-

But economists predict upward pressure in the coming months after comments from Federal Reserve Chair Jerome Powell.

January 27 -

Federal Reserve Chair Jerome Powell said the central bank was ready to raise interest rates in March and didn’t rule out moving at every meeting to tackle the highest inflation in a generation.

January 26 -

However, the shortage of entry-level home listings should result in a competitive spring purchase season, the government-sponsored enterprise said.

January 24 -

Treasury dealers and investors are busy trying to predict exactly when the Federal Reserve might pull the trigger on cutting the size of its balance sheet and how big that drawdown could be when it does.

January 21 -

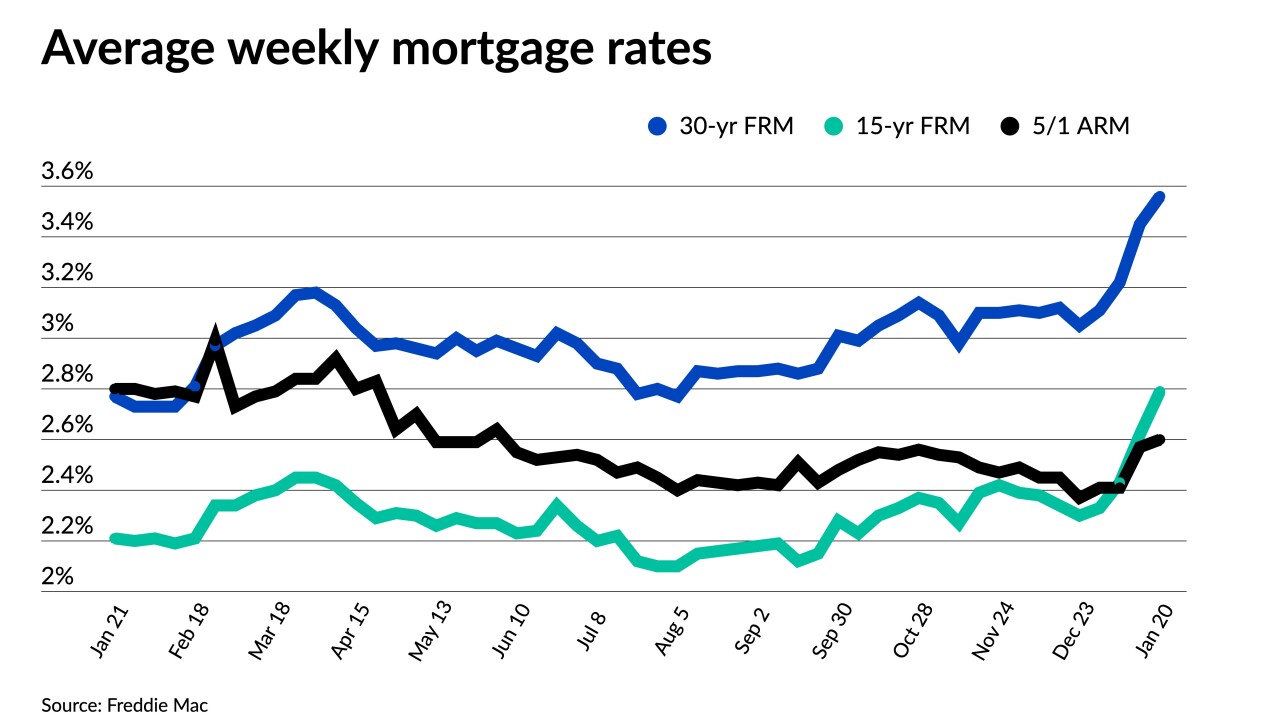

All major averages have risen to start 2022, with the 15-year surpassing the ARM.

January 20 -

The latest jobs and economic numbers pave the way for additional upward movement throughout 2022, analysts said.

January 13 -

December's activity was down 18% from November, led by a 23% drop in purchase volume and a 17% decline in rate-and-term refinancings, Black Knight said.

January 10 -

Nearly half of likely buyers said they feel more urgency to act if the 30-year FRM reached 3.5%, a Redfin survey found.

January 7 -

Despite the rising number of COVID infections, investors made no moves that would apply downward pressure.

