-

September has been the most volatile month since March when it comes to 30-year conforming mortgage rates, with average weekly movements of 11 basis points up or down, according to Freddie Mac.

September 26 -

Foreclosure starts dropped to their lowest level in 18 years, and properties foreclosed on but not yet sold fell to a 14-year low in August, according to Black Knight.

September 23 -

Mortgage rates had their largest week-to-week uptick since October 2018 as bond market investors reacted to positive news about the economy, according to Freddie Mac.

September 19 -

Mortgage rates rose seven basis points compared with the prior week, but remained below 3.6% over four consecutive weeks for the first time since the fourth quarter of 2016, according to Freddie Mac.

September 12 -

Mortgage rates fell to lows not seen October 2016, affected by concerns over manufacturing and the ongoing trade war with China, according to Freddie Mac.

September 5 -

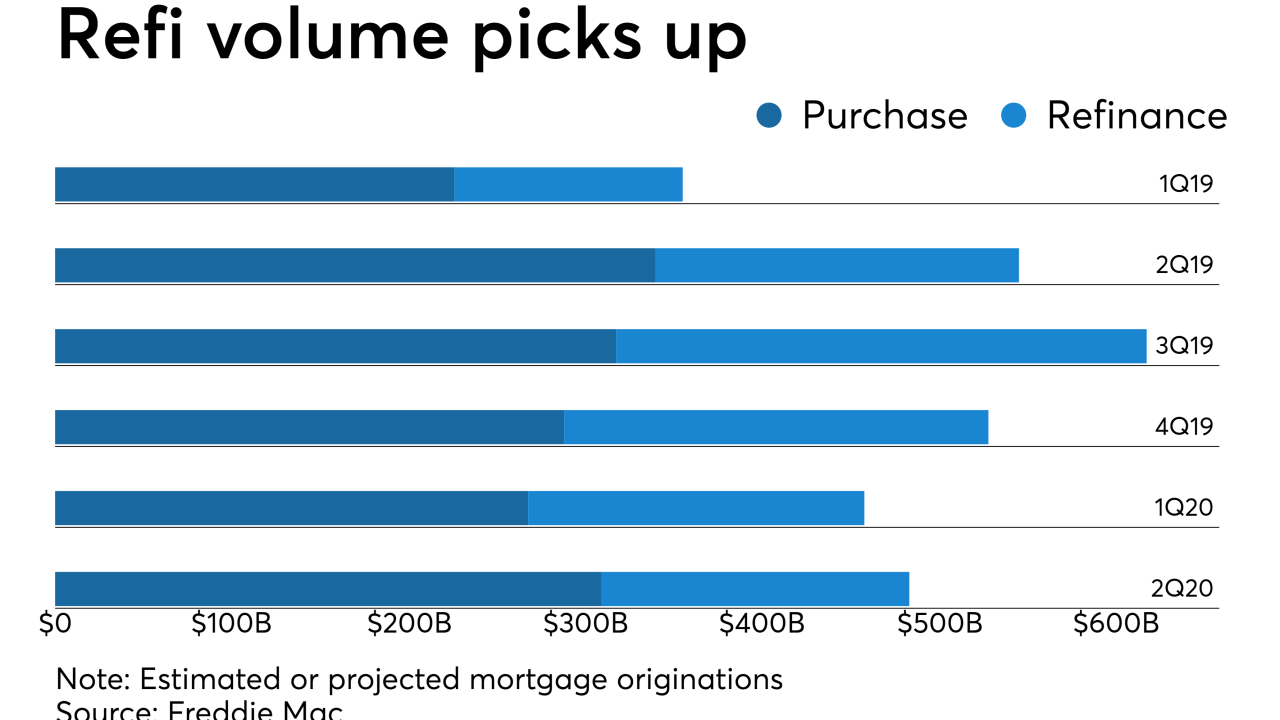

Freddie Mac now forecasts that refinance volume will make up nearly half of third and fourth quarter production, and has increased its origination estimate for the year to over $2 trillion.

August 30 -

Mortgage rates remained near three-year lows last week, but their movement did not mirror the period's big shifts in the 10-year Treasury yield.

August 29 -

Mortgage rates continued to drop this week and hit their lowest levels since November 2016, while stimulating the real estate market and the economy, according to Freddie Mac.

August 22 -

The world's headlong dash to zero or negative interest rates just passed another milestone: Homebuyers in Denmark effectively are being paid to take out 10-year mortgages.

August 19 -

The global rally in bonds on Thursday drove the yield on the benchmark 10-year Treasury below 1.5% for the first time since August 2016.

August 15 -

Mortgage rates remained unchanged this past week even with all of the upheaval in the bond markets that pushed long-term Treasury yields down, according to Freddie Mac.

August 15 -

The U.S. government bond market sounded alarms Wednesday as investors fleeing riskier assets drove the 30-year bond's yield to a record low and the 10-year yield fell below the two-year for the first time since 2007.

August 14 -

Mortgage-backed securities investors are looking to the specified pool market to counter higher prepayment speeds seen with loans purchased through the TBA window.

August 9 -

Mortgage rates tumbled to lows not seen since November 2016 as benchmark 10-year Treasury yields continue to decline due to investors' uncertainty over trade and the economy, according to Freddie Mac.

August 8 -

The U.S. government's trade war with China is pushing down yields on 10-year and 30-year Treasury notes.

August 7 -

Mortgage rates were unchanged from last week, but going forward, they are likely to decline following investors' reaction to the Federal Open Market Committee's July 31 short-term rate cut announcement.

August 1 -

Any growth in housing starts and home sales in the second half of 2019 will be muted by continuing inventory constraints and rising home prices, according to Freddie Mac.

July 30 -

From Jacksonville, Fla., to Seattle, here's a look at the 12 most favorable housing markets for homebuyer purchasing power, based on a combination of local wages, lower property values and mortgage rates.

July 29 -

When a recession occurs, it won't be because of the housing market, according to Zillow. Unlike 2008, 2020 forecasts a gradual slowdown in housing rather than an abrupt crash.

July 25 -

Bond market investors acted cautiously in the wake of next week's Federal Open Market Committee meeting and that likely resulted in mortgage rates moving lower this past week.

July 25