-

Investors in agency mortgage-backed securities will find next year to be "anything but smooth sailing" as Federal Reserve rate hikes and balance sheet reduction will lead to an increase in real rates and volatility while pushing spreads wider, Bank of America said.

December 7 -

Despite increasing mortgage rates and a tepid housing market, positive consumer perception of the economy carried over to home buying during November, according to Fannie Mae.

December 7 -

Mortgage rates dropped this past week as investors pulled money from the stock market over global trade worries and instead purchased bonds, according to Freddie Mac.

December 6 -

Mortgage rates held steady this week, remaining near their lowest levels in more than a month, according to Freddie Mac.

November 29 -

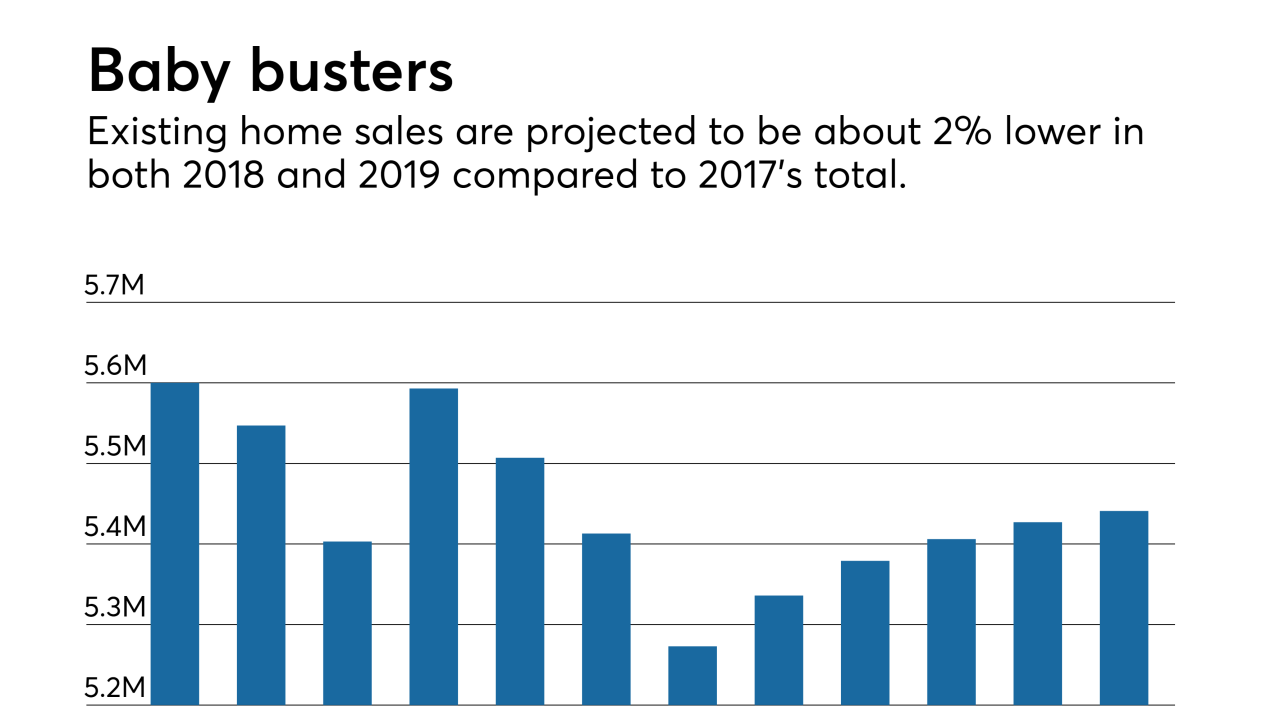

Existing-home sales are on pace to fall 2.3% year-over-year in 2018, and the baby boomer generation is a big reason why, according to Fannie Mae Chief Economist Doug Duncan.

