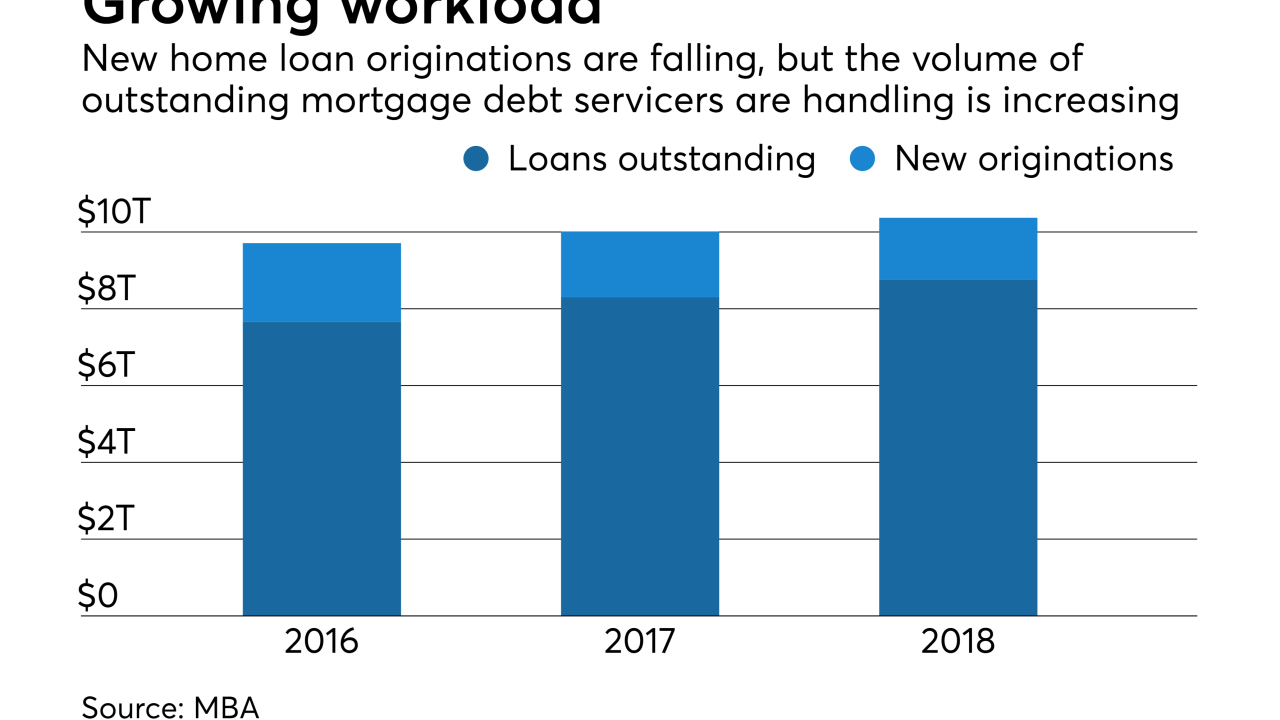

Rising mortgage rates have taken a toll on refinance lending and extended the lifecycle of existing loans. With new purchase originations also making portfolios larger, servicers must take steps to avoid capacity constraints.

January 31 -

Warehouse lines of credit are getting more expensive as short-term interest rates rise, and lenders have limited options for reducing their costs.

