-

Monetary policy officials have finally gone a month without tightening but made it clear more action could lie ahead, suggesting it could be awhile before housing finance costs consistently fall.

June 14 -

Bond traders are girding for the risk that Federal Reserve Chair Jerome Powell is ready, willing and able to plunge the U.S. into recession to get the inflation bogey under control.

September 22 -

Federal Reserve officials broadly agreed last month they should start reducing emergency pandemic support for the economy, minutes of the Sept. 21-22 Federal Open Market Committee meeting released Wednesday said.

October 13 -

Take our survey to share your views on how the market will develop in the coming year.

October 6 -

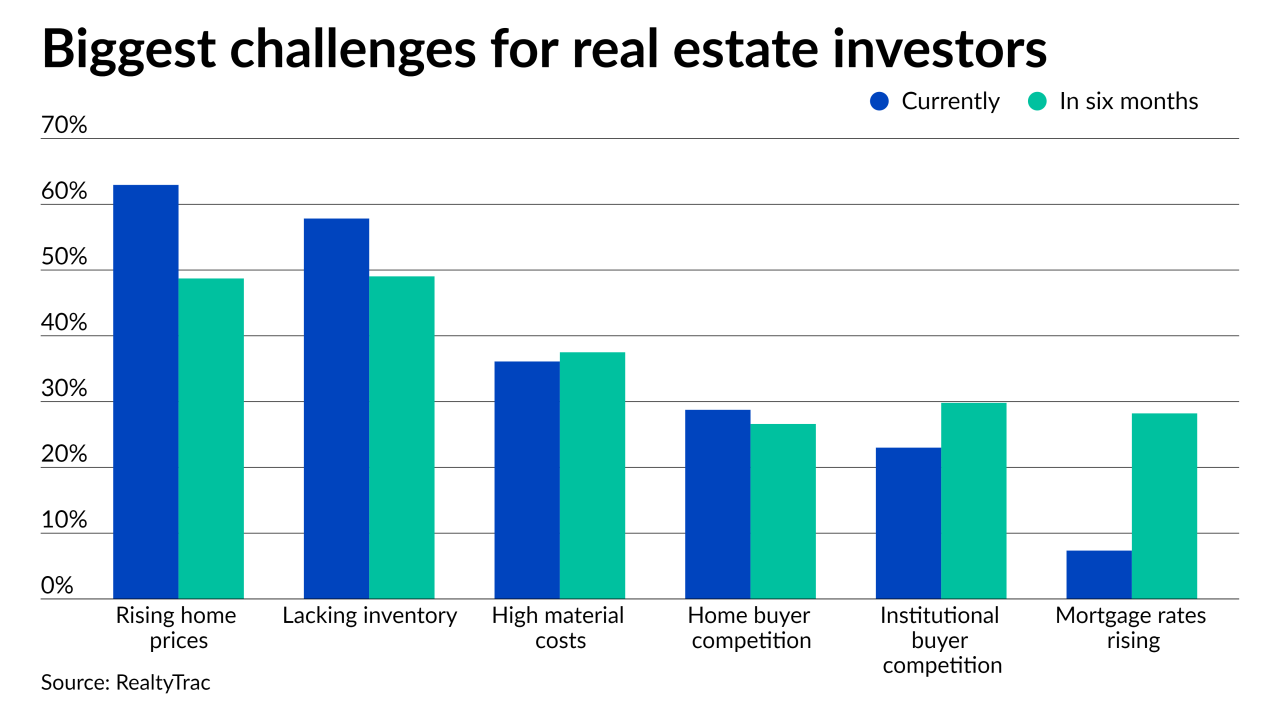

The home price increases and the ongoing inventory shortage made buying conditions difficult and many think it’s only getting more challenging, according to RealtyTrac.

September 29 -

A rising — but still small — share of borrowers believe interest rates and housing price appreciation will fall in the next year, according to Fannie Mae.

September 7 -

Tight inventory and heightened competition kept prime purchasers at bay as property values continued their summer surge, according to Fannie Mae.

August 9 -

Officials have pledged to maintain bond buying until the economy shows "substantial further progress" on inflation and employment as it recovers from COVID-19.

July 23 -

The adverse market fee change could contribute to an increase in refinance volume, adds Mortgage Bankers Association economist Mike Fratantoni.

July 19 -

The GSE forecasts $4 trillion in production this year because refinance activity is stronger than expected.

July 16 -

Still, the average time a property is on the market is at an all-time low, with more than half going into contract within two weeks.

July 9 -

The dynamic between housing market players diverged to an even greater degree amid intense demand and surging home prices, according to Fannie Mae.

July 7 -

While purchasing power grew for the 16th straight month in April, surging property values and increased mortgage rate forecasts will keep driving down affordability, according to First American.

June 28 -

Median home prices are higher than the historical average in 61% of U.S. counties, Attom Data Solutions said, and it's unclear if the situation gets better or worse.

June 24 -

While a growing share of consumers feel optimistic about the economic recovery underway, the extreme seller’s market made the majority of prospective borrowers pessimistic for only the second time in 10 years, according to Fannie Mae.

June 7 -

Home prices grew at a record annual pace in April but indicators of a possible slowdown popped up in May, Redfin noted.

June 7 -

A week of light data could possibly lead to further mortgage-rate volatility ahead depending on what monetary officials say in the coming days.

May 20 -

Economic recovery should soar into the summer as vaccination rates climb and restrictions loosen up, but low inventory is likely to limit mortgage activity into the next year, according to Fannie Mae.

May 19 -

Inflation concerns may reverse the trend that has seen the 30-year rate decline six out of the last seven weeks.

May 13 -

In spite of an improving economy, acute competition and supply scarcity soured homeshoppers on the purchase market in April, according to Fannie Mae.

May 7