-

Mortgage companies' average net gain on loans has returned to the four-digit range after dropping into the low three-digits after the federal election last year.

August 29 -

If mortgage rates rise slowly as the economy continues to grow, the impact from the Fed’s unwind on housing likely will result in a decline in refinancing activity.

August 28 Fannie Mae

Fannie Mae -

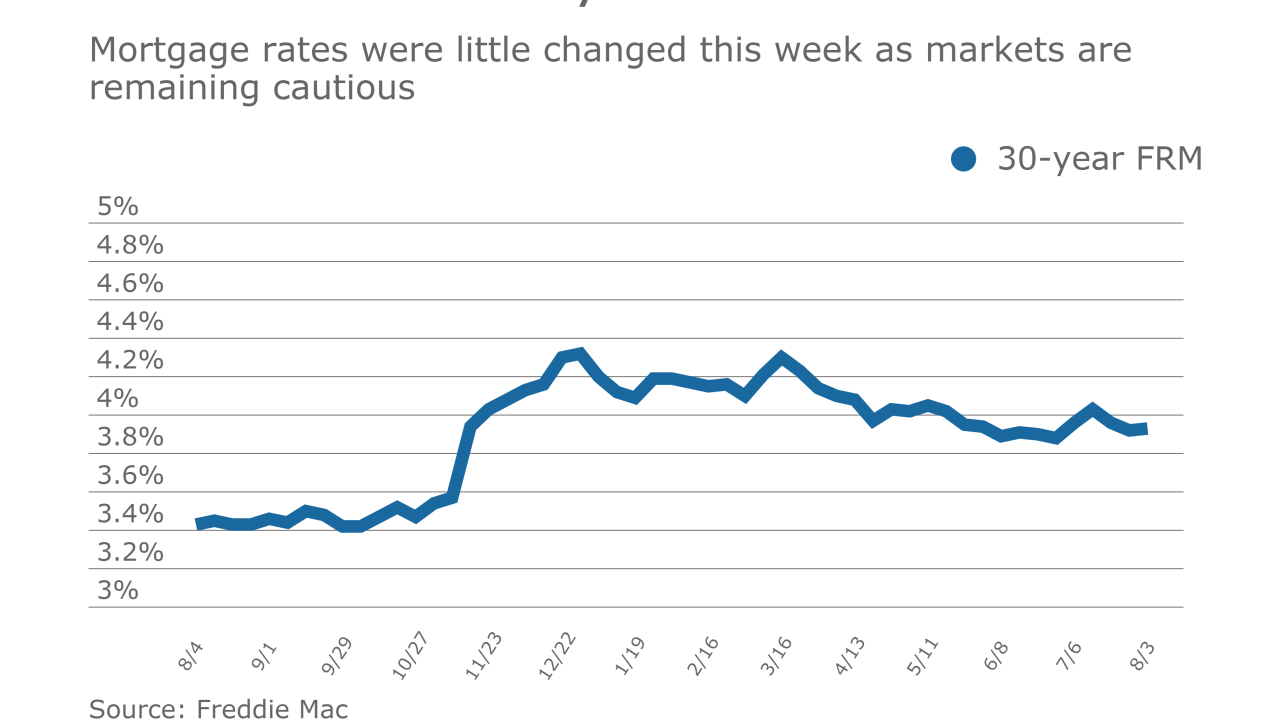

Mortgage rates decreased for the fourth consecutive week and dropped to their lowest mark since November, according to Freddie Mac.

August 24 -

There was very little change in mortgage application activity for the second consecutive week, according to the Mortgage Bankers Association.

August 23 -

Mortgage rates continued to move lower as a result of economic uncertainty, according to Freddie Mac.

August 17 -

The share of refinance loans in the market bounced back slightly in July, according to Ellie Mae's latest monthly report.

August 16 -

Mortgage application volume was practically flat when compared with one week earlier, according to the Mortgage Bankers Association.

August 16 -

Sentiment among American homebuilders unexpectedly increased to a three-month high as builders saw greater prospects for industry demand despite elevated material costs and shortages of labor and lots.

August 15 -

Housing affordability dipped as rising home prices offset a quarter-point drop in mortgage interest rates.

August 14 -

For all the talk that Janet Yellen’s plan to shrink the Federal Reserve’s balance sheet will hurt Treasuries, U.S. mortgage bonds face a bigger test.