January 29 -

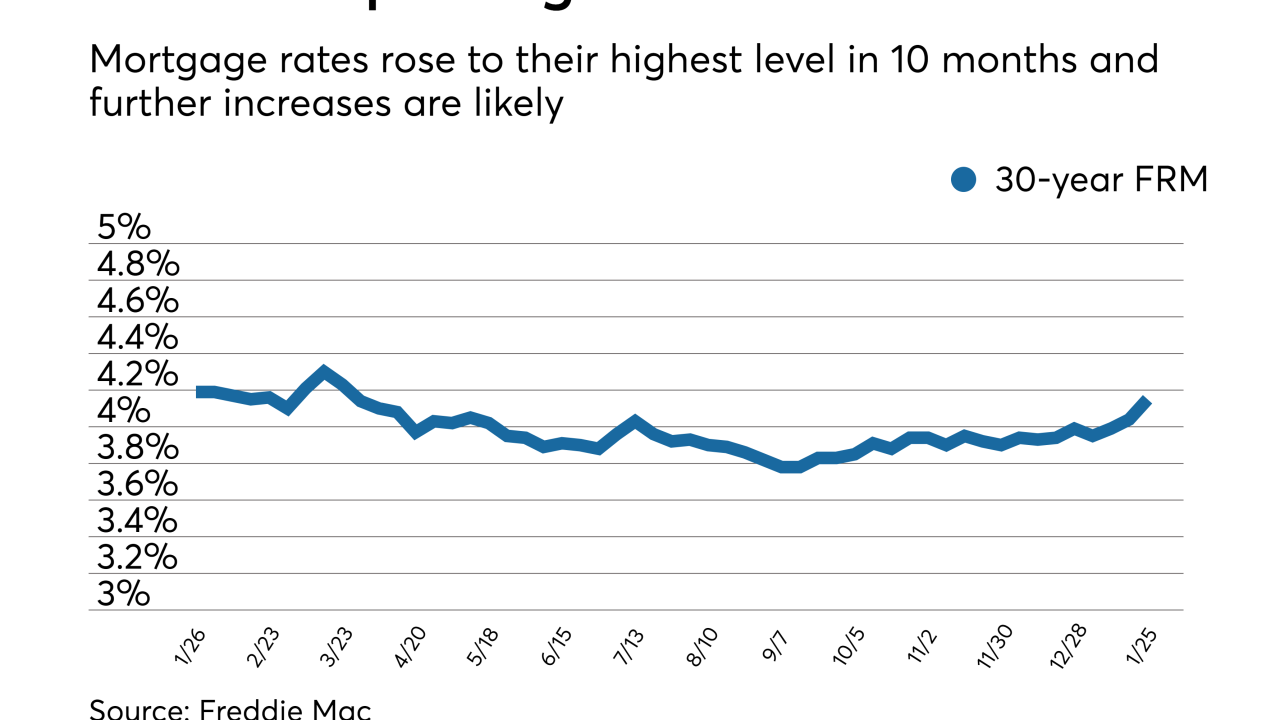

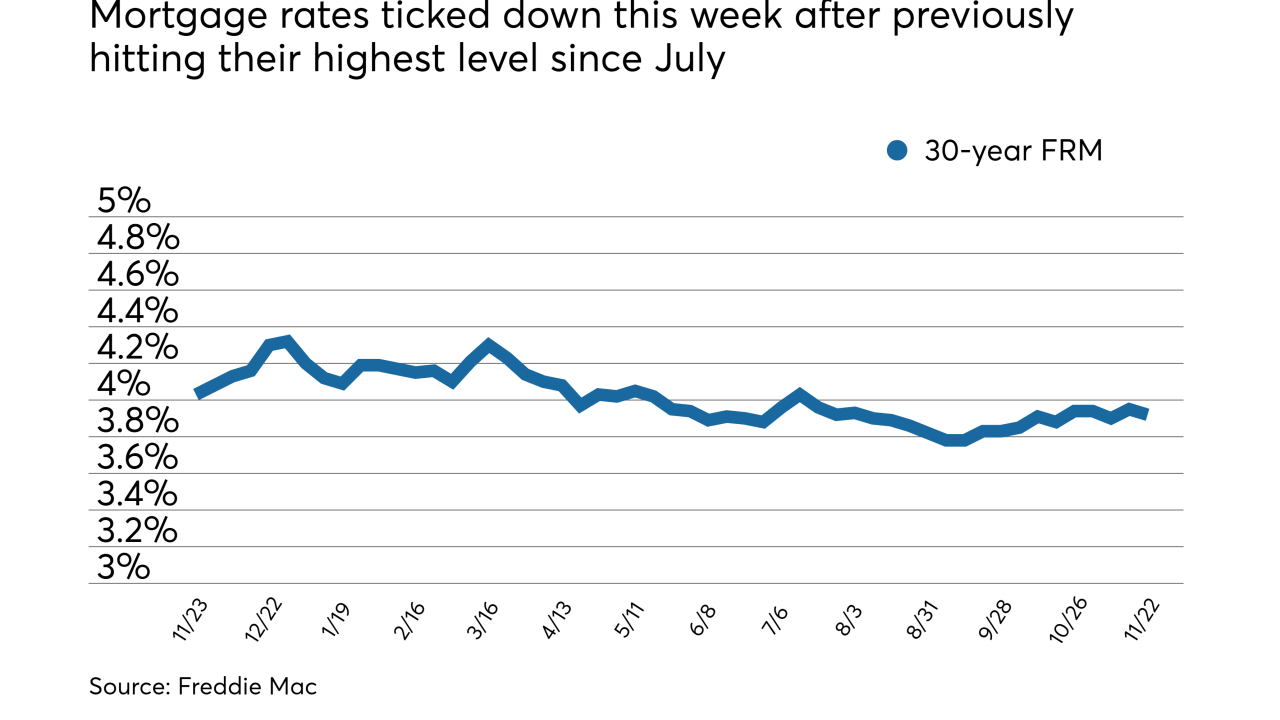

Mortgage rates rose for the third consecutive week and with expected continued economic growth, further increases are likely.

January 25 -

Net interest income has surged thanks to rising rates, but noninterest income has lagged as trading revenue has weakened, refi demand has softened and fees from deposit service charges have barely budged. Is this the new normal?

January 24 -

Sales of previously owned homes fell in December for the first time in four months, as the market struggles with record-low supply and rising prices.

January 24 -

Given the improving U.S. economy, mortgage rates will probably not fall back under the 4% mark anytime soon.

January 18 -

Mortgage rates jumped across the board as investors sold some of their Treasury bond holdings, which led to higher yields, according to Freddie Mac.

January 11 -

Mortgage rates dropped to start the year as the markets had little new news to react on during the holiday period.