November 29 -

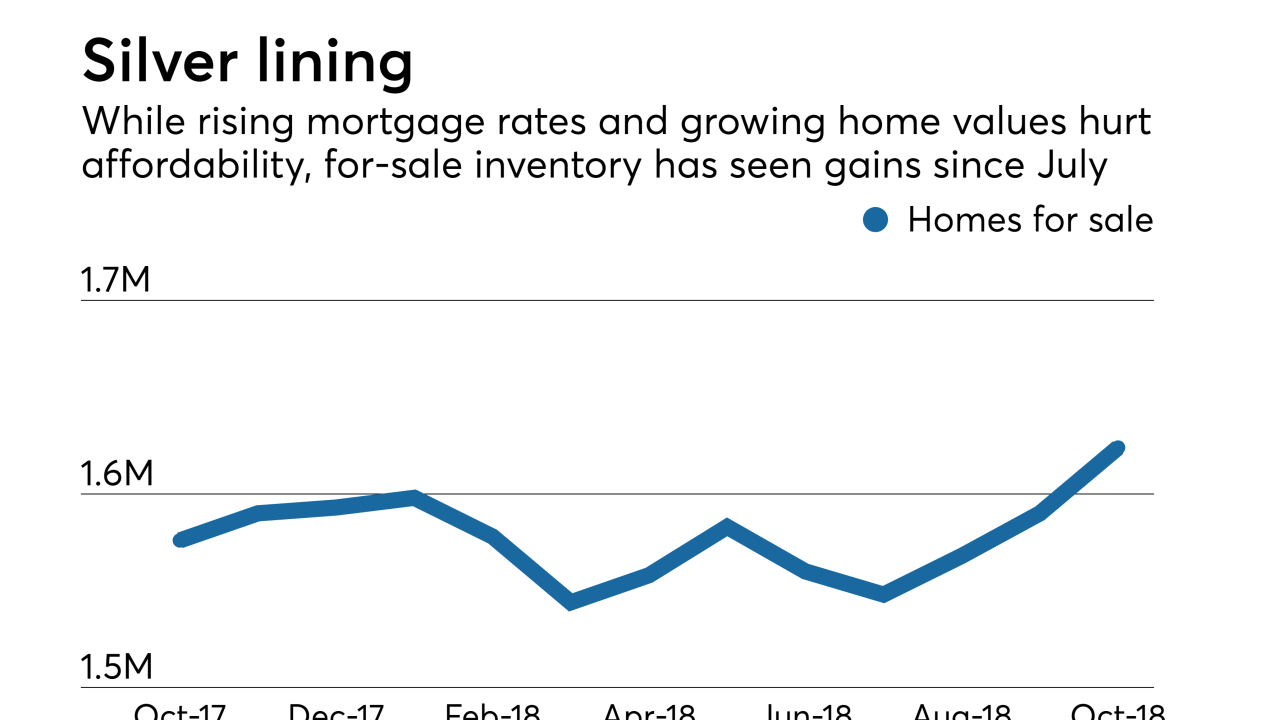

Affordability will take a hit and rent prices are expected to go higher next year behind rising mortgage rates, but they'll bring positive developments, according to Zillow.

November 28 -

While a downturn is expected to come for the housing market, it could be more of a side-step than falling off a cliff, according to the latest Barclays Global Economics Weekly report.

November 26 -

While the housing market perennially decelerates in the winter, it can be a wonderland for potential homebuyers, according to Attom Data Solutions.

November 21 -

Falling oil prices and continued volatility in the stock market resulted in the largest week-to-week decline in mortgage rates in over three years, according to Freddie Mac.

November 21 -

While it's normally a time the market slows down for mortgage lenders relative to the rest of the year, this winter shouldn't be used to hibernate, according to Attom Data Solutions.

November 20 -

Rising interest rates are holding back existing homeowners from listing their properties, driving the gap between existing and potential sales even as that disparity narrows, First American Financial said.

November 19 -

After last week's surge of 11 basis points, mortgage rates held steady due to a dip in energy costs, even with continued stock market volatility, according to Freddie Mac.

November 15 -

Rising home prices and climbing mortgage rates pulled down affordability to the lowest point since before the housing market crash.

November 9 -

Mortgage rates rose significantly across the board as the economy continued to show resilience with strong business activity and growth in employment, according to Freddie Mac.

November 8 -

The prospect of growing mortgage rates took a negative hit on consumer perception of home buying and selling during October, according to Fannie Mae.

November 7 -

Returns on mortgage-backed securities in October lagged Treasuries by 37 basis points, the most since November 2016.

November 5 -

Mortgage rates dropped slightly for the second time in the past three weeks as yields on the benchmark 10-year Treasury note remained flat for most of the period, according to Freddie Mac.

November 1 -

A combination of moderate rises in mortgage rates and dipping growth in home prices are projected to boost existing and new housing sales through 2020, according to Freddie Mac.

October 31 -

As potential homebuyers anticipate mortgage rates to keep rising, September was a strong month for housing demand, according to Redfin.

October 30 -

Mortgage rates increased slightly across the board, even as the Dow Jones Industrial Average fell nearly 1,000 points over the past few days, according to Freddie Mac.

October 25