August 11 -

Mortgage rates dropped to their lowest point in six weeks as bond investors were concerned about inflation and the U.S. economy, according to Freddie Mac.

August 10 -

Mortgage application volume increased 3% from one week earlier as slightly lower interest rates resulted in more refinance activity, according to the Mortgage Bankers Association.

August 9 -

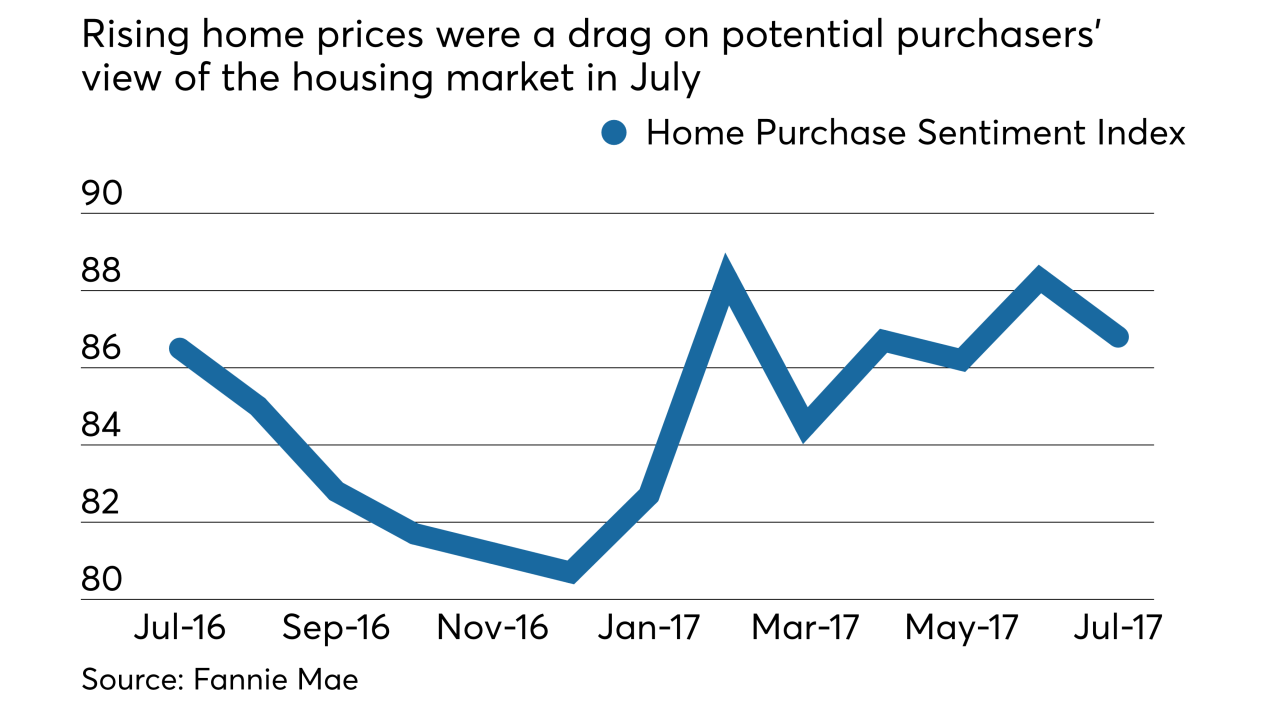

The percentage of people who said July was a bad time to buy a home increased to a survey high because of rising prices, according to Fannie Mae.

August 7 -

Mortgage rates were little changed this week after declining the previous two weeks, according to Freddie Mac.

August 3 -

Mortgage application activity decreased 2.8% from one week earlier as interest rates were flat or moved slightly higher, according to the Mortgage Bankers Association.

August 2 -

Mortgage rates dropped for the second consecutive week, although the yield on the benchmark 10-year Treasury actually increased during the period, according to Freddie Mac.

July 27 -

Federal Reserve officials said they would begin running off their $4.5 trillion balance sheet “relatively soon” and left their benchmark policy rate unchanged as they assess progress toward their inflation goal.

July 26 -

Loan application volume increased 0.4% from one week earlier, according to the Mortgage Bankers Association, as rates fell to their lowest level in three weeks.

July 26 -

The housing market is stabilizing near 10-year highs, according to government data Wednesday that showed sales of new homes were slightly less than forecast.

July 26