January 6 -

Federal Reserve officials said a strengthening economy and higher inflation could lead to earlier and faster interest-rate increases than previously expected, with some policy makers also favoring starting to shrink the balance sheet soon after.

January 5 -

The 30-year average climbed six basis points after falling to a monthly low a week earlier.

December 30 -

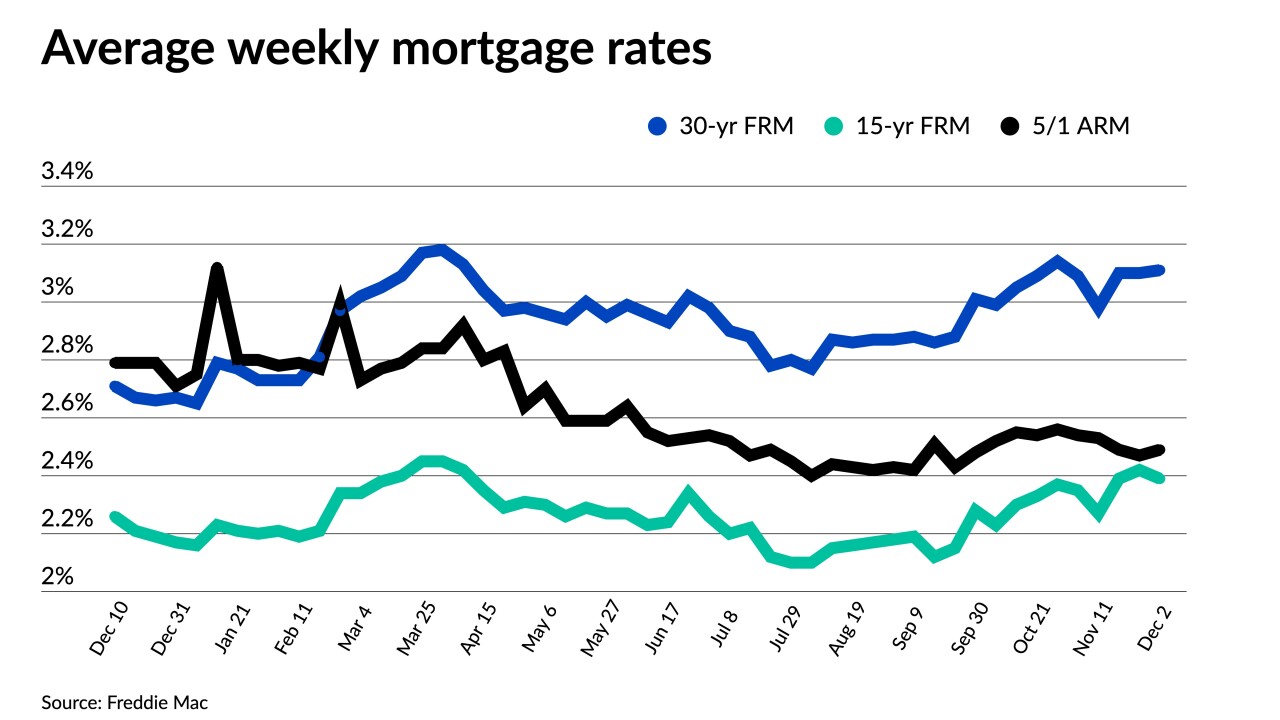

The average 30-year rate dropped seven basis points to 3.05%.

December 23 -

In four of the six periods in the last 30 years where mortgage rates increased significantly, sales also grew, First American said.

December 22 -

The central bank’s new tone has many in the industry planning for potential volatility in 2022.

December 16 -

Federal Reserve officials intensified their battle against the hottest inflation in a generation by shifting to end their asset-buying program earlier and signaling they favor raising interest rates in 2022 at a faster pace than economists were expecting.

December 15 -

Treasuries plunged following news of the omicron variant, but subsequently reversed course.

December 2 -

Fed moves, inflation and retail sales applied upward pressure, contributing to the increase.

November 18 -

The average for a 30-year loan was 2.98%, down from 3.09% last week, Freddie Mac said in a statement Thursday.

November 10 -

But the Fed’s taper announcement has the industry planning for increases throughout 2022.

November 4 -

But the number of prospects remains at the high end of its pre-pandemic range.

November 2