January 4 -

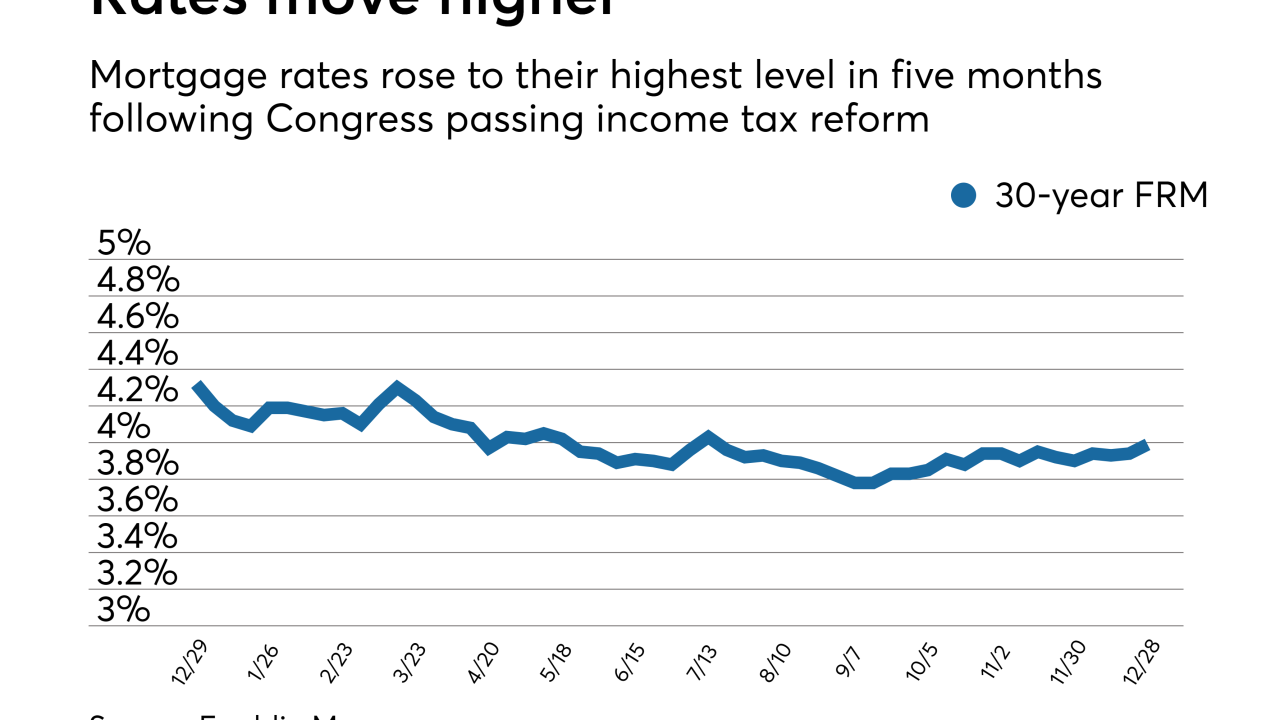

Mortgage rates rose to their highest level since the summer as predicted following Congress passing income tax reform, according to Freddie Mac.

December 28 -

The tax reform bill Congress sent to President Trump's desk this week is likely to prompt at least a short-term spike in mortgage rates.

December 21 -

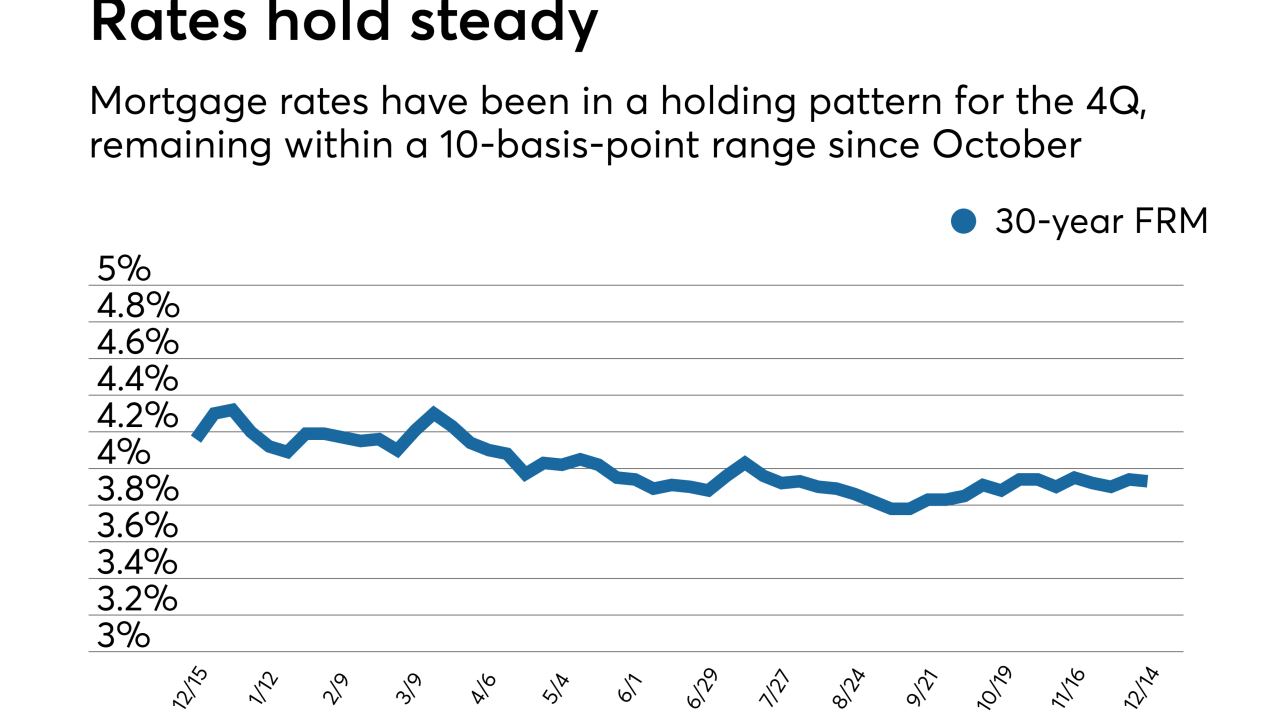

The mortgage market had already priced the Federal Open Market Committee's 25-basis-point hike into its rates so there was little change, according to Freddie Mac.

December 14 -

Mortgage rates ticked up this week, but a larger rise is possible next week depending on what Congress does about tax reform and the budget.

