-

Rising interest rates are holding back existing homeowners from listing their properties, driving the gap between existing and potential sales even as that disparity narrows, First American Financial said.

November 19 -

After last week's surge of 11 basis points, mortgage rates held steady due to a dip in energy costs, even with continued stock market volatility, according to Freddie Mac.

November 15 -

Rising home prices and climbing mortgage rates pulled down affordability to the lowest point since before the housing market crash.

November 9 -

Mortgage rates rose significantly across the board as the economy continued to show resilience with strong business activity and growth in employment, according to Freddie Mac.

November 8 -

The prospect of growing mortgage rates took a negative hit on consumer perception of home buying and selling during October, according to Fannie Mae.

November 7 -

Returns on mortgage-backed securities in October lagged Treasuries by 37 basis points, the most since November 2016.

November 5 -

Mortgage rates dropped slightly for the second time in the past three weeks as yields on the benchmark 10-year Treasury note remained flat for most of the period, according to Freddie Mac.

November 1 -

A combination of moderate rises in mortgage rates and dipping growth in home prices are projected to boost existing and new housing sales through 2020, according to Freddie Mac.

October 31 -

As potential homebuyers anticipate mortgage rates to keep rising, September was a strong month for housing demand, according to Redfin.

October 30 -

Mortgage rates increased slightly across the board, even as the Dow Jones Industrial Average fell nearly 1,000 points over the past few days, according to Freddie Mac.

October 25 -

A typical homebuyer has already lost over 6% of purchasing power because of rising interest rates since the start of the year, a study by Redfin found.

October 24 -

Rising mortgage interest rates not only will continue to constrain banks' once-robust revenue from this business, they will also affect existing borrower credit quality, a report from Moody's said.

October 19 -

Conforming mortgage interest rates dropped slightly over the past seven days after weeks of steady increases, according to Freddie Mac.

October 18 -

While mortgage volume is expected to shrink next year, it should increase during the following two years and beyond as millennials start buying homes, the Mortgage Bankers Association forecasts.

October 16 -

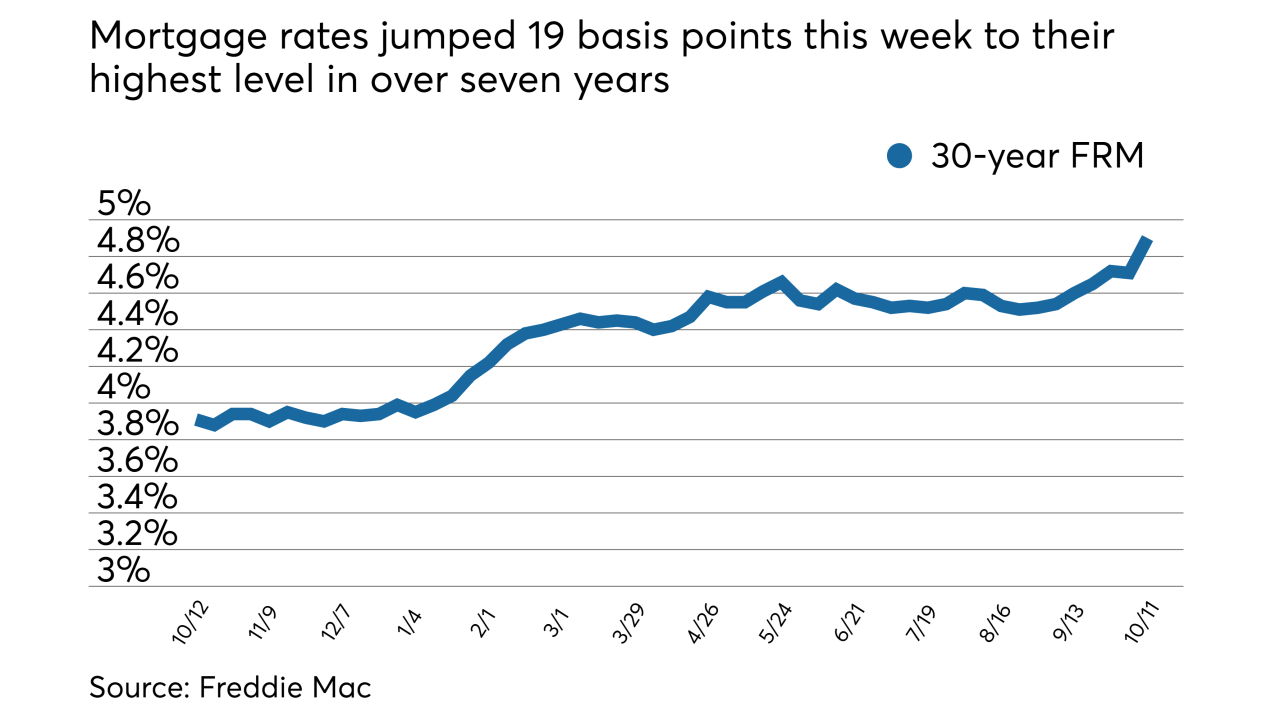

Mortgage rates, after a brief respite last week, rose to their highest level in over seven years, according to Freddie Mac.

October 11 -

Rising interest rates, both current and the prospect for future increases, took a toll on consumers' outlook on the housing market during September, according to Fannie Mae.

October 9 -

Mortgage rates dropped slightly for the first time after five weeks of increases, but this is only a temporary lull as the economy remains strong, Freddie Mac said.

October 4 -

The strong U.S. economy pushed mortgage rates in the past week to their highest level in over seven years, and further hikes are on the way, according to Freddie Mac.

September 27 -

Mortgage rates increased 5 basis points this week, up for the fourth week in a row with momentum building for further hikes, according to Freddie Mac.

September 20 -

While new-home construction and sales should rise in the next 18 months, next year's mortgage origination volume estimate was cut slightly as the economy is expected to slow down soon, said Fannie Mae.

September 17