-

Blackstone Group, which led Wall Street's initial foray into the single-family rental business, is making a new investment in suburban houses at a time when the COVID-19 pandemic is pressuring traditional commercial real estate.

August 28 -

Mortgage industry hiring and new job appointments for the week ending Aug. 28.

August 28 -

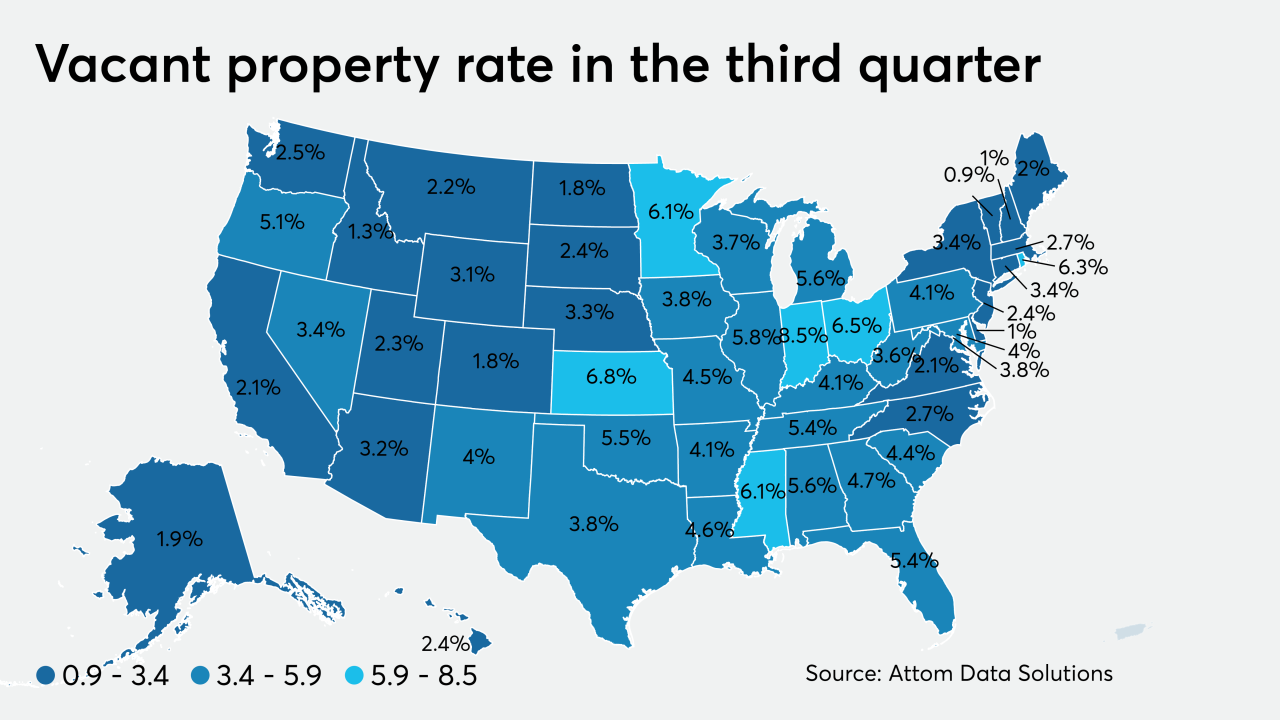

While the overall amount of foreclosures continued to decline due to the coronavirus moratorium, the share of zombie properties grew during the third quarter, according to Attom Data Solutions.

August 27 -

As the end of the first six-month forbearance period arrives, the impact of the new cap is coming into focus.

August 27 -

Three non-QM deal issuers in August report varying levels of progress in moving borrowers from expired forbearance programs.

August 27 -

If it makes landfall as a Category 3 storm as was initially projected, damage from Hurricane Laura's surge could potentially devastate 432,810 residential properties in Texas and Louisiana, according to CoreLogic.

August 25 -

The number of loans going into coronavirus-related forbearance decreased for the tenth straight week, but to a lesser degree than in previous weeks, according to the Mortgage Bankers Association.

August 24 -

Late fees on loan payments and late-arriving documents tied to forbearance and loan forgiveness are just some examples of how delays caused by cutbacks at the U.S. Postal Service could affect lenders and their customers.

August 24 -

Freedom Mortgage's acquisition of RoundPoint Mortgage Servicing gives it a MSR portfolio of over $300 billion.

August 18 -

There are five separate note offerings with maturities ranging from 2023 to 2060.

August 18