December 7 -

Mortgage rates moved lower this week, but strong economic data and comments by the outgoing Federal Reserve chair left many anticipating higher rates, according to Freddie Mac.

November 30 -

Consumer house-buying power, measuring how much one can purchase based on changes in income and interest rates, fell 2.1% year-over-year, but increased by 1.3% from the month prior, according to First American Financial Corp.

November 28 -

Federal Reserve officials meeting earlier this month saw an interest-rate increase in the near term even as divisions persisted over the policy path forward amid tepid inflation.

November 22 -

Mortgage rates ticked down this week after previously hitting their highest level since July, according to Freddie Mac.

November 22 -

Mortgage rates moved to their highest mark since July and the 10-year Treasury yield ticked up 6 basis points, according to Freddie Mac.

November 16 -

Mortgage rates fell slightly across the board after the release of the Republican Party tax plan and the nomination of a new Federal Reserve chairman.

November 9 -

Home prices are up strongly both year-over-year and month-over-month, and nearly half of the nation's largest 50 markets are overvalued, according to CoreLogic.

November 8 -

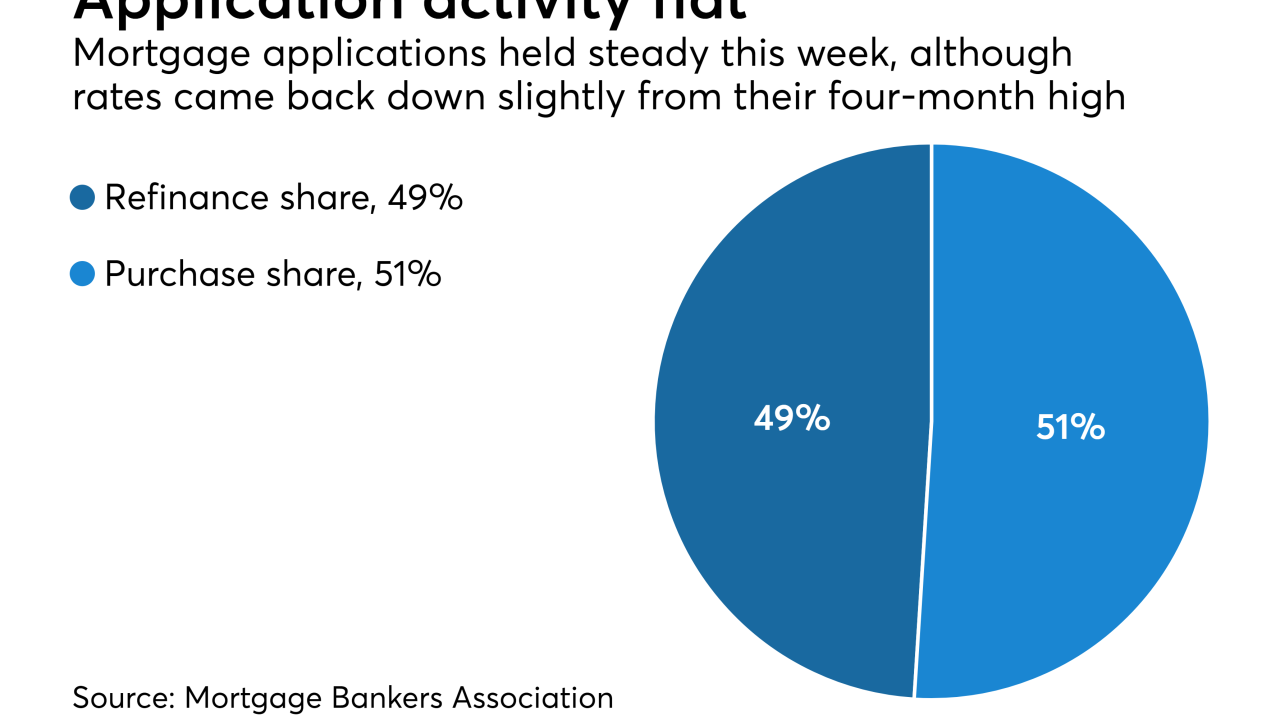

Mortgage application activity was unchanged from one week earlier although rates came back down slightly from their four-month high, according to the Mortgage Bankers Association.

November 8