-

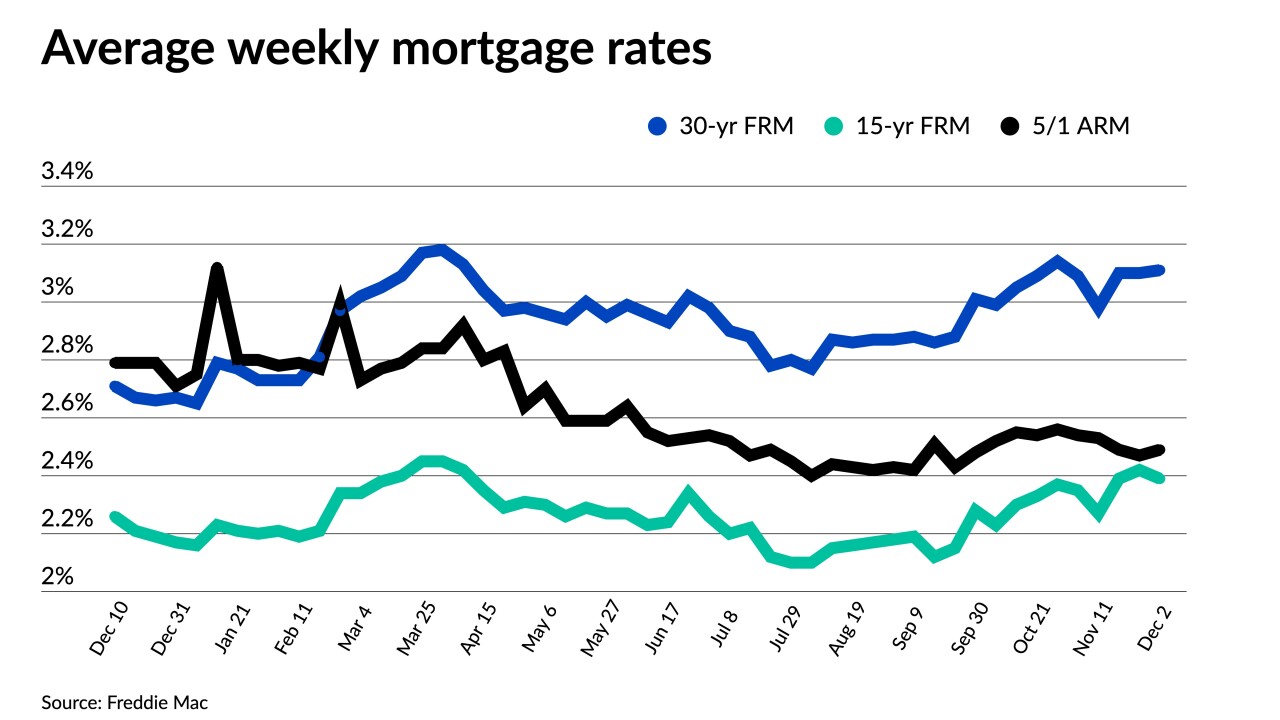

The 30-year average climbed six basis points after falling to a monthly low a week earlier.

December 30 -

The average 30-year rate dropped seven basis points to 3.05%.

December 23 -

In four of the six periods in the last 30 years where mortgage rates increased significantly, sales also grew, First American said.

December 22 -

The central bank’s new tone has many in the industry planning for potential volatility in 2022.

December 16 -

Federal Reserve officials intensified their battle against the hottest inflation in a generation by shifting to end their asset-buying program earlier and signaling they favor raising interest rates in 2022 at a faster pace than economists were expecting.

December 15 -

Treasuries plunged following news of the omicron variant, but subsequently reversed course.

December 2 -

Fed moves, inflation and retail sales applied upward pressure, contributing to the increase.

November 18 -

The average for a 30-year loan was 2.98%, down from 3.09% last week, Freddie Mac said in a statement Thursday.

November 10 -

But the Fed’s taper announcement has the industry planning for increases throughout 2022.

November 4 -

But the number of prospects remains at the high end of its pre-pandemic range.

November 2 -

A majority of the 49 economists in the survey predicted the U.S. central bank will begin the taper in November and wrap it up by mid-2022, curbing the current $120 billion monthly buying pace by reducing Treasuries by $10 billion a month and mortgage-backed securities by $5 billion.

