-

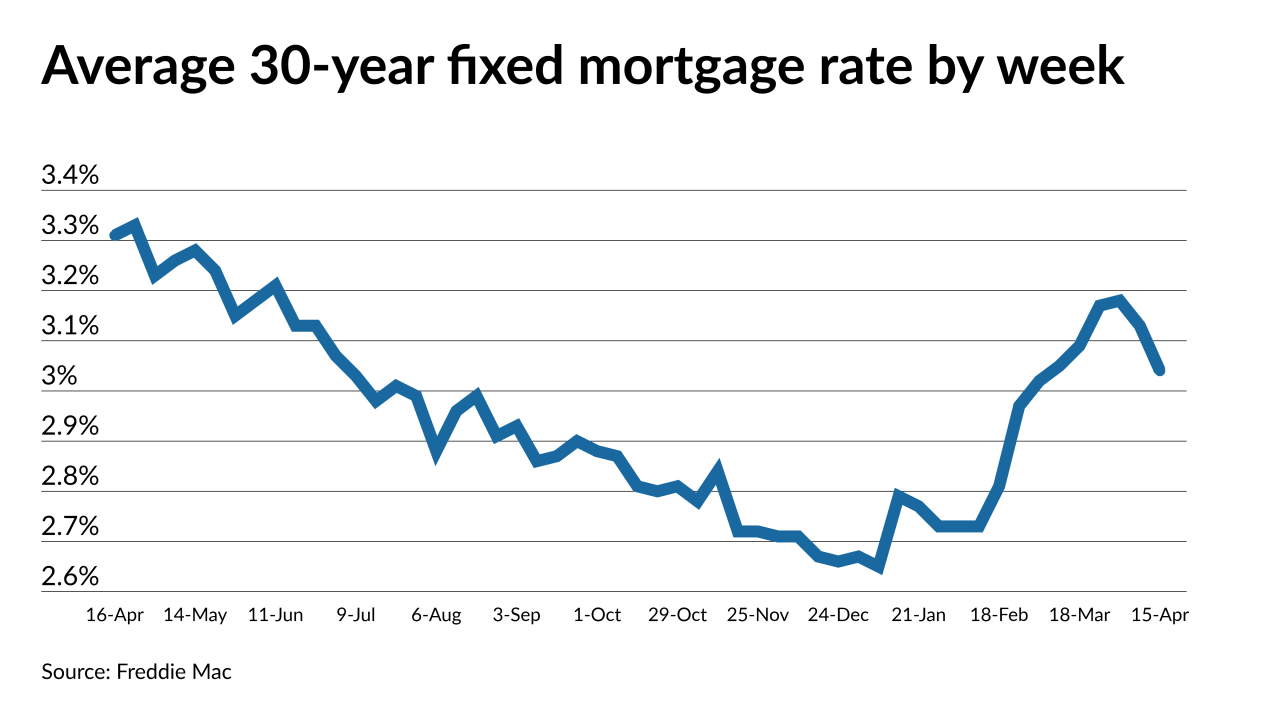

Depressed Treasury yields have kept mortgage rates under 3% recently, but positive economic news could indicate larger increases will follow this week’s uptick.

April 29 -

Inflation, an improving economy and the increased federal budget deficit make rate increase inevitable this year, the Mortgage Bankers Association said.

April 22 -

While it’s the third straight week of a downward trend, borrowers likely have only a brief opportunity to take advantage of sub-3% rates before a reversal comes.

April 22 -

Rising cases and vaccine issues caused bond yields to fall, but inflationary pressures will likely reverse that course.

April 15 -

Vaccinations and a third round of stimulus payments are boosting consumers views on the housing market, according to Fannie Mae.

April 7 -

After two straight months on an upward trajectory, rising interest rates pushed homebuyer demand down to a third of where it stood at the start of 2021, according to Freddie Mac.

April 1 -

But the 10-year Treasury yield began backing down after the weekend as investors reacted to turmoil in Europe.

March 25 -

From offering operations folks big bonuses to grooming recent grads, lenders are getting creative in their efforts to manage staffing throughout the boom-bust cycle.

March 22 -

However, the increase has been more gradual than that seen in Treasury yields, and loan activity has only subsided slightly to date.

March 18 -

Apart from saving more money, millennials prefer to spend their savings on a home down payment, Zonda economist Ali Wolf said.

March 17