-

Minus various expenses including corporate, legal and servicing rights valuation, Ocwen had adjusted pretax income of $13.5 million.

October 20 -

A total of 34 states have offered coronavirus-related rental or mortgage assistance, much of which is funded by the CARES Act, according to the National Council of State Housing Agencies.

October 19 -

The overall forbearance rate was under 6% for the first time since April as another large swath of loans fell out of CARES Act coverage, according to the Mortgage Bankers Association.

October 19 -

As financial distress mounted, 12.4% of mortgagors missed payments across the second and third quarters of 2020 — and it could get worse, according to a study from the Mortgage Bankers Association.

October 16 -

Mortgage companies contended with an average of 1,316 fraud attempts per month in 2020, up from 1,280 in the previous year, according to the latest study by LexisNexis Risk Solutions.

October 16 -

The company expects to get between $17 and $19 per share.

October 15 -

The agreement with Florida ends the saga that began in April 2017, when several states sued the company. However, the CFPB's case filed at the same time remains active.

October 15 -

While overall mortgage delinquency rates slowly descend, serious delinquencies — especially loans past 120 days due — jumped in July, according to CoreLogic.

October 13 -

Forbearance rates dropped below 7% for the first time in six months, but the decrease is largely due to the ending of the initial six-month term of forbearance granted by the legislation, according to the Mortgage Bankers Association.

October 13 -

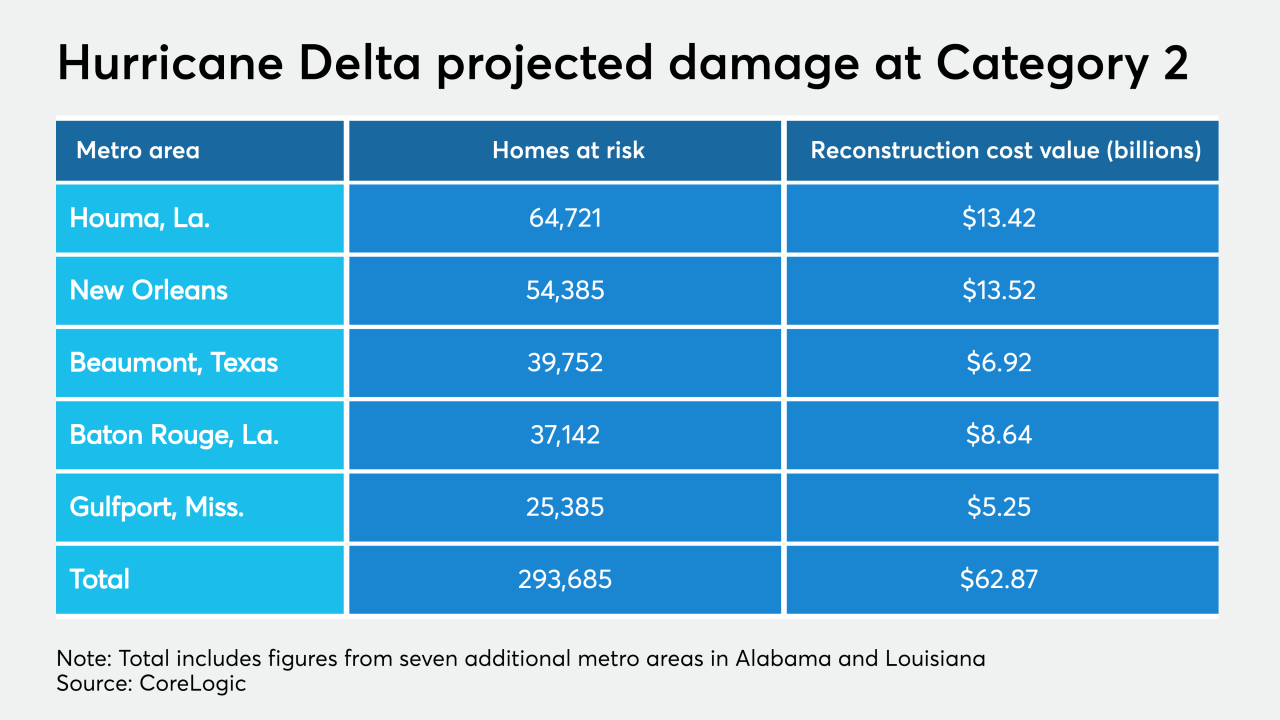

Expected to make landfall as a Category 2 storm, Hurricane Delta's surge is estimated to cause damage to 293,685 residential properties across Alabama, Louisiana, Mississippi and Texas, according to CoreLogic.

October 9