November 2 -

The 30-year average stayed above 3% for the second straight seven-day period, with improved retail sales data helping drive the uptick.

October 21 -

Inflation, supply chain issues and labor shortages will lead to a tightening by the Fed sooner rather than later.

October 15 -

Rising inflation and moves by the Federal Reserve are expected to fuel interest rate growth into 2022.

October 14 -

Federal Reserve officials broadly agreed last month they should start reducing emergency pandemic support for the economy, minutes of the Sept. 21-22 Federal Open Market Committee meeting released Wednesday said.

October 13 -

However, economic data points to likely future increases, with investors awaiting numbers from upcoming jobs report.

October 7 -

Take our survey to share your views on how the market will develop in the coming year.

October 6 -

Taper announcement, slowing COVID cases help remove downward pressure, leading to increases across all loan-term types.

September 30 -

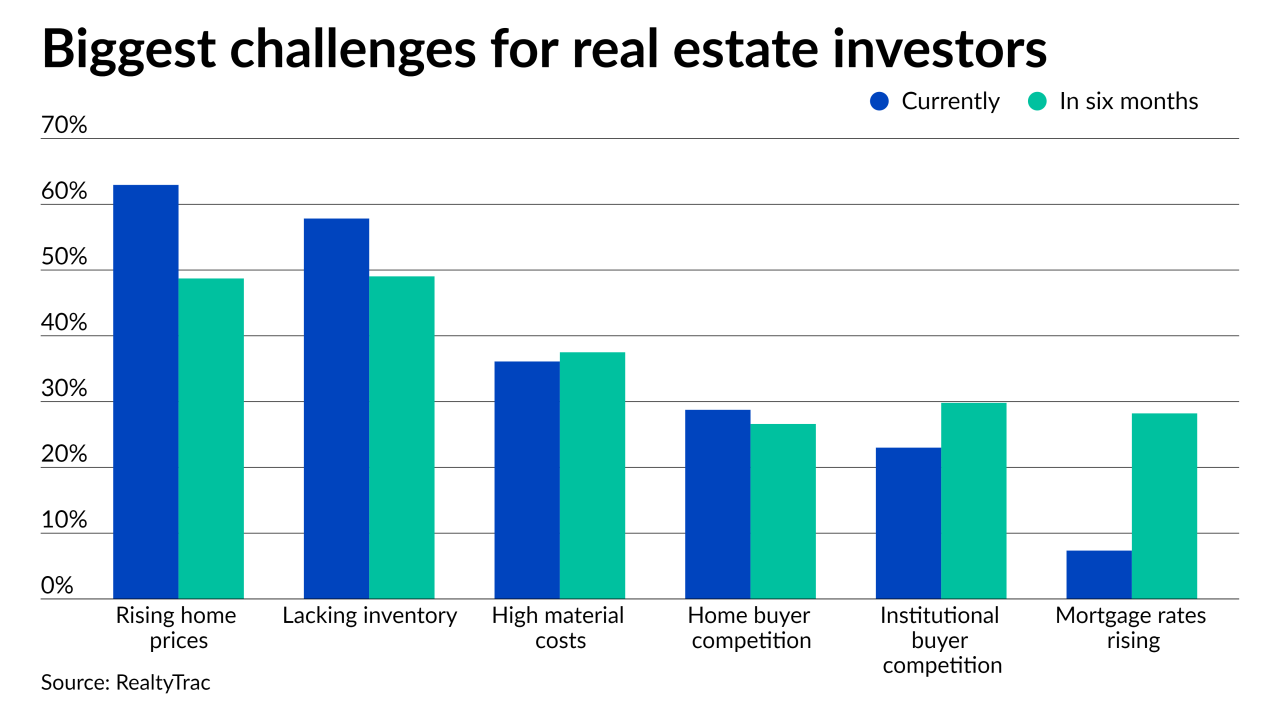

The home price increases and the ongoing inventory shortage made buying conditions difficult and many think it’s only getting more challenging, according to RealtyTrac.

September 29 -

Federal Reserve officials reinforced the U.S. central bank’s message that it would probably begin winding down its bond-buying program soon, though the economic recovery still had a way to go before interest rate increases would be appropriate.

September 28