-

While the economic recovery and stimulus checks drove upward movement in purchases, it wasn’t enough to offset tumbling refinance activity.

March 17 -

Apart from saving more money, millennials prefer to spend their savings on a home down payment, Zonda economist Ali Wolf said.

March 17 -

Economists see two quarter-point hikes in 2023. But they also expect the U.S. central bank’s own forecast will show the median Fed official projecting rates staying on hold near zero throughout that year.

March 15 -

After a booming 2020, more mortgage lenders than ever before expect diminishing margins in the coming months as climbing interest rates set up heightened competition.

March 11 -

Consumers may want to strike while the iron’s hot and apply for loans now, before rates get much higher.

March 11 -

Mortgage rates surged 40 basis points since the start of the year as the economy improved.

March 10 -

Servicers struggled to bring back their borrowers as the overall retention rate crept down to a nadir in the fourth quarter, according to Black Knight.

March 8 -

And there are some brawls on the field affecting the direction of business for the rest of this year.

March 8 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The gap between those that considered it a good or bad time to buy narrowed 10 percentage points in February, the tightest spread since last April, Fannie Mae found.

March 8 -

With the latest growth, interest rates spiked 37 basis points since the calendar flipped to 2021 alongside rising Treasury bond yields.

March 4 -

A slight lift in the purchase market paired with a surprising reversal in the size of the average loan, according to the Mortgage Bankers Association.

March 3 -

With the pandemic’s radical disruption of the housing market, values grew at the highest rate in eight years, according to CoreLogic.

March 2 -

After several weeks of resistance, mortgage rates are now moving in lockstep with the recent increases in the 10-year Treasury yield.

February 25 -

Servicers could be dealing with approximately 1.8 million distressed properties when the latest forbearance extension ends in June, Black Knight said.

February 24 -

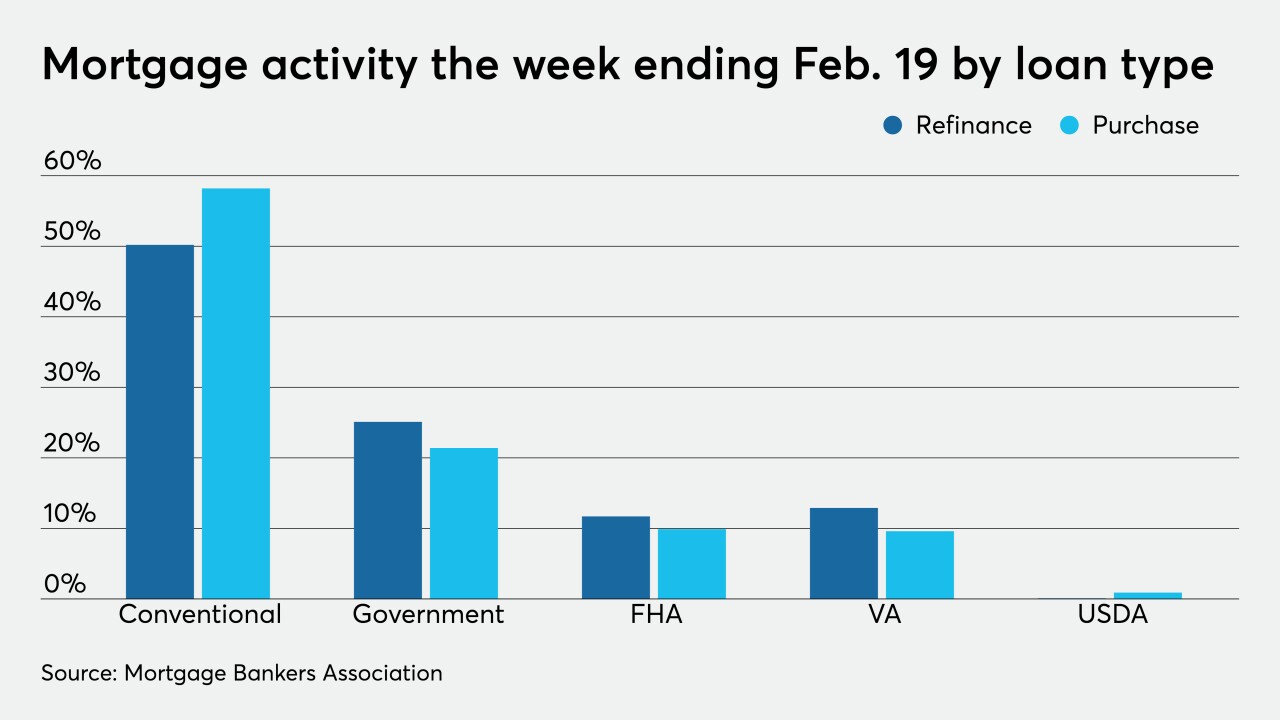

Severe winter weather and another hike in mortgage rates stifled loan volume for the week, according to the Mortgage Bankers Association.

February 24 -

Just because the Fed is staying put doesn’t mean that mortgage rates, and prices of MBS, are staying put as well, writes Vice Capital Markets Principal Chris Bennett.

February 19 Vice Capital Markets

Vice Capital Markets -

“Sales could be even higher,” if more homes were put on the market, NAR’s chief economist Lawrence Yun said

February 19 -

Today, the mortgage players who most actively hedged — Fannie and Freddie, real estate investment trusts and large bank servicers — have significantly reduced their need to to do so, analysts said.

February 19 -

With the most recent stimulus aiding economic recovery, mortgage lending’s feeding frenzy could be coming to an end.

February 18 -

While sales shot up from the same time last year, inventory reached its lowest level since Remax started its National Housing Report in 2007